GSA Capital Partners LLP bought a new position in shares of Broadridge Financial Solutions, Inc. (NYSE:BR - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 2,458 shares of the business services provider's stock, valued at approximately $529,000.

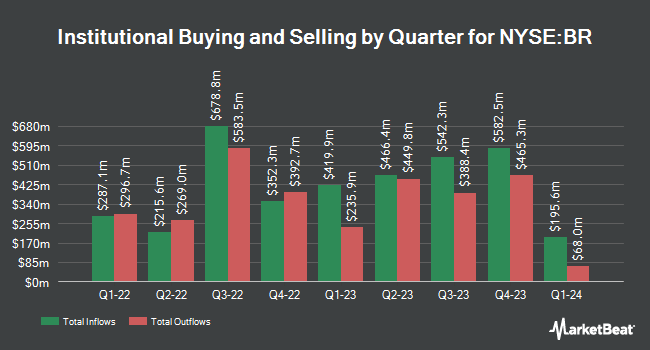

Several other institutional investors have also recently bought and sold shares of the business. Assenagon Asset Management S.A. boosted its holdings in Broadridge Financial Solutions by 3,197.8% in the third quarter. Assenagon Asset Management S.A. now owns 204,366 shares of the business services provider's stock valued at $43,945,000 after acquiring an additional 198,169 shares during the last quarter. International Assets Investment Management LLC bought a new position in Broadridge Financial Solutions in the 3rd quarter valued at $274,650,000. Earnest Partners LLC grew its stake in Broadridge Financial Solutions by 25.9% in the 1st quarter. Earnest Partners LLC now owns 364,195 shares of the business services provider's stock valued at $74,609,000 after purchasing an additional 75,006 shares during the period. Dimensional Fund Advisors LP grew its stake in shares of Broadridge Financial Solutions by 8.3% during the 2nd quarter. Dimensional Fund Advisors LP now owns 941,125 shares of the business services provider's stock worth $185,417,000 after acquiring an additional 72,018 shares during the period. Finally, Canada Pension Plan Investment Board grew its stake in shares of Broadridge Financial Solutions by 97.2% during the 1st quarter. Canada Pension Plan Investment Board now owns 105,871 shares of the business services provider's stock worth $21,689,000 after acquiring an additional 52,171 shares during the period. Institutional investors and hedge funds own 90.03% of the company's stock.

Broadridge Financial Solutions Trading Up 0.2 %

Shares of BR traded up $0.55 during mid-day trading on Wednesday, hitting $225.39. 452,398 shares of the company's stock traded hands, compared to its average volume of 519,114. The company has a quick ratio of 1.39, a current ratio of 1.39 and a debt-to-equity ratio of 1.63. Broadridge Financial Solutions, Inc. has a 1 year low of $183.60 and a 1 year high of $230.00. The firm has a market capitalization of $26.35 billion, a P/E ratio of 38.99 and a beta of 1.05. The business's 50-day moving average price is $216.78 and its 200-day moving average price is $208.75.

Broadridge Financial Solutions (NYSE:BR - Get Free Report) last posted its earnings results on Tuesday, November 5th. The business services provider reported $1.00 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.97 by $0.03. The firm had revenue of $1.42 billion for the quarter, compared to analysts' expectations of $1.48 billion. Broadridge Financial Solutions had a return on equity of 41.79% and a net margin of 10.57%. The business's revenue was down .6% compared to the same quarter last year. During the same period in the previous year, the firm earned $1.09 earnings per share. As a group, sell-side analysts forecast that Broadridge Financial Solutions, Inc. will post 8.53 EPS for the current fiscal year.

Broadridge Financial Solutions Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, January 3rd. Investors of record on Friday, December 13th will be paid a $0.88 dividend. The ex-dividend date is Friday, December 13th. This represents a $3.52 annualized dividend and a yield of 1.56%. Broadridge Financial Solutions's payout ratio is 60.90%.

Wall Street Analyst Weigh In

A number of research firms have weighed in on BR. Royal Bank of Canada reaffirmed an "outperform" rating and set a $246.00 target price on shares of Broadridge Financial Solutions in a report on Wednesday, November 6th. StockNews.com downgraded Broadridge Financial Solutions from a "buy" rating to a "hold" rating in a research report on Saturday, November 9th. JPMorgan Chase & Co. lifted their price target on Broadridge Financial Solutions from $224.00 to $225.00 and gave the company a "neutral" rating in a research report on Tuesday, August 20th. Finally, Morgan Stanley boosted their target price on Broadridge Financial Solutions from $200.00 to $207.00 and gave the stock an "equal weight" rating in a research report on Wednesday, November 6th. Four research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $217.83.

Check Out Our Latest Stock Analysis on BR

Insider Transactions at Broadridge Financial Solutions

In other Broadridge Financial Solutions news, Director Maura A. Markus sold 3,880 shares of the stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $227.02, for a total value of $880,837.60. Following the transaction, the director now owns 27,788 shares of the company's stock, valued at approximately $6,308,431.76. This represents a 12.25 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, VP Thomas P. Carey sold 10,757 shares of the company's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $226.82, for a total value of $2,439,902.74. Following the completion of the sale, the vice president now owns 12,689 shares of the company's stock, valued at approximately $2,878,118.98. The trade was a 45.88 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 109,033 shares of company stock valued at $23,382,322. Insiders own 1.30% of the company's stock.

About Broadridge Financial Solutions

(

Free Report)

Broadridge Financial Solutions, Inc provides investor communications and technology-driven solutions for the financial services industry. The company's Investor Communication Solutions segment processes and distributes proxy materials to investors in equity securities and mutual funds, as well as facilitates related vote processing services; and distributes regulatory reports, class action, and corporate action/reorganization event information, as well as tax reporting solutions.

See Also

Before you consider Broadridge Financial Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadridge Financial Solutions wasn't on the list.

While Broadridge Financial Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.