Amalgamated Bank decreased its holdings in Expedia Group, Inc. (NASDAQ:EXPE - Free Report) by 38.6% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 26,361 shares of the online travel company's stock after selling 16,588 shares during the period. Amalgamated Bank's holdings in Expedia Group were worth $3,902,000 at the end of the most recent reporting period.

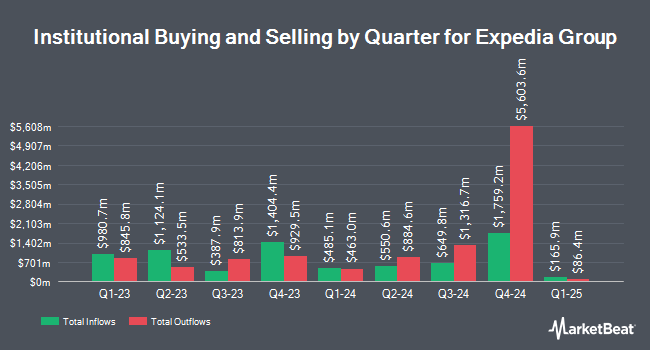

A number of other large investors have also recently made changes to their positions in the stock. DoubleLine ETF Adviser LP bought a new position in shares of Expedia Group in the second quarter worth approximately $465,000. Robeco Institutional Asset Management B.V. raised its holdings in Expedia Group by 13.1% in the third quarter. Robeco Institutional Asset Management B.V. now owns 649,716 shares of the online travel company's stock worth $96,171,000 after buying an additional 75,120 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. lifted its holdings in shares of Expedia Group by 18.3% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 154,867 shares of the online travel company's stock valued at $21,333,000 after purchasing an additional 23,939 shares in the last quarter. Swedbank AB grew its stake in shares of Expedia Group by 5.0% in the second quarter. Swedbank AB now owns 169,076 shares of the online travel company's stock worth $21,302,000 after acquiring an additional 8,026 shares during the period. Finally, Forsta AP Fonden lifted its stake in shares of Expedia Group by 26.6% in the 3rd quarter. Forsta AP Fonden now owns 42,300 shares of the online travel company's stock worth $6,261,000 after purchasing an additional 8,900 shares during the period. 90.76% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

EXPE has been the topic of a number of research analyst reports. BTIG Research boosted their target price on Expedia Group from $175.00 to $200.00 and gave the stock a "buy" rating in a research report on Friday. Susquehanna boosted their price target on Expedia Group from $125.00 to $145.00 and gave the stock a "neutral" rating in a research note on Monday, August 12th. UBS Group raised their price target on shares of Expedia Group from $137.00 to $156.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 23rd. DA Davidson reissued a "neutral" rating and set a $135.00 target price on shares of Expedia Group in a research note on Friday, August 9th. Finally, Piper Sandler reiterated a "neutral" rating and issued a $140.00 target price (down from $145.00) on shares of Expedia Group in a research report on Friday, August 9th. Twenty investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $159.88.

Get Our Latest Report on Expedia Group

Expedia Group Stock Performance

NASDAQ EXPE traded up $6.63 on Friday, reaching $180.76. The stock had a trading volume of 4,871,457 shares, compared to its average volume of 1,550,834. Expedia Group, Inc. has a 1-year low of $107.25 and a 1-year high of $190.40. The company has a market cap of $23.53 billion, a P/E ratio of 32.28, a price-to-earnings-growth ratio of 0.67 and a beta of 1.78. The firm has a fifty day moving average of $149.81 and a two-hundred day moving average of $133.47. The company has a debt-to-equity ratio of 2.45, a current ratio of 0.76 and a quick ratio of 0.76.

Expedia Group (NASDAQ:EXPE - Get Free Report) last released its quarterly earnings data on Thursday, August 8th. The online travel company reported $3.51 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.17 by $0.34. Expedia Group had a return on equity of 47.55% and a net margin of 6.09%. The company had revenue of $3.56 billion during the quarter, compared to the consensus estimate of $3.53 billion. During the same quarter in the prior year, the firm posted $2.34 earnings per share. The firm's revenue was up 6.0% compared to the same quarter last year. On average, equities research analysts anticipate that Expedia Group, Inc. will post 8.99 EPS for the current year.

Insider Transactions at Expedia Group

In related news, insider Robert J. Dzielak sold 5,417 shares of the company's stock in a transaction on Monday, August 19th. The stock was sold at an average price of $134.60, for a total transaction of $729,128.20. Following the completion of the sale, the insider now owns 84,543 shares in the company, valued at approximately $11,379,487.80. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. In other Expedia Group news, insider Robert J. Dzielak sold 5,417 shares of the stock in a transaction on Monday, August 19th. The stock was sold at an average price of $134.60, for a total transaction of $729,128.20. Following the sale, the insider now owns 84,543 shares in the company, valued at $11,379,487.80. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Robert J. Dzielak sold 12,602 shares of the company's stock in a transaction that occurred on Thursday, August 15th. The stock was sold at an average price of $131.50, for a total transaction of $1,657,163.00. Following the sale, the insider now directly owns 89,960 shares in the company, valued at $11,829,740. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 48,019 shares of company stock valued at $6,958,891 in the last 90 days. 6.80% of the stock is currently owned by corporate insiders.

About Expedia Group

(

Free Report)

Expedia Group, Inc operates as an online travel company in the United States and internationally. The company operates through B2C, B2B, and trivago segments. Its B2C segment includes Brand Expedia, a full-service online travel brand offers various travel products and services; Hotels.com for lodging accommodations; Vrbo, an online marketplace for the alternative accommodations; Orbitz, Travelocity, Wotif Group, ebookers, CheapTickets, Hotwire.com and CarRentals.com.

See Also

Before you consider Expedia Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expedia Group wasn't on the list.

While Expedia Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report