Pathstone Holdings LLC lowered its position in shares of Autodesk, Inc. (NASDAQ:ADSK - Free Report) by 4.3% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 45,849 shares of the software company's stock after selling 2,072 shares during the quarter. Pathstone Holdings LLC's holdings in Autodesk were worth $12,631,000 as of its most recent SEC filing.

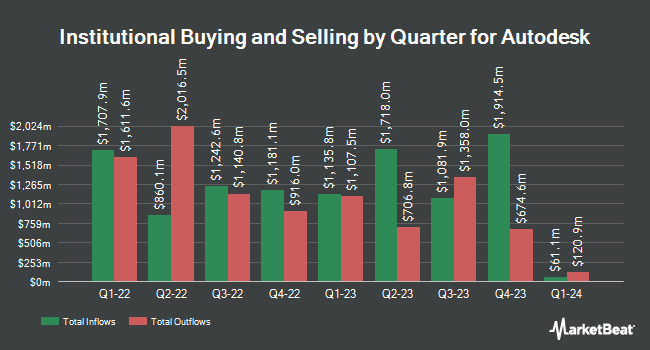

Other large investors have also added to or reduced their stakes in the company. Jag Capital Management LLC purchased a new position in shares of Autodesk in the third quarter worth about $13,861,000. Cetera Investment Advisers lifted its position in Autodesk by 163.4% during the first quarter. Cetera Investment Advisers now owns 61,574 shares of the software company's stock valued at $16,035,000 after purchasing an additional 38,196 shares during the last quarter. Forsta AP Fonden grew its stake in Autodesk by 7.9% in the 3rd quarter. Forsta AP Fonden now owns 51,600 shares of the software company's stock worth $14,215,000 after buying an additional 3,800 shares in the last quarter. QRG Capital Management Inc. raised its position in Autodesk by 32.0% during the third quarter. QRG Capital Management Inc. now owns 13,437 shares of the software company's stock valued at $3,702,000 after purchasing an additional 3,259 shares in the last quarter. Finally, Primecap Management Co. CA grew its position in Autodesk by 8.2% during the second quarter. Primecap Management Co. CA now owns 655,900 shares of the software company's stock valued at $162,302,000 after acquiring an additional 49,500 shares during the last quarter. Institutional investors and hedge funds own 90.24% of the company's stock.

Insider Activity

In other news, Director Mary T. Mcdowell sold 550 shares of the firm's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $265.50, for a total value of $146,025.00. Following the completion of the transaction, the director now owns 31,349 shares in the company, valued at $8,323,159.50. This trade represents a 1.72 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CAO Stephen W. Hope sold 286 shares of the company's stock in a transaction that occurred on Monday, September 30th. The shares were sold at an average price of $274.84, for a total transaction of $78,604.24. Following the transaction, the chief accounting officer now directly owns 4,879 shares in the company, valued at $1,340,944.36. The trade was a 5.54 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 19,280 shares of company stock worth $5,232,213. 0.14% of the stock is currently owned by insiders.

Autodesk Stock Performance

ADSK traded up $8.49 on Thursday, reaching $316.33. The stock had a trading volume of 961,220 shares, compared to its average volume of 1,572,190. Autodesk, Inc. has a 12-month low of $195.32 and a 12-month high of $317.23. The business's 50-day moving average price is $284.18 and its two-hundred day moving average price is $253.46. The company has a current ratio of 0.64, a quick ratio of 0.64 and a debt-to-equity ratio of 0.80. The company has a market cap of $68.01 billion, a P/E ratio of 62.95, a price-to-earnings-growth ratio of 3.90 and a beta of 1.47.

Autodesk (NASDAQ:ADSK - Get Free Report) last posted its earnings results on Thursday, August 29th. The software company reported $2.15 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.00 by $0.15. The company had revenue of $1.51 billion during the quarter, compared to analysts' expectations of $1.48 billion. Autodesk had a return on equity of 59.41% and a net margin of 18.21%. The firm's quarterly revenue was up 11.9% compared to the same quarter last year. During the same quarter last year, the firm earned $1.12 earnings per share. Sell-side analysts forecast that Autodesk, Inc. will post 5.73 earnings per share for the current year.

Analysts Set New Price Targets

Several brokerages have recently issued reports on ADSK. Scotiabank initiated coverage on shares of Autodesk in a report on Monday. They issued a "sector outperform" rating and a $360.00 target price on the stock. Wells Fargo & Company assumed coverage on shares of Autodesk in a report on Wednesday, October 16th. They issued an "overweight" rating and a $340.00 price objective for the company. Barclays raised their target price on Autodesk from $310.00 to $355.00 and gave the company an "overweight" rating in a research note on Friday, November 15th. The Goldman Sachs Group raised Autodesk from a "sell" rating to a "neutral" rating and boosted their price target for the stock from $225.00 to $295.00 in a research report on Tuesday, September 3rd. Finally, HSBC raised Autodesk from a "hold" rating to a "buy" rating and upped their price objective for the company from $242.00 to $299.00 in a research report on Tuesday, September 3rd. Eight equities research analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $302.38.

Get Our Latest Report on Autodesk

Autodesk Profile

(

Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

Recommended Stories

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report