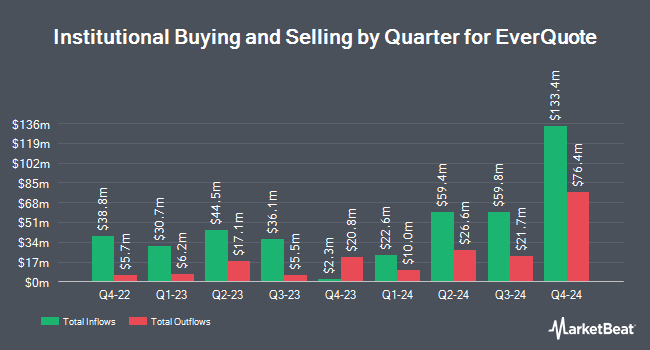

Baillie Gifford & Co. cut its holdings in shares of EverQuote, Inc. (NASDAQ:EVER - Free Report) by 37.8% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 263,931 shares of the company's stock after selling 160,252 shares during the quarter. Baillie Gifford & Co. owned approximately 0.75% of EverQuote worth $5,566,000 as of its most recent SEC filing.

Other large investors have also made changes to their positions in the company. Quarry LP grew its position in shares of EverQuote by 215.5% during the second quarter. Quarry LP now owns 1,442 shares of the company's stock valued at $30,000 after purchasing an additional 985 shares in the last quarter. nVerses Capital LLC bought a new position in shares of EverQuote during the 2nd quarter valued at approximately $35,000. CWM LLC increased its position in EverQuote by 133.2% in the second quarter. CWM LLC now owns 1,861 shares of the company's stock worth $39,000 after purchasing an additional 1,063 shares during the last quarter. Meeder Asset Management Inc. purchased a new stake in EverQuote during the second quarter valued at $76,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank purchased a new stake in EverQuote during the second quarter valued at $147,000. 91.54% of the stock is currently owned by hedge funds and other institutional investors.

EverQuote Stock Performance

NASDAQ:EVER traded down $0.68 during mid-day trading on Thursday, hitting $18.73. 126,222 shares of the company's stock traded hands, compared to its average volume of 472,418. The company has a market capitalization of $657.05 million, a P/E ratio of 57.09 and a beta of 1.06. The company has a fifty day moving average of $20.07 and a 200 day moving average of $21.79. EverQuote, Inc. has a twelve month low of $8.18 and a twelve month high of $28.09.

EverQuote (NASDAQ:EVER - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The company reported $0.31 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.22 by $0.09. The business had revenue of $144.53 million for the quarter, compared to analyst estimates of $140.30 million. EverQuote had a net margin of 3.31% and a return on equity of 13.94%. EverQuote's revenue for the quarter was up 162.7% compared to the same quarter last year. During the same quarter in the prior year, the business posted ($0.40) EPS. On average, research analysts expect that EverQuote, Inc. will post 0.65 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several equities research analysts have weighed in on the company. Craig Hallum boosted their price objective on EverQuote from $30.00 to $33.00 and gave the stock a "buy" rating in a research note on Tuesday, August 6th. B. Riley dropped their price target on shares of EverQuote from $36.50 to $29.00 and set a "buy" rating for the company in a research note on Tuesday, November 5th. JPMorgan Chase & Co. reduced their price objective on shares of EverQuote from $34.00 to $28.00 and set an "overweight" rating on the stock in a research report on Tuesday, November 5th. Finally, Needham & Company LLC upped their target price on EverQuote from $30.00 to $38.00 and gave the company a "buy" rating in a research note on Tuesday, August 6th. Six equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, EverQuote presently has an average rating of "Buy" and an average target price of $28.50.

Get Our Latest Stock Analysis on EverQuote

Insiders Place Their Bets

In other EverQuote news, Director George R. Neble sold 2,500 shares of EverQuote stock in a transaction dated Thursday, October 10th. The stock was sold at an average price of $19.42, for a total transaction of $48,550.00. Following the completion of the transaction, the director now owns 54,970 shares in the company, valued at approximately $1,067,517.40. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. In other news, Director George R. Neble sold 2,500 shares of the firm's stock in a transaction dated Thursday, October 10th. The stock was sold at an average price of $19.42, for a total transaction of $48,550.00. Following the sale, the director now directly owns 54,970 shares in the company, valued at $1,067,517.40. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CTO David Brainard sold 1,641 shares of the stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $20.22, for a total value of $33,181.02. Following the transaction, the chief technology officer now owns 155,491 shares in the company, valued at $3,144,028.02. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 20,270 shares of company stock valued at $431,011. 29.79% of the stock is owned by insiders.

EverQuote Profile

(

Free Report)

EverQuote, Inc operates an online marketplace for insurance shopping in the United States. The company offers auto, home and renters, and life insurance. The company serves carriers and agents, as well as indirect distributors. The company was formerly known as AdHarmonics, Inc, and changed its name to EverQuote, Inc in November 2014.

Recommended Stories

Before you consider EverQuote, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EverQuote wasn't on the list.

While EverQuote currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.