Allen Capital Group LLC boosted its position in First Horizon Co. (NYSE:FHN - Free Report) by 128.4% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 52,612 shares of the financial services provider's stock after buying an additional 29,581 shares during the quarter. Allen Capital Group LLC's holdings in First Horizon were worth $817,000 at the end of the most recent quarter.

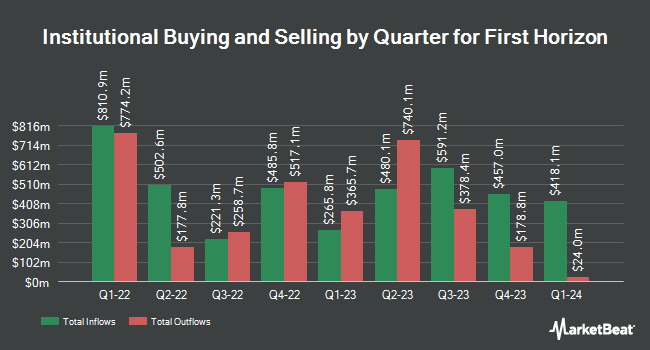

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. Millennium Management LLC boosted its holdings in shares of First Horizon by 46.5% in the 2nd quarter. Millennium Management LLC now owns 14,370,699 shares of the financial services provider's stock valued at $226,626,000 after buying an additional 4,558,129 shares during the period. Jupiter Asset Management Ltd. bought a new position in shares of First Horizon during the second quarter valued at approximately $66,779,000. Bank of New York Mellon Corp lifted its holdings in shares of First Horizon by 13.6% in the 2nd quarter. Bank of New York Mellon Corp now owns 32,389,497 shares of the financial services provider's stock worth $510,782,000 after purchasing an additional 3,870,946 shares during the last quarter. Dimensional Fund Advisors LP boosted its position in First Horizon by 28.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 15,515,494 shares of the financial services provider's stock valued at $244,647,000 after purchasing an additional 3,470,346 shares during the period. Finally, Sculptor Capital LP grew its stake in First Horizon by 18.2% during the 2nd quarter. Sculptor Capital LP now owns 10,200,000 shares of the financial services provider's stock worth $160,854,000 after buying an additional 1,570,000 shares during the last quarter. 80.28% of the stock is owned by institutional investors.

First Horizon Stock Up 3.8 %

NYSE:FHN traded up $0.76 during mid-day trading on Friday, reaching $20.93. The stock had a trading volume of 7,125,807 shares, compared to its average volume of 6,611,490. The stock has a market cap of $11.10 billion, a P/E ratio of 14.62, a PEG ratio of 1.50 and a beta of 0.86. The business's 50 day moving average is $17.22 and its 200 day moving average is $16.23. The company has a debt-to-equity ratio of 0.14, a current ratio of 0.96 and a quick ratio of 0.95. First Horizon Co. has a fifty-two week low of $11.87 and a fifty-two week high of $21.01.

First Horizon (NYSE:FHN - Get Free Report) last released its earnings results on Wednesday, October 16th. The financial services provider reported $0.42 earnings per share for the quarter, beating the consensus estimate of $0.38 by $0.04. First Horizon had a net margin of 15.43% and a return on equity of 9.51%. The business had revenue of $1.32 billion during the quarter, compared to analysts' expectations of $821.63 million. During the same quarter last year, the company earned $0.27 earnings per share. As a group, sell-side analysts predict that First Horizon Co. will post 1.49 earnings per share for the current year.

First Horizon Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Stockholders of record on Friday, December 13th will be issued a dividend of $0.15 per share. This represents a $0.60 dividend on an annualized basis and a dividend yield of 2.87%. The ex-dividend date is Friday, December 13th. First Horizon's payout ratio is 43.48%.

First Horizon announced that its Board of Directors has approved a share repurchase program on Tuesday, October 29th that authorizes the company to buyback $1.00 billion in outstanding shares. This buyback authorization authorizes the financial services provider to reacquire up to 10.6% of its shares through open market purchases. Shares buyback programs are often an indication that the company's leadership believes its shares are undervalued.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on FHN shares. Barclays boosted their price target on shares of First Horizon from $21.00 to $23.00 and gave the company an "overweight" rating in a report on Friday, November 8th. Robert W. Baird set a $17.00 target price on shares of First Horizon in a research note on Thursday, October 17th. Wedbush lowered shares of First Horizon from an "outperform" rating to a "neutral" rating and dropped their price target for the company from $20.00 to $17.00 in a research note on Tuesday, September 24th. Evercore ISI boosted their price objective on First Horizon from $18.00 to $20.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 30th. Finally, Raymond James raised their target price on First Horizon from $19.00 to $22.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Six equities research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $18.38.

Check Out Our Latest Stock Analysis on First Horizon

Insider Activity

In related news, EVP David T. Popwell sold 100,974 shares of First Horizon stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $19.77, for a total transaction of $1,996,255.98. Following the completion of the transaction, the executive vice president now directly owns 519,926 shares of the company's stock, valued at $10,278,937.02. This trade represents a 16.26 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Harry V. Barton, Jr. sold 10,000 shares of the firm's stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $19.92, for a total transaction of $199,200.00. Following the sale, the director now directly owns 166,840 shares of the company's stock, valued at approximately $3,323,452.80. The trade was a 5.65 % decrease in their position. The disclosure for this sale can be found here. 0.87% of the stock is owned by company insiders.

About First Horizon

(

Free Report)

First Horizon Corporation operates as the bank holding company for First Horizon Bank that provides various financial services. The company operates through Regional Banking and Specialty Banking segments. It offers general banking services for consumers, businesses, financial institutions, and governments.

Further Reading

Before you consider First Horizon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Horizon wasn't on the list.

While First Horizon currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report