Charles Schwab Investment Management Inc. raised its stake in shares of Advanced Micro Devices, Inc. (NASDAQ:AMD - Free Report) by 1.9% in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 9,656,965 shares of the semiconductor manufacturer's stock after purchasing an additional 177,700 shares during the period. Charles Schwab Investment Management Inc. owned 0.60% of Advanced Micro Devices worth $1,584,515,000 as of its most recent filing with the Securities & Exchange Commission.

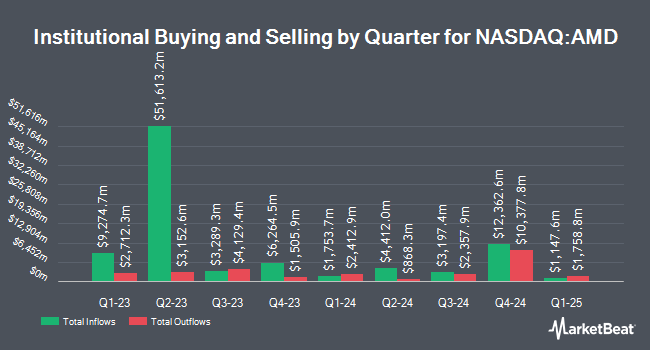

A number of other institutional investors have also recently made changes to their positions in AMD. International Assets Investment Management LLC lifted its stake in shares of Advanced Micro Devices by 17,137.3% in the 3rd quarter. International Assets Investment Management LLC now owns 7,860,909 shares of the semiconductor manufacturer's stock valued at $1,289,818,000 after purchasing an additional 7,815,305 shares during the last quarter. Van ECK Associates Corp boosted its stake in Advanced Micro Devices by 52.6% during the second quarter. Van ECK Associates Corp now owns 8,645,658 shares of the semiconductor manufacturer's stock worth $1,402,412,000 after buying an additional 2,979,204 shares during the period. Assenagon Asset Management S.A. increased its position in Advanced Micro Devices by 42.2% during the third quarter. Assenagon Asset Management S.A. now owns 8,420,766 shares of the semiconductor manufacturer's stock valued at $1,381,679,000 after acquiring an additional 2,497,056 shares during the last quarter. Renaissance Technologies LLC purchased a new stake in shares of Advanced Micro Devices in the second quarter valued at $296,178,000. Finally, Swedbank AB purchased a new position in shares of Advanced Micro Devices during the 1st quarter worth about $290,842,000. Hedge funds and other institutional investors own 71.34% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have commented on AMD shares. Citigroup cut their price objective on Advanced Micro Devices from $210.00 to $200.00 and set a "buy" rating on the stock in a research report on Wednesday, October 30th. Edward Jones assumed coverage on shares of Advanced Micro Devices in a research report on Tuesday, August 20th. They issued a "buy" rating for the company. Rosenblatt Securities reaffirmed a "buy" rating and set a $250.00 price target on shares of Advanced Micro Devices in a research note on Monday, October 28th. UBS Group dropped their price objective on Advanced Micro Devices from $210.00 to $205.00 and set a "buy" rating on the stock in a research note on Wednesday, October 30th. Finally, Morgan Stanley lowered their target price on Advanced Micro Devices from $178.00 to $169.00 and set an "equal weight" rating for the company in a report on Wednesday, October 30th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating, twenty-eight have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $192.79.

Read Our Latest Analysis on AMD

Insider Activity at Advanced Micro Devices

In other news, CEO Lisa T. Su sold 80,000 shares of the business's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $143.87, for a total transaction of $11,509,600.00. Following the completion of the sale, the chief executive officer now owns 3,566,762 shares in the company, valued at approximately $513,150,048.94. The trade was a 2.19 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP Forrest Eugene Norrod sold 40,540 shares of the firm's stock in a transaction that occurred on Tuesday, November 5th. The shares were sold at an average price of $141.67, for a total transaction of $5,743,301.80. Following the completion of the transaction, the executive vice president now owns 293,347 shares in the company, valued at $41,558,469.49. The trade was a 12.14 % decrease in their position. The disclosure for this sale can be found here. 0.73% of the stock is owned by insiders.

Advanced Micro Devices Price Performance

Shares of AMD stock traded down $0.39 during trading hours on Thursday, hitting $137.21. The company's stock had a trading volume of 24,423,599 shares, compared to its average volume of 55,154,898. Advanced Micro Devices, Inc. has a twelve month low of $116.37 and a twelve month high of $227.30. The company has a current ratio of 2.50, a quick ratio of 1.78 and a debt-to-equity ratio of 0.03. The business has a fifty day moving average of $153.95 and a 200-day moving average of $154.70. The stock has a market cap of $222.67 billion, a price-to-earnings ratio of 123.61, a P/E/G ratio of 1.93 and a beta of 1.71.

Advanced Micro Devices (NASDAQ:AMD - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The semiconductor manufacturer reported $0.92 earnings per share for the quarter, meeting analysts' consensus estimates of $0.92. The business had revenue of $6.82 billion during the quarter, compared to analyst estimates of $6.71 billion. Advanced Micro Devices had a net margin of 7.52% and a return on equity of 6.62%. The company's revenue was up 17.6% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.53 earnings per share. As a group, equities research analysts anticipate that Advanced Micro Devices, Inc. will post 2.53 EPS for the current year.

Advanced Micro Devices Profile

(

Free Report)

Advanced Micro Devices, Inc operates as a semiconductor company worldwide. It operates through Data Center, Client, Gaming, and Embedded segments. The company offers x86 microprocessors and graphics processing units (GPUs) as an accelerated processing unit, chipsets, data center, and professional GPUs; and embedded processors, and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology, data processing unites, field programmable gate arrays (FPGA), and adaptive SoC products.

Read More

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report