Los Angeles Capital Management LLC acquired a new position in Prosperity Bancshares, Inc. (NYSE:PB - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 66,660 shares of the bank's stock, valued at approximately $4,804,000. Los Angeles Capital Management LLC owned approximately 0.07% of Prosperity Bancshares at the end of the most recent quarter.

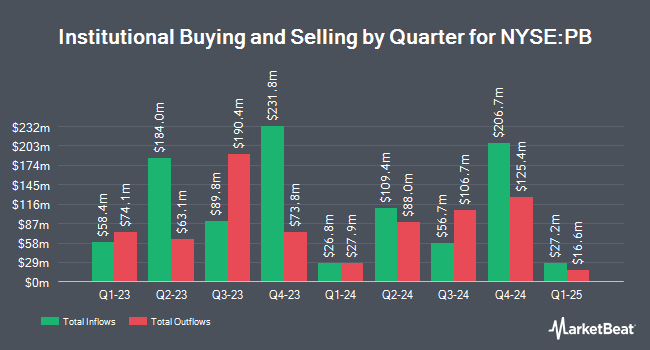

A number of other institutional investors and hedge funds have also made changes to their positions in PB. Kingsview Wealth Management LLC acquired a new stake in shares of Prosperity Bancshares in the first quarter worth $2,343,000. Amica Mutual Insurance Co. boosted its stake in shares of Prosperity Bancshares by 41.9% in the second quarter. Amica Mutual Insurance Co. now owns 157,770 shares of the bank's stock valued at $9,646,000 after buying an additional 46,593 shares in the last quarter. Harbor Capital Advisors Inc. boosted its stake in shares of Prosperity Bancshares by 394.8% during the 2nd quarter. Harbor Capital Advisors Inc. now owns 11,465 shares of the bank's stock worth $701,000 after purchasing an additional 9,148 shares during the last quarter. Thrivent Financial for Lutherans boosted its position in Prosperity Bancshares by 16.0% during the 2nd quarter. Thrivent Financial for Lutherans now owns 811,772 shares of the bank's stock worth $49,632,000 after purchasing an additional 112,101 shares during the period. Finally, Silver Lake Advisory LLC acquired a new stake in shares of Prosperity Bancshares in the second quarter valued at about $611,000. Institutional investors own 80.69% of the company's stock.

Prosperity Bancshares Stock Up 1.4 %

Shares of PB traded up $1.15 during trading hours on Tuesday, hitting $83.38. 354,390 shares of the company were exchanged, compared to its average volume of 571,597. The company has a market cap of $7.94 billion, a price-to-earnings ratio of 17.46, a P/E/G ratio of 1.19 and a beta of 0.89. The firm's fifty day moving average is $73.00 and its 200 day moving average is $67.84. Prosperity Bancshares, Inc. has a fifty-two week low of $54.53 and a fifty-two week high of $83.40.

Prosperity Bancshares (NYSE:PB - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The bank reported $1.34 earnings per share for the quarter, beating the consensus estimate of $1.31 by $0.03. The business had revenue of $459.00 million during the quarter, compared to analyst estimates of $299.83 million. Prosperity Bancshares had a return on equity of 6.46% and a net margin of 25.39%. During the same period in the prior year, the company earned $1.20 earnings per share. Analysts anticipate that Prosperity Bancshares, Inc. will post 5.05 EPS for the current year.

Prosperity Bancshares Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, December 13th will be given a dividend of $0.58 per share. This represents a $2.32 annualized dividend and a dividend yield of 2.78%. The ex-dividend date is Friday, December 13th. This is a positive change from Prosperity Bancshares's previous quarterly dividend of $0.56. Prosperity Bancshares's payout ratio is 47.56%.

Analysts Set New Price Targets

A number of research analysts have issued reports on the company. Compass Point boosted their price target on Prosperity Bancshares from $73.00 to $80.00 and gave the stock a "buy" rating in a research report on Friday, July 26th. Wedbush reiterated an "outperform" rating and set a $90.00 target price on shares of Prosperity Bancshares in a research note on Thursday, October 24th. StockNews.com lowered Prosperity Bancshares from a "hold" rating to a "sell" rating in a research report on Wednesday, August 28th. Truist Financial lowered shares of Prosperity Bancshares from a "buy" rating to a "hold" rating and lowered their price objective for the stock from $81.00 to $79.00 in a research note on Friday, September 20th. Finally, DA Davidson cut Prosperity Bancshares from a "buy" rating to a "neutral" rating and reduced their price target for the stock from $80.00 to $78.00 in a report on Tuesday, October 15th. One research analyst has rated the stock with a sell rating, four have issued a hold rating and nine have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $78.96.

Read Our Latest Analysis on PB

Prosperity Bancshares Profile

(

Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Read More

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.