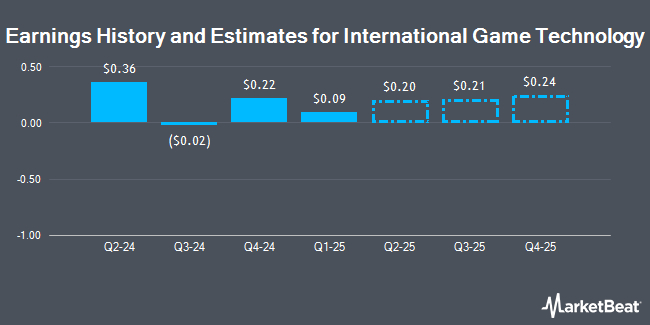

International Game Technology PLC (NYSE:IGT - Free Report) - B. Riley raised their FY2024 EPS estimates for International Game Technology in a report released on Wednesday, November 13th. B. Riley analyst D. Bain now forecasts that the company will post earnings of $1.00 per share for the year, up from their previous forecast of $0.79. B. Riley currently has a "Buy" rating and a $30.00 target price on the stock. The consensus estimate for International Game Technology's current full-year earnings is $1.16 per share. B. Riley also issued estimates for International Game Technology's Q4 2024 earnings at $0.20 EPS, Q2 2025 earnings at $0.20 EPS, Q3 2025 earnings at $0.21 EPS, Q4 2025 earnings at $0.24 EPS and FY2025 earnings at $0.90 EPS.

International Game Technology (NYSE:IGT - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($0.02) EPS for the quarter, missing the consensus estimate of $0.22 by ($0.24). International Game Technology had a net margin of 4.17% and a return on equity of 16.17%. The firm had revenue of $587.00 million during the quarter, compared to analysts' expectations of $591.50 million. During the same quarter last year, the business posted $0.52 EPS. The company's quarterly revenue was down 2.3% on a year-over-year basis.

A number of other equities research analysts have also recently commented on IGT. Stifel Nicolaus lifted their target price on International Game Technology from $26.00 to $30.00 and gave the stock a "buy" rating in a research note on Wednesday, July 31st. StockNews.com raised International Game Technology from a "hold" rating to a "buy" rating in a research report on Friday, November 8th. Two investment analysts have rated the stock with a hold rating and five have given a buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $28.67.

View Our Latest Analysis on International Game Technology

International Game Technology Stock Performance

Shares of IGT traded down $0.33 on Monday, reaching $19.19. 1,363,545 shares of the company's stock traded hands, compared to its average volume of 1,114,337. The stock's 50 day simple moving average is $20.94 and its two-hundred day simple moving average is $20.93. The company has a current ratio of 2.36, a quick ratio of 0.71 and a debt-to-equity ratio of 2.85. International Game Technology has a 52-week low of $18.90 and a 52-week high of $28.82. The stock has a market cap of $3.82 billion, a PE ratio of 32.52 and a beta of 1.96.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently modified their holdings of the business. Barclays PLC lifted its position in International Game Technology by 49.1% during the third quarter. Barclays PLC now owns 291,626 shares of the company's stock valued at $6,212,000 after purchasing an additional 96,019 shares during the last quarter. Y Intercept Hong Kong Ltd lifted its holdings in shares of International Game Technology by 180.1% during the 3rd quarter. Y Intercept Hong Kong Ltd now owns 29,932 shares of the company's stock worth $638,000 after acquiring an additional 19,247 shares during the last quarter. Zacks Investment Management purchased a new position in International Game Technology in the third quarter worth $645,000. State Street Corp increased its stake in International Game Technology by 1.0% in the third quarter. State Street Corp now owns 2,103,275 shares of the company's stock valued at $44,800,000 after acquiring an additional 21,295 shares during the last quarter. Finally, Stifel Financial Corp raised its holdings in shares of International Game Technology by 22.2% during the 3rd quarter. Stifel Financial Corp now owns 56,179 shares of the company's stock valued at $1,197,000 after buying an additional 10,193 shares in the last quarter. Hedge funds and other institutional investors own 44.33% of the company's stock.

International Game Technology Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Tuesday, November 26th will be paid a $0.20 dividend. The ex-dividend date is Tuesday, November 26th. This represents a $0.80 dividend on an annualized basis and a yield of 4.17%. International Game Technology's dividend payout ratio is currently 133.33%.

International Game Technology Company Profile

(

Get Free Report)

International Game Technology PLC operates and provides gaming technology products and services in the United States, Canada, Italy, The United Kingdom, rest of Europe, and internationally. It operates through three segments: Global Lottery, Global Gaming, and PlayDigital. The company designs, sells, operates, and leases a suite of point-of-sale machines that reconciles lottery funds between the retailer and lottery authority; provides online lottery transaction processing systems; produces instant ticket games; and offers printing services, such as instant ticket marketing plans and graphic design, programming, packaging, shipping, and delivery services, as well as iLottery solutions and services.

See Also

Before you consider International Game Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Game Technology wasn't on the list.

While International Game Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.