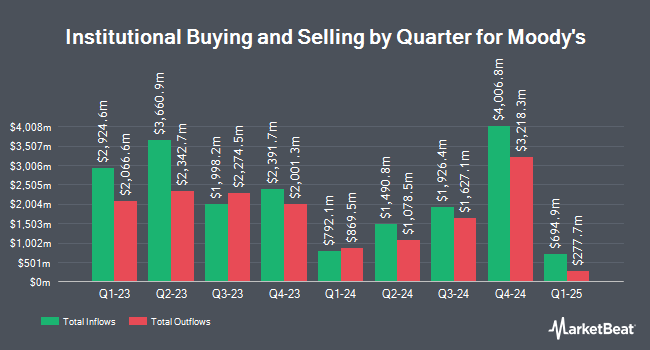

B. Metzler seel. Sohn & Co. Holding AG bought a new stake in Moody's Co. (NYSE:MCO - Free Report) in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 14,115 shares of the business services provider's stock, valued at approximately $6,699,000.

Other large investors have also recently bought and sold shares of the company. Fifth Third Wealth Advisors LLC boosted its holdings in Moody's by 4.0% in the third quarter. Fifth Third Wealth Advisors LLC now owns 1,471 shares of the business services provider's stock valued at $698,000 after acquiring an additional 56 shares during the last quarter. Quest Partners LLC acquired a new position in Moody's in the third quarter valued at about $2,583,000. Adero Partners LLC raised its position in shares of Moody's by 3.8% during the third quarter. Adero Partners LLC now owns 660 shares of the business services provider's stock worth $313,000 after purchasing an additional 24 shares during the period. Natixis Advisors LLC raised its position in shares of Moody's by 6.7% during the third quarter. Natixis Advisors LLC now owns 170,698 shares of the business services provider's stock worth $81,012,000 after purchasing an additional 10,790 shares during the period. Finally, Mizuho Securities USA LLC grew its stake in Moody's by 567.2% in the third quarter. Mizuho Securities USA LLC now owns 80,781 shares of the business services provider's stock valued at $38,338,000 after purchasing an additional 68,674 shares in the last quarter. 92.11% of the stock is currently owned by institutional investors.

Insider Buying and Selling at Moody's

In other news, SVP Caroline Sullivan sold 1,681 shares of the firm's stock in a transaction that occurred on Monday, October 28th. The shares were sold at an average price of $462.40, for a total transaction of $777,294.40. Following the completion of the sale, the senior vice president now owns 1,415 shares in the company, valued at $654,296. This trade represents a 54.30 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Robert Fauber sold 281 shares of the firm's stock in a transaction that occurred on Friday, November 15th. The stock was sold at an average price of $478.99, for a total transaction of $134,596.19. Following the sale, the chief executive officer now owns 61,354 shares of the company's stock, valued at $29,387,952.46. This represents a 0.46 % decrease in their position. The disclosure for this sale can be found here. 0.07% of the stock is owned by corporate insiders.

Moody's Trading Up 1.2 %

NYSE MCO traded up $5.76 during trading hours on Wednesday, hitting $474.54. 934,001 shares of the company were exchanged, compared to its average volume of 738,184. The stock has a 50-day moving average price of $473.37 and a 200 day moving average price of $450.02. The company has a quick ratio of 1.67, a current ratio of 1.67 and a debt-to-equity ratio of 1.69. Moody's Co. has a 52 week low of $358.49 and a 52 week high of $495.10. The stock has a market cap of $85.99 billion, a PE ratio of 43.34, a price-to-earnings-growth ratio of 3.08 and a beta of 1.29.

Moody's (NYSE:MCO - Get Free Report) last posted its earnings results on Tuesday, October 22nd. The business services provider reported $3.21 earnings per share for the quarter, topping analysts' consensus estimates of $2.89 by $0.32. The company had revenue of $1.81 billion during the quarter, compared to analyst estimates of $1.71 billion. Moody's had a return on equity of 57.97% and a net margin of 29.05%. Moody's's revenue was up 23.2% on a year-over-year basis. During the same quarter in the prior year, the business earned $2.43 earnings per share. Analysts forecast that Moody's Co. will post 12.07 earnings per share for the current fiscal year.

Moody's Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 22nd will be given a $0.85 dividend. This represents a $3.40 annualized dividend and a dividend yield of 0.72%. The ex-dividend date is Friday, November 22nd. Moody's's payout ratio is 31.05%.

Wall Street Analyst Weigh In

Several analysts recently weighed in on MCO shares. Barclays lifted their price target on Moody's from $500.00 to $570.00 and gave the stock an "overweight" rating in a report on Friday, September 13th. StockNews.com lowered Moody's from a "buy" rating to a "hold" rating in a research report on Wednesday, October 23rd. Oppenheimer upped their price target on Moody's from $536.00 to $543.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 23rd. Raymond James downgraded Moody's from a "market perform" rating to an "underperform" rating in a research note on Monday, September 23rd. Finally, Royal Bank of Canada increased their price objective on Moody's from $450.00 to $475.00 and gave the company an "outperform" rating in a report on Wednesday, July 24th. One analyst has rated the stock with a sell rating, six have assigned a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat, Moody's presently has an average rating of "Hold" and an average price target of $500.00.

View Our Latest Analysis on Moody's

About Moody's

(

Free Report)

Moody's Corporation operates as an integrated risk assessment firm worldwide. It operates in two segments, Moody's Analytics and Moody's Investors Services. The Moody's Analytics segment develops a range of products and services that support the risk management activities of institutional participants in financial markets.

See Also

Before you consider Moody's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moody's wasn't on the list.

While Moody's currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.