Baillie Gifford & Co. increased its stake in Aehr Test Systems (NASDAQ:AEHR - Free Report) by 8.2% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,806,849 shares of the semiconductor company's stock after acquiring an additional 136,259 shares during the period. Baillie Gifford & Co. owned approximately 6.10% of Aehr Test Systems worth $23,218,000 at the end of the most recent reporting period.

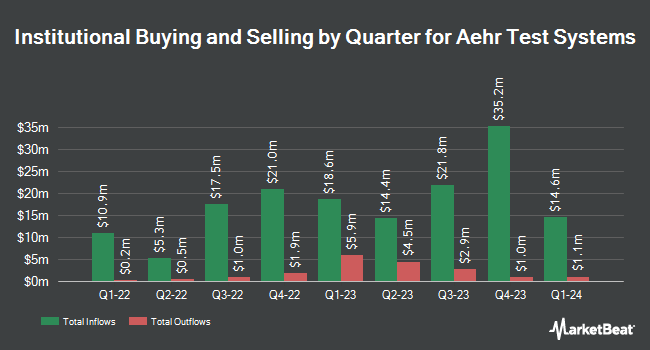

A number of other hedge funds have also made changes to their positions in the stock. nVerses Capital LLC bought a new stake in shares of Aehr Test Systems in the 2nd quarter worth approximately $25,000. Quest Partners LLC bought a new position in shares of Aehr Test Systems in the second quarter valued at $47,000. US Bancorp DE acquired a new stake in shares of Aehr Test Systems during the 3rd quarter valued at $77,000. B. Riley Wealth Advisors Inc. bought a new stake in shares of Aehr Test Systems during the 1st quarter worth $109,000. Finally, Montanaro Asset Management Ltd bought a new stake in shares of Aehr Test Systems during the 3rd quarter worth $112,000. Institutional investors and hedge funds own 69.69% of the company's stock.

Aehr Test Systems Stock Performance

NASDAQ:AEHR traded down $0.27 during trading hours on Wednesday, hitting $11.73. 1,123,062 shares of the company's stock traded hands, compared to its average volume of 1,375,838. Aehr Test Systems has a twelve month low of $9.83 and a twelve month high of $30.50. The firm has a market cap of $347.56 million, a P/E ratio of 11.93 and a beta of 2.03. The stock's fifty day moving average price is $13.45 and its two-hundred day moving average price is $13.45.

Aehr Test Systems (NASDAQ:AEHR - Get Free Report) last issued its earnings results on Thursday, October 10th. The semiconductor company reported $0.04 earnings per share for the quarter, beating analysts' consensus estimates of ($0.01) by $0.05. The company had revenue of $13.12 million for the quarter, compared to the consensus estimate of $11.90 million. Aehr Test Systems had a return on equity of 29.31% and a net margin of 49.63%. On average, equities research analysts predict that Aehr Test Systems will post 0.22 earnings per share for the current year.

Analyst Ratings Changes

Several equities research analysts have recently commented on AEHR shares. Craig Hallum raised Aehr Test Systems from a "hold" rating to a "buy" rating and upped their target price for the company from $12.00 to $25.00 in a report on Wednesday, July 17th. StockNews.com downgraded Aehr Test Systems from a "hold" rating to a "sell" rating in a report on Saturday, October 5th.

Get Our Latest Analysis on Aehr Test Systems

About Aehr Test Systems

(

Free Report)

Aehr Test Systems provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, and package part form, and installed systems worldwide. Its product portfolio includes FOX-XP and FOX-NP systems that are full wafer contact and singulated die/module test and burn-in systems that can test, burn-in, and stabilize range of devices, including silicon carbide-based and other power semiconductors, 2D and 3D sensors used in mobile phones, tablets and other computing devices, memory semiconductors, processors, microcontrollers, systems-on-a-chip, and photonics and integrated optical devices.

Featured Stories

Before you consider Aehr Test Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aehr Test Systems wasn't on the list.

While Aehr Test Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.