Lithium Americas (NYSE:LAC - Get Free Report) had its target price lifted by investment analysts at B. Riley from $4.50 to $5.00 in a research note issued on Tuesday,Benzinga reports. The firm presently has a "buy" rating on the stock. B. Riley's price target would suggest a potential upside of 21.36% from the stock's previous close.

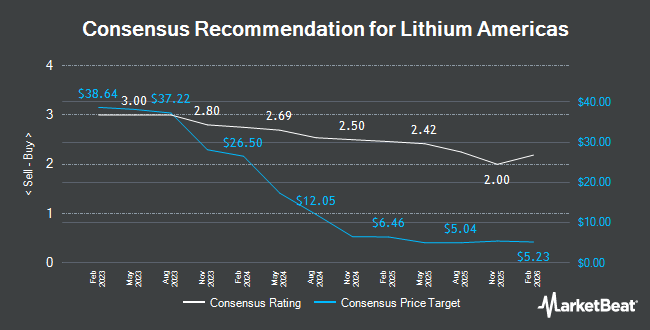

A number of other analysts also recently commented on LAC. BMO Capital Markets raised Lithium Americas to a "hold" rating in a research note on Wednesday, October 23rd. National Bank Financial upgraded Lithium Americas from a "sector perform" rating to an "outperform" rating in a report on Thursday, October 17th. Piper Sandler initiated coverage on Lithium Americas in a research note on Monday, July 29th. They set a "neutral" rating and a $3.90 price target on the stock. Deutsche Bank Aktiengesellschaft decreased their price objective on Lithium Americas from $3.00 to $2.50 and set a "hold" rating on the stock in a report on Friday, August 16th. Finally, Scotiabank cut their price objective on Lithium Americas from $3.00 to $2.50 and set a "sector perform" rating for the company in a research report on Friday, October 18th. Six equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus target price of $5.63.

Get Our Latest Stock Report on Lithium Americas

Lithium Americas Trading Down 2.6 %

Shares of Lithium Americas stock traded down $0.11 on Tuesday, reaching $4.12. 9,413,372 shares of the stock were exchanged, compared to its average volume of 5,346,039. Lithium Americas has a 1-year low of $2.02 and a 1-year high of $7.86. The business has a fifty day moving average price of $2.99 and a two-hundred day moving average price of $3.08. The firm has a market capitalization of $909.16 million and a PE ratio of -34.33.

Lithium Americas (NYSE:LAC - Get Free Report) last issued its quarterly earnings results on Tuesday, August 13th. The company reported ($0.05) EPS for the quarter, missing the consensus estimate of ($0.03) by ($0.02). Research analysts expect that Lithium Americas will post -0.09 EPS for the current year.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Wolverine Asset Management LLC increased its stake in Lithium Americas by 3.7% in the 3rd quarter. Wolverine Asset Management LLC now owns 278,622 shares of the company's stock valued at $752,000 after purchasing an additional 10,000 shares in the last quarter. Creative Financial Designs Inc. ADV increased its holdings in shares of Lithium Americas by 39.5% during the 3rd quarter. Creative Financial Designs Inc. ADV now owns 13,040 shares of the company's stock worth $35,000 after purchasing an additional 3,693 shares during the period. Hedges Asset Management LLC grew its holdings in shares of Lithium Americas by 100.0% during the third quarter. Hedges Asset Management LLC now owns 50,000 shares of the company's stock worth $135,000 after purchasing an additional 25,000 shares during the last quarter. Wealth Enhancement Advisory Services LLC raised its position in shares of Lithium Americas by 41.2% in the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 373,380 shares of the company's stock valued at $1,008,000 after acquiring an additional 108,993 shares during the period. Finally, PFG Investments LLC acquired a new position in Lithium Americas during the 3rd quarter worth approximately $90,000.

Lithium Americas Company Profile

(

Get Free Report)

Lithium Americas Corp. engages in the exploration and development of lithium properties in the United States and Canada. It holds a 100% interest in the Thacker Pass project located in northern Nevada, as well as investments in exploration properties in the United States and Canada. Lithium Americas Corp.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lithium Americas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas wasn't on the list.

While Lithium Americas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.