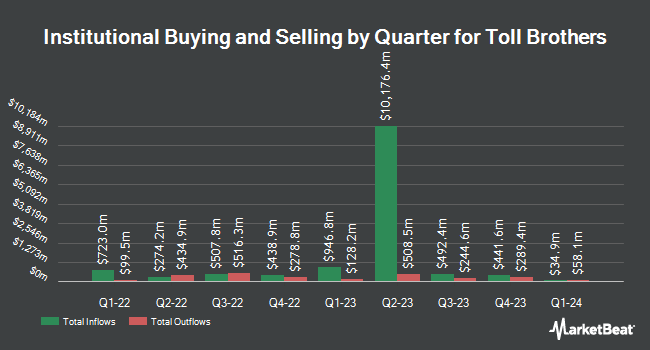

Avior Wealth Management LLC grew its holdings in Toll Brothers, Inc. (NYSE:TOL - Free Report) by 4,894.1% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 3,396 shares of the construction company's stock after buying an additional 3,328 shares during the period. Avior Wealth Management LLC's holdings in Toll Brothers were worth $525,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other hedge funds have also modified their holdings of the business. First Trust Direct Indexing L.P. increased its position in Toll Brothers by 1.4% during the third quarter. First Trust Direct Indexing L.P. now owns 5,089 shares of the construction company's stock worth $786,000 after purchasing an additional 72 shares during the last quarter. Fifth Third Bancorp boosted its stake in shares of Toll Brothers by 11.2% in the second quarter. Fifth Third Bancorp now owns 814 shares of the construction company's stock valued at $94,000 after purchasing an additional 82 shares during the period. First Citizens Bank & Trust Co. lifted its stake in Toll Brothers by 3.7% in the third quarter. First Citizens Bank & Trust Co. now owns 2,351 shares of the construction company's stock worth $363,000 after acquiring an additional 83 shares during the last quarter. Clifford Swan Investment Counsel LLC lifted its stake in Toll Brothers by 5.1% in the second quarter. Clifford Swan Investment Counsel LLC now owns 1,839 shares of the construction company's stock worth $212,000 after acquiring an additional 89 shares during the last quarter. Finally, J.Safra Asset Management Corp lifted its stake in Toll Brothers by 21.5% in the second quarter. J.Safra Asset Management Corp now owns 509 shares of the construction company's stock worth $59,000 after acquiring an additional 90 shares during the last quarter. 91.76% of the stock is currently owned by institutional investors and hedge funds.

Toll Brothers Trading Up 3.4 %

NYSE TOL traded up $5.23 during mid-day trading on Friday, hitting $157.59. The company's stock had a trading volume of 1,219,334 shares, compared to its average volume of 1,351,988. Toll Brothers, Inc. has a 52-week low of $84.40 and a 52-week high of $160.12. The stock's fifty day simple moving average is $151.91 and its two-hundred day simple moving average is $135.94. The company has a debt-to-equity ratio of 0.38, a current ratio of 4.52 and a quick ratio of 0.57. The firm has a market capitalization of $15.91 billion, a P/E ratio of 10.52, a price-to-earnings-growth ratio of 1.14 and a beta of 1.68.

Toll Brothers (NYSE:TOL - Get Free Report) last issued its quarterly earnings data on Tuesday, August 20th. The construction company reported $3.60 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.31 by $0.29. Toll Brothers had a net margin of 14.63% and a return on equity of 19.82%. The company had revenue of $2.73 billion during the quarter, compared to the consensus estimate of $2.71 billion. During the same quarter last year, the company earned $3.73 earnings per share. Toll Brothers's revenue for the quarter was up 1.5% on a year-over-year basis. Research analysts expect that Toll Brothers, Inc. will post 13.53 EPS for the current year.

Toll Brothers Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, October 25th. Shareholders of record on Friday, October 11th were issued a $0.23 dividend. This represents a $0.92 dividend on an annualized basis and a yield of 0.58%. The ex-dividend date was Friday, October 11th. Toll Brothers's dividend payout ratio is presently 6.34%.

Insiders Place Their Bets

In other Toll Brothers news, Director John A. Mclean sold 1,000 shares of the firm's stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $151.10, for a total value of $151,100.00. Following the sale, the director now directly owns 9,944 shares in the company, valued at approximately $1,502,538.40. This trade represents a 9.14 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, CEO Douglas C. Jr. Yearley sold 25,000 shares of Toll Brothers stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $158.23, for a total transaction of $3,955,750.00. Following the sale, the chief executive officer now owns 221,382 shares in the company, valued at approximately $35,029,273.86. This represents a 10.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 128,673 shares of company stock valued at $19,684,387 over the last 90 days. 1.54% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

TOL has been the topic of a number of research analyst reports. Wedbush raised shares of Toll Brothers from a "neutral" rating to an "outperform" rating and raised their price objective for the stock from $148.00 to $175.00 in a report on Friday, October 25th. Seaport Res Ptn cut shares of Toll Brothers from a "hold" rating to a "strong sell" rating in a research note on Sunday, August 4th. StockNews.com cut shares of Toll Brothers from a "buy" rating to a "hold" rating in a research note on Wednesday, September 11th. Oppenheimer increased their price objective on shares of Toll Brothers from $168.00 to $189.00 and gave the company an "outperform" rating in a research note on Wednesday, October 2nd. Finally, Keefe, Bruyette & Woods reaffirmed an "outperform" rating and set a $142.00 price target on shares of Toll Brothers in a research note on Wednesday, August 21st. Two analysts have rated the stock with a sell rating, three have issued a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $148.87.

Get Our Latest Stock Analysis on Toll Brothers

About Toll Brothers

(

Free Report)

Toll Brothers, Inc, together with its subsidiaries, designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States. It designs, builds, markets, and sells condominiums through Toll Brothers City Living. The company also develops a range of single-story living and first-floor primary bedroom suite home designs, as well as communities with recreational amenities, such as golf courses, marinas, pool complexes, country clubs, and fitness and recreation centers; and develops, operates, and rents apartments.

Recommended Stories

Before you consider Toll Brothers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toll Brothers wasn't on the list.

While Toll Brothers currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.