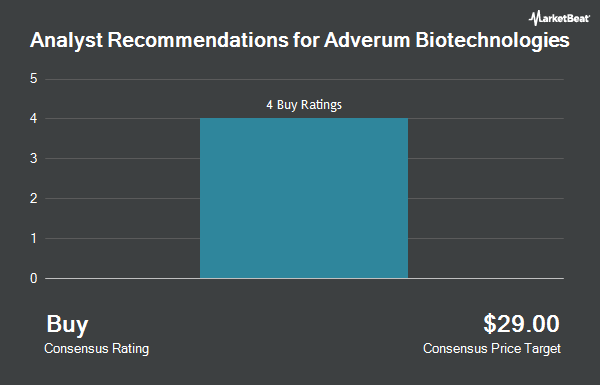

HC Wainwright restated their buy rating on shares of Adverum Biotechnologies (NASDAQ:ADVM - Free Report) in a report issued on Tuesday morning,Benzinga reports. They currently have a $30.00 price target on the biotechnology company's stock.

A number of other research analysts also recently issued reports on the stock. Royal Bank of Canada dropped their target price on shares of Adverum Biotechnologies from $12.00 to $10.00 and set a "sector perform" rating on the stock in a research report on Tuesday, November 5th. StockNews.com cut shares of Adverum Biotechnologies from a "hold" rating to a "sell" rating in a research report on Wednesday, November 6th. Finally, Truist Financial decreased their target price on Adverum Biotechnologies from $60.00 to $40.00 and set a "buy" rating for the company in a research report on Wednesday, August 14th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $27.83.

View Our Latest Research Report on ADVM

Adverum Biotechnologies Price Performance

Shares of Adverum Biotechnologies stock traded down $0.57 during trading on Tuesday, hitting $6.28. The company's stock had a trading volume of 557,056 shares, compared to its average volume of 277,238. The stock has a market cap of $130.62 million, a price-to-earnings ratio of -1.05 and a beta of 1.02. Adverum Biotechnologies has a 52 week low of $6.14 and a 52 week high of $29.70. The stock has a 50-day moving average price of $7.48 and a two-hundred day moving average price of $7.56.

Adverum Biotechnologies (NASDAQ:ADVM - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The biotechnology company reported ($1.30) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.20) by ($0.10). The firm had revenue of $1.00 million for the quarter, compared to analysts' expectations of $0.50 million. On average, equities analysts predict that Adverum Biotechnologies will post -4.92 EPS for the current fiscal year.

Institutional Investors Weigh In On Adverum Biotechnologies

A number of institutional investors and hedge funds have recently made changes to their positions in ADVM. Barclays PLC increased its holdings in Adverum Biotechnologies by 125.8% during the 3rd quarter. Barclays PLC now owns 35,832 shares of the biotechnology company's stock worth $252,000 after purchasing an additional 19,965 shares in the last quarter. Zacks Investment Management purchased a new stake in Adverum Biotechnologies in the 3rd quarter valued at $89,000. State Street Corp boosted its holdings in Adverum Biotechnologies by 32.7% during the 3rd quarter. State Street Corp now owns 369,616 shares of the biotechnology company's stock worth $2,595,000 after acquiring an additional 91,112 shares during the last quarter. Captrust Financial Advisors bought a new stake in shares of Adverum Biotechnologies in the 3rd quarter worth $71,000. Finally, MetLife Investment Management LLC raised its holdings in shares of Adverum Biotechnologies by 129.1% in the third quarter. MetLife Investment Management LLC now owns 12,582 shares of the biotechnology company's stock valued at $88,000 after purchasing an additional 7,089 shares during the last quarter. Institutional investors and hedge funds own 48.17% of the company's stock.

Adverum Biotechnologies Company Profile

(

Get Free Report)

Adverum Biotechnologies, Inc, a clinical-stage company, develops gene therapy product candidates to treat ocular diseases. Its lead product candidate is ixoberogene soroparvovec (ADVM-022), a single intravitreal injection gene therapy candidate used for the treatment of patients with wet age-related macular degeneration and diabetic macular edema which is in phase 2 clinical trials.

Featured Articles

Before you consider Adverum Biotechnologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adverum Biotechnologies wasn't on the list.

While Adverum Biotechnologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.