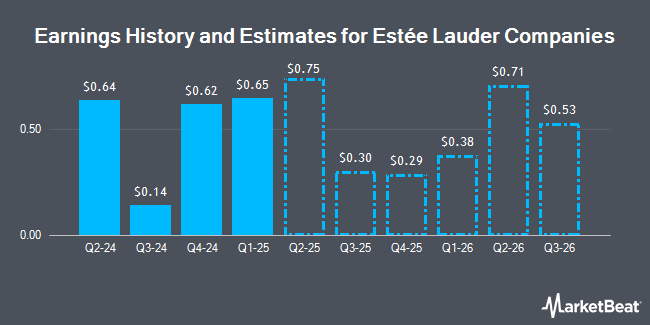

The Estée Lauder Companies Inc. (NYSE:EL - Free Report) - Equities researchers at B. Riley decreased their Q2 2025 earnings per share estimates for shares of Estée Lauder Companies in a report released on Sunday, November 3rd. B. Riley analyst A. Glaessgen now forecasts that the company will post earnings of $0.32 per share for the quarter, down from their previous forecast of $0.99. B. Riley currently has a "Neutral" rating and a $70.00 target price on the stock. The consensus estimate for Estée Lauder Companies' current full-year earnings is $2.95 per share. B. Riley also issued estimates for Estée Lauder Companies' Q3 2025 earnings at $0.70 EPS, Q4 2025 earnings at $0.41 EPS, FY2025 earnings at $1.57 EPS and FY2026 earnings at $2.63 EPS.

Estée Lauder Companies (NYSE:EL - Get Free Report) last issued its earnings results on Thursday, October 31st. The company reported $0.14 earnings per share for the quarter, topping analysts' consensus estimates of $0.09 by $0.05. Estée Lauder Companies had a return on equity of 17.31% and a net margin of 1.31%. The business had revenue of $3.36 billion during the quarter, compared to analyst estimates of $3.37 billion. During the same quarter in the previous year, the firm earned $0.11 EPS. Estée Lauder Companies's revenue was down 4.5% on a year-over-year basis.

Other equities analysts have also issued research reports about the company. Hsbc Global Res lowered Estée Lauder Companies from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, October 16th. Canaccord Genuity Group cut their price target on Estée Lauder Companies from $100.00 to $75.00 and set a "hold" rating for the company in a research note on Friday, November 1st. DA Davidson restated a "buy" rating and set a $130.00 price target on shares of Estée Lauder Companies in a research note on Tuesday, October 29th. Bank of America cut their price target on Estée Lauder Companies from $100.00 to $75.00 and set a "neutral" rating for the company in a research note on Friday, November 1st. Finally, Morgan Stanley cut their price target on Estée Lauder Companies from $100.00 to $85.00 and set an "equal weight" rating for the company in a research note on Friday, November 1st. Nineteen equities research analysts have rated the stock with a hold rating and four have given a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $100.90.

Get Our Latest Analysis on Estée Lauder Companies

Estée Lauder Companies Stock Performance

NYSE:EL traded down $2.58 during mid-day trading on Wednesday, reaching $63.28. The company's stock had a trading volume of 8,082,213 shares, compared to its average volume of 3,408,273. Estée Lauder Companies has a 12-month low of $62.88 and a 12-month high of $159.75. The firm's fifty day moving average price is $88.41 and its two-hundred day moving average price is $104.59. The company has a current ratio of 1.32, a quick ratio of 0.90 and a debt-to-equity ratio of 1.44. The stock has a market cap of $22.70 billion, a P/E ratio of 113.00, a PEG ratio of 1.17 and a beta of 1.05.

Hedge Funds Weigh In On Estée Lauder Companies

Several hedge funds have recently bought and sold shares of EL. Rothschild Investment LLC bought a new position in shares of Estée Lauder Companies during the 2nd quarter worth $30,000. Ashton Thomas Securities LLC bought a new position in shares of Estée Lauder Companies during the 3rd quarter worth $31,000. PARK CIRCLE Co bought a new position in shares of Estée Lauder Companies during the 2nd quarter worth $32,000. Kimelman & Baird LLC bought a new position in shares of Estée Lauder Companies during the 2nd quarter worth $32,000. Finally, Crewe Advisors LLC bought a new position in shares of Estée Lauder Companies during the 1st quarter worth $35,000. Institutional investors own 55.15% of the company's stock.

Insider Buying and Selling

In other news, CEO Fabrizio Freda sold 10,969 shares of the company's stock in a transaction that occurred on Friday, November 1st. The stock was sold at an average price of $67.76, for a total transaction of $743,259.44. Following the sale, the chief executive officer now directly owns 295,838 shares of the company's stock, valued at $20,045,982.88. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other Estée Lauder Companies news, CEO Fabrizio Freda sold 10,969 shares of the company's stock in a transaction on Friday, November 1st. The stock was sold at an average price of $67.76, for a total value of $743,259.44. Following the transaction, the chief executive officer now owns 295,838 shares of the company's stock, valued at $20,045,982.88. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director Lynn Forester sold 3,890 shares of the company's stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $93.61, for a total value of $364,142.90. Following the completion of the transaction, the director now directly owns 15,209 shares in the company, valued at $1,423,714.49. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 18,296 shares of company stock valued at $1,423,366. Corporate insiders own 12.78% of the company's stock.

Estée Lauder Companies Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 29th will be issued a $0.35 dividend. The ex-dividend date is Friday, November 29th. This represents a $1.40 dividend on an annualized basis and a yield of 2.21%. Estée Lauder Companies's dividend payout ratio is presently 250.00%.

About Estée Lauder Companies

(

Get Free Report)

The Estée Lauder Companies Inc manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide. It offers skin care products, including moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, and sun care products; and makeup products, such as lipsticks, lip glosses, mascaras, foundations, eyeshadows, and powders, as well as compacts, brushes, and other makeup tools.

Further Reading

Before you consider Estée Lauder Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Estée Lauder Companies wasn't on the list.

While Estée Lauder Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report