Advisors Asset Management Inc. grew its position in shares of Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI - Free Report) by 72.0% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 468,335 shares of the real estate investment trust's stock after buying an additional 196,122 shares during the quarter. Advisors Asset Management Inc. owned 0.34% of Apollo Commercial Real Estate Finance worth $4,304,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

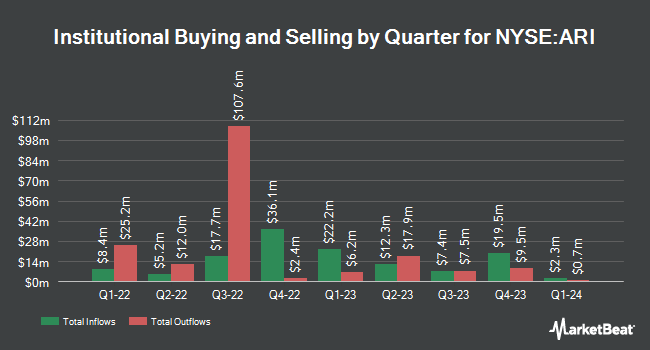

Several other hedge funds and other institutional investors have also recently modified their holdings of ARI. Triad Wealth Partners LLC bought a new position in Apollo Commercial Real Estate Finance in the 2nd quarter worth $43,000. Future Financial Wealth Managment LLC bought a new position in Apollo Commercial Real Estate Finance in the 3rd quarter worth $44,000. EverSource Wealth Advisors LLC bought a new position in Apollo Commercial Real Estate Finance in the 2nd quarter worth $59,000. KBC Group NV raised its holdings in Apollo Commercial Real Estate Finance by 57.7% in the 3rd quarter. KBC Group NV now owns 7,002 shares of the real estate investment trust's stock worth $64,000 after purchasing an additional 2,562 shares during the period. Finally, Quest Partners LLC raised its holdings in Apollo Commercial Real Estate Finance by 7,689.4% in the 2nd quarter. Quest Partners LLC now owns 9,581 shares of the real estate investment trust's stock worth $94,000 after purchasing an additional 9,458 shares during the period. 54.43% of the stock is owned by institutional investors.

Apollo Commercial Real Estate Finance Trading Down 0.2 %

Shares of Apollo Commercial Real Estate Finance stock opened at $9.19 on Friday. The firm has a market cap of $1.27 billion, a price-to-earnings ratio of -9.98 and a beta of 1.75. The business has a 50-day moving average price of $9.08 and a 200-day moving average price of $9.83. The company has a quick ratio of 46.13, a current ratio of 46.13 and a debt-to-equity ratio of 0.67. Apollo Commercial Real Estate Finance, Inc. has a twelve month low of $8.52 and a twelve month high of $12.74.

Apollo Commercial Real Estate Finance Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were issued a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a dividend yield of 10.89%. The ex-dividend date was Monday, September 30th. Apollo Commercial Real Estate Finance's payout ratio is -108.69%.

Analysts Set New Price Targets

A number of equities analysts recently commented on the company. UBS Group decreased their target price on Apollo Commercial Real Estate Finance from $10.00 to $9.50 and set a "neutral" rating on the stock in a report on Friday, November 15th. StockNews.com lowered Apollo Commercial Real Estate Finance from a "hold" rating to a "sell" rating in a research note on Monday, November 4th. Finally, JPMorgan Chase & Co. cut their price target on Apollo Commercial Real Estate Finance from $9.50 to $8.50 and set a "neutral" rating for the company in a research note on Thursday, October 17th. Two research analysts have rated the stock with a sell rating and four have issued a hold rating to the company's stock. According to MarketBeat.com, Apollo Commercial Real Estate Finance presently has a consensus rating of "Hold" and a consensus target price of $9.63.

Get Our Latest Stock Report on ARI

Apollo Commercial Real Estate Finance Profile

(

Free Report)

Apollo Commercial Real Estate Finance, Inc operates as a real estate investment trust (REIT) that originates, acquires, invests in, and manages commercial first mortgage loans, subordinate financings, and other commercial real estate-related debt investments in the United States, the United Kingdom, and Europe.

Featured Stories

Before you consider Apollo Commercial Real Estate Finance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Commercial Real Estate Finance wasn't on the list.

While Apollo Commercial Real Estate Finance currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.