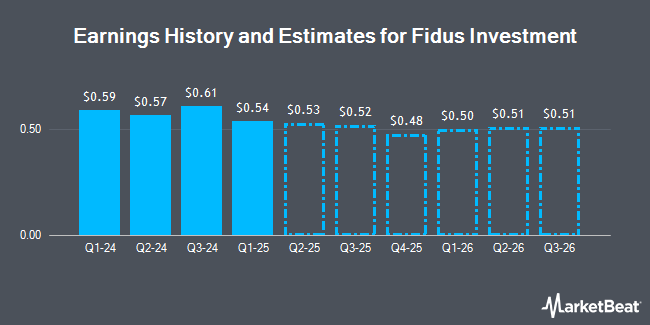

Fidus Investment Co. (NASDAQ:FDUS - Free Report) - B. Riley raised their FY2024 earnings per share (EPS) estimates for shares of Fidus Investment in a note issued to investors on Monday, November 4th. B. Riley analyst B. Rowe now expects that the asset manager will post earnings per share of $2.28 for the year, up from their prior forecast of $2.22. The consensus estimate for Fidus Investment's current full-year earnings is $2.31 per share. B. Riley also issued estimates for Fidus Investment's Q4 2024 earnings at $0.52 EPS, Q1 2025 earnings at $0.53 EPS and Q3 2025 earnings at $0.53 EPS.

Separately, Keefe, Bruyette & Woods raised Fidus Investment to a "hold" rating in a research note on Monday, August 5th.

Check Out Our Latest Report on Fidus Investment

Fidus Investment Price Performance

FDUS stock traded up $0.51 during trading on Wednesday, hitting $19.61. The stock had a trading volume of 306,000 shares, compared to its average volume of 243,072. Fidus Investment has a twelve month low of $18.41 and a twelve month high of $20.60. The company's 50-day moving average price is $19.68 and its two-hundred day moving average price is $19.73. The stock has a market capitalization of $650.27 million, a P/E ratio of 6.96 and a beta of 1.40.

Fidus Investment (NASDAQ:FDUS - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The asset manager reported $0.61 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.57 by $0.04. The business had revenue of $38.38 million for the quarter, compared to the consensus estimate of $36.43 million. Fidus Investment had a net margin of 60.09% and a return on equity of 12.11%. During the same period last year, the firm posted $0.68 earnings per share.

Institutional Investors Weigh In On Fidus Investment

Large investors have recently made changes to their positions in the stock. Cetera Investment Advisers boosted its stake in Fidus Investment by 42.2% during the first quarter. Cetera Investment Advisers now owns 197,965 shares of the asset manager's stock worth $3,908,000 after buying an additional 58,768 shares during the last quarter. Cetera Advisors LLC increased its position in Fidus Investment by 611.5% during the first quarter. Cetera Advisors LLC now owns 71,651 shares of the asset manager's stock worth $1,414,000 after purchasing an additional 61,580 shares during the last quarter. Van ECK Associates Corp raised its stake in Fidus Investment by 20.8% during the second quarter. Van ECK Associates Corp now owns 725,873 shares of the asset manager's stock worth $14,140,000 after purchasing an additional 125,011 shares during the period. Legacy Capital Wealth Partners LLC purchased a new position in Fidus Investment during the second quarter worth about $1,521,000. Finally, NewEdge Advisors LLC boosted its holdings in Fidus Investment by 9.3% in the 2nd quarter. NewEdge Advisors LLC now owns 122,359 shares of the asset manager's stock valued at $2,384,000 after purchasing an additional 10,364 shares during the last quarter. 28.14% of the stock is currently owned by hedge funds and other institutional investors.

Fidus Investment Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Tuesday, December 17th will be issued a $0.61 dividend. This is an increase from Fidus Investment's previous quarterly dividend of $0.57. The ex-dividend date of this dividend is Tuesday, December 17th. This represents a $2.44 dividend on an annualized basis and a yield of 12.44%. Fidus Investment's dividend payout ratio is presently 61.43%.

Fidus Investment Company Profile

(

Get Free Report)

Fidus Investment Corporation is a business development company. It specializing in leveraged buyouts, refinancings, change of ownership transactions, recapitalizations, strategic acquisitions, mezzanine, growth capital, business expansion, lower middle market investments, debt investments, subordinated and second lien loans, senior secured and unitranche debt, preferred equity, warrants, subordinated debt, senior subordinated notes, junior secured loans, and unitranche loans.

See Also

Before you consider Fidus Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidus Investment wasn't on the list.

While Fidus Investment currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.