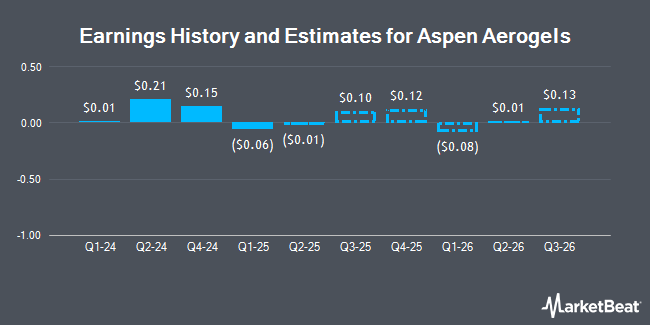

Aspen Aerogels, Inc. (NYSE:ASPN - Free Report) - Analysts at B. Riley cut their FY2027 earnings per share estimates for Aspen Aerogels in a note issued to investors on Tuesday, November 5th. B. Riley analyst R. Pfingst now anticipates that the construction company will post earnings of $1.64 per share for the year, down from their previous estimate of $1.79. The consensus estimate for Aspen Aerogels' current full-year earnings is $0.10 per share.

Several other analysts also recently weighed in on the company. Piper Sandler dropped their price objective on Aspen Aerogels from $36.00 to $33.00 and set an "overweight" rating for the company in a research report on Tuesday, October 22nd. Benchmark reissued a "buy" rating and issued a $14.00 target price on shares of Aspen Aerogels in a report on Thursday, August 8th. Roth Mkm reiterated a "buy" rating and set a $36.00 price objective on shares of Aspen Aerogels in a research report on Wednesday, August 21st. Barclays started coverage on shares of Aspen Aerogels in a research report on Tuesday, August 6th. They issued an "overweight" rating and a $27.00 target price on the stock. Finally, HC Wainwright reiterated a "buy" rating and set a $30.00 price target on shares of Aspen Aerogels in a report on Wednesday, October 16th. One investment analyst has rated the stock with a sell rating, nine have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, Aspen Aerogels currently has a consensus rating of "Moderate Buy" and a consensus target price of $29.40.

Read Our Latest Research Report on Aspen Aerogels

Aspen Aerogels Price Performance

Shares of ASPN stock traded down $1.66 during trading hours on Wednesday, reaching $16.85. The company's stock had a trading volume of 6,756,825 shares, compared to its average volume of 1,531,669. Aspen Aerogels has a fifty-two week low of $8.76 and a fifty-two week high of $33.15. The firm's 50 day simple moving average is $23.58 and its 200-day simple moving average is $24.66. The company has a quick ratio of 2.82, a current ratio of 3.46 and a debt-to-equity ratio of 0.23. The company has a market capitalization of $1.30 billion, a price-to-earnings ratio of -1,685.00 and a beta of 2.21.

Aspen Aerogels (NYSE:ASPN - Get Free Report) last issued its quarterly earnings results on Wednesday, August 7th. The construction company reported $0.21 earnings per share for the quarter, topping analysts' consensus estimates of $0.05 by $0.16. Aspen Aerogels had a net margin of 0.39% and a return on equity of 0.74%. The company had revenue of $117.80 million during the quarter, compared to the consensus estimate of $101.99 million. During the same quarter in the prior year, the firm posted ($0.22) EPS. The firm's quarterly revenue was up 144.4% on a year-over-year basis.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in the company. Sargent Investment Group LLC increased its position in shares of Aspen Aerogels by 1.8% during the third quarter. Sargent Investment Group LLC now owns 323,369 shares of the construction company's stock valued at $8,954,000 after acquiring an additional 5,830 shares during the last quarter. Black Swift Group LLC grew its stake in Aspen Aerogels by 34.1% in the 3rd quarter. Black Swift Group LLC now owns 106,500 shares of the construction company's stock valued at $2,949,000 after purchasing an additional 27,100 shares during the period. Oppenheimer & Co. Inc. increased its position in shares of Aspen Aerogels by 167.2% during the 3rd quarter. Oppenheimer & Co. Inc. now owns 102,535 shares of the construction company's stock valued at $2,839,000 after purchasing an additional 64,154 shares during the last quarter. Peregrine Asset Advisers Inc. bought a new stake in shares of Aspen Aerogels during the 3rd quarter worth $1,520,000. Finally, Sigma Planning Corp purchased a new position in shares of Aspen Aerogels in the 3rd quarter worth about $274,000. 97.64% of the stock is owned by institutional investors.

Insider Buying and Selling

In related news, CEO Donald R. Young sold 63,355 shares of Aspen Aerogels stock in a transaction on Monday, September 30th. The shares were sold at an average price of $30.03, for a total value of $1,902,550.65. Following the completion of the sale, the chief executive officer now owns 483,640 shares of the company's stock, valued at approximately $14,523,709.20. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. In other Aspen Aerogels news, CEO Donald R. Young sold 63,355 shares of Aspen Aerogels stock in a transaction dated Monday, September 30th. The stock was sold at an average price of $30.03, for a total transaction of $1,902,550.65. Following the completion of the transaction, the chief executive officer now owns 483,640 shares in the company, valued at approximately $14,523,709.20. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO Ricardo C. Rodriguez sold 32,465 shares of the stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $30.14, for a total value of $978,495.10. Following the completion of the sale, the chief financial officer now directly owns 20,790 shares of the company's stock, valued at approximately $626,610.60. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 4.30% of the stock is owned by company insiders.

About Aspen Aerogels

(

Get Free Report)

Aspen Aerogels, Inc designs, develops, manufactures, and sells aerogel insulation products primarily for use in the energy infrastructure and sustainable insulation materials markets in the United States, Asia, Canada, Europe, and Latin America. It operates in two segments, Energy Industrial and Thermal Barrier.

Read More

Before you consider Aspen Aerogels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aspen Aerogels wasn't on the list.

While Aspen Aerogels currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.