Amalgamated Bank cut its holdings in Carvana Co. (NYSE:CVNA - Free Report) by 47.8% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 6,222 shares of the company's stock after selling 5,707 shares during the period. Amalgamated Bank's holdings in Carvana were worth $1,083,000 as of its most recent filing with the Securities and Exchange Commission.

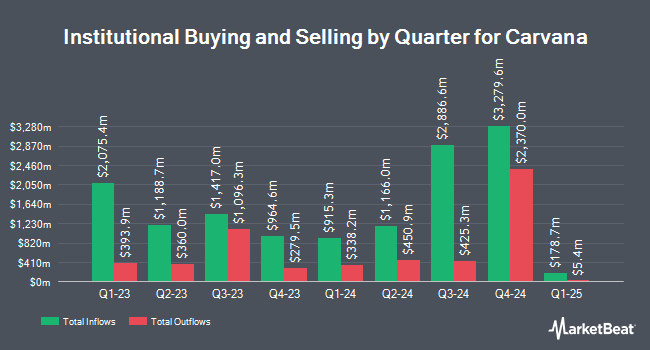

A number of other hedge funds and other institutional investors also recently made changes to their positions in CVNA. QRG Capital Management Inc. increased its stake in Carvana by 16.2% in the third quarter. QRG Capital Management Inc. now owns 6,713 shares of the company's stock valued at $1,169,000 after purchasing an additional 935 shares in the last quarter. Forum Financial Management LP grew its stake in shares of Carvana by 3.8% in the 3rd quarter. Forum Financial Management LP now owns 2,071 shares of the company's stock valued at $361,000 after buying an additional 76 shares during the period. CacheTech Inc. bought a new stake in Carvana in the 3rd quarter valued at about $224,000. New York State Common Retirement Fund raised its stake in Carvana by 6.0% during the 3rd quarter. New York State Common Retirement Fund now owns 156,901 shares of the company's stock worth $27,318,000 after buying an additional 8,849 shares during the period. Finally, US Bancorp DE raised its stake in Carvana by 80.1% during the 3rd quarter. US Bancorp DE now owns 10,342 shares of the company's stock worth $1,801,000 after buying an additional 4,599 shares during the period. 56.71% of the stock is owned by institutional investors and hedge funds.

Carvana Stock Performance

CVNA traded up $1.01 during mid-day trading on Thursday, reaching $240.99. 1,193,055 shares of the company traded hands, compared to its average volume of 4,733,478. The stock has a market capitalization of $50.04 billion, a P/E ratio of 24,031.00 and a beta of 3.37. Carvana Co. has a 52-week low of $29.84 and a 52-week high of $259.39. The company has a quick ratio of 2.12, a current ratio of 3.25 and a debt-to-equity ratio of 18.99. The company's fifty day moving average price is $188.57 and its 200-day moving average price is $147.52.

Carvana (NYSE:CVNA - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported $0.64 earnings per share for the quarter, topping the consensus estimate of $0.23 by $0.41. The business had revenue of $3.66 billion during the quarter, compared to the consensus estimate of $3.47 billion. During the same quarter in the previous year, the business posted $0.23 earnings per share. The firm's revenue was up 31.8% on a year-over-year basis. On average, sell-side analysts expect that Carvana Co. will post 0.62 EPS for the current year.

Analysts Set New Price Targets

Several equities research analysts have recently commented on CVNA shares. Wells Fargo & Company boosted their price objective on Carvana from $175.00 to $250.00 and gave the company an "overweight" rating in a report on Wednesday, October 23rd. Jefferies Financial Group boosted their price target on shares of Carvana from $150.00 to $185.00 and gave the company a "hold" rating in a research note on Tuesday, October 22nd. Morgan Stanley raised shares of Carvana from an "underweight" rating to an "equal weight" rating and raised their price objective for the company from $110.00 to $260.00 in a research note on Tuesday, November 5th. Robert W. Baird boosted their target price on shares of Carvana from $160.00 to $240.00 and gave the stock a "neutral" rating in a research report on Thursday, October 31st. Finally, Bank of America raised their price target on shares of Carvana from $185.00 to $210.00 and gave the company a "buy" rating in a research report on Wednesday, October 9th. Eleven analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $217.71.

View Our Latest Stock Analysis on Carvana

Insiders Place Their Bets

In other Carvana news, CFO Mark W. Jenkins sold 20,000 shares of the firm's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $241.78, for a total transaction of $4,835,600.00. Following the sale, the chief financial officer now directly owns 170,732 shares of the company's stock, valued at $41,279,582.96. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. In other Carvana news, CFO Mark W. Jenkins sold 20,000 shares of the stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $241.78, for a total transaction of $4,835,600.00. Following the completion of the sale, the chief financial officer now directly owns 170,732 shares of the company's stock, valued at $41,279,582.96. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CFO Mark W. Jenkins sold 208,495 shares of the business's stock in a transaction on Monday, November 4th. The stock was sold at an average price of $224.43, for a total transaction of $46,792,532.85. Following the completion of the transaction, the chief financial officer now directly owns 90,732 shares in the company, valued at $20,362,982.76. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 2,627,249 shares of company stock worth $468,516,322 over the last three months. 17.12% of the stock is currently owned by company insiders.

Carvana Profile

(

Free Report)

Carvana Co, together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. Its platform allows customers to research and identify a vehicle; inspect it using company's 360-degree vehicle imaging technology; obtain financing and warranty coverage; purchase the vehicle; and schedule delivery or pick-up from their desktop or mobile devices.

Featured Stories

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.