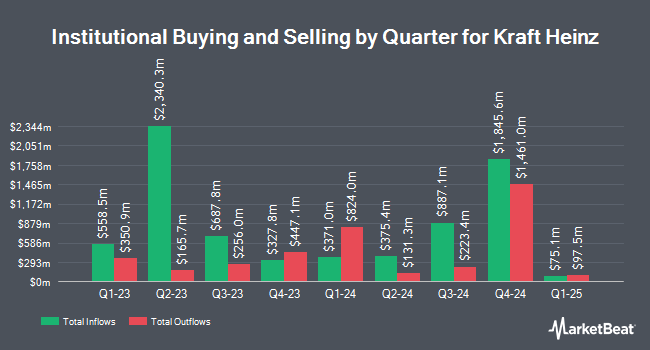

Bank of Montreal Can decreased its position in shares of The Kraft Heinz Company (NASDAQ:KHC - Free Report) by 1.2% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,753,803 shares of the company's stock after selling 22,086 shares during the period. Bank of Montreal Can owned approximately 0.15% of Kraft Heinz worth $62,032,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in KHC. Fortitude Family Office LLC raised its stake in Kraft Heinz by 249.5% during the third quarter. Fortitude Family Office LLC now owns 741 shares of the company's stock valued at $26,000 after purchasing an additional 529 shares in the last quarter. New Covenant Trust Company N.A. purchased a new stake in shares of Kraft Heinz during the 1st quarter valued at about $27,000. Ashton Thomas Securities LLC bought a new position in shares of Kraft Heinz in the 3rd quarter valued at about $27,000. DiNuzzo Private Wealth Inc. grew its position in Kraft Heinz by 1,077.0% in the third quarter. DiNuzzo Private Wealth Inc. now owns 871 shares of the company's stock worth $31,000 after acquiring an additional 797 shares in the last quarter. Finally, Asset Dedication LLC increased its stake in Kraft Heinz by 94.8% during the second quarter. Asset Dedication LLC now owns 978 shares of the company's stock worth $32,000 after acquiring an additional 476 shares during the last quarter. 78.17% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently commented on the company. Barclays dropped their target price on Kraft Heinz from $36.00 to $35.00 and set an "equal weight" rating for the company in a report on Friday, November 1st. Wells Fargo & Company boosted their price objective on shares of Kraft Heinz from $34.00 to $35.00 and gave the company an "equal weight" rating in a research report on Thursday, August 1st. Stifel Nicolaus lowered shares of Kraft Heinz from a "buy" rating to a "hold" rating and lowered their target price for the stock from $40.00 to $38.00 in a report on Friday, October 25th. Piper Sandler reiterated a "neutral" rating and set a $35.00 price target (down from $40.00) on shares of Kraft Heinz in a report on Tuesday, November 19th. Finally, Citigroup decreased their price objective on shares of Kraft Heinz from $39.00 to $38.00 and set a "buy" rating for the company in a research note on Thursday, October 31st. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat, Kraft Heinz currently has a consensus rating of "Hold" and an average target price of $36.55.

Read Our Latest Report on KHC

Kraft Heinz Trading Down 0.1 %

Shares of Kraft Heinz stock traded down $0.04 on Thursday, hitting $31.93. 6,703,961 shares of the company traded hands, compared to its average volume of 8,011,506. The Kraft Heinz Company has a 52 week low of $30.40 and a 52 week high of $38.96. The company has a market cap of $38.61 billion, a PE ratio of 28.77, a PEG ratio of 3.66 and a beta of 0.49. The stock's 50 day moving average price is $33.89 and its 200-day moving average price is $34.17. The company has a current ratio of 1.06, a quick ratio of 0.56 and a debt-to-equity ratio of 0.40.

Kraft Heinz (NASDAQ:KHC - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $0.75 earnings per share for the quarter, topping the consensus estimate of $0.74 by $0.01. The business had revenue of $6.38 billion during the quarter, compared to analysts' expectations of $6.42 billion. Kraft Heinz had a return on equity of 7.46% and a net margin of 5.24%. The business's revenue for the quarter was down 2.8% compared to the same quarter last year. During the same period in the prior year, the business earned $0.72 EPS. Equities research analysts predict that The Kraft Heinz Company will post 3.01 EPS for the current year.

Kraft Heinz Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Friday, November 29th will be given a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 5.01%. The ex-dividend date is Friday, November 29th. Kraft Heinz's dividend payout ratio (DPR) is 144.14%.

Insider Activity

In other news, EVP Pedro F. P. Navio sold 45,000 shares of the business's stock in a transaction on Tuesday, November 5th. The stock was sold at an average price of $33.45, for a total value of $1,505,250.00. Following the completion of the transaction, the executive vice president now directly owns 168,195 shares of the company's stock, valued at approximately $5,626,122.75. The trade was a 21.11 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 0.37% of the company's stock.

Kraft Heinz Company Profile

(

Free Report)

The Kraft Heinz Company, together with its subsidiaries, manufactures and markets food and beverage products in North America and internationally. Its products include condiments and sauces, cheese and dairy products, meals, meats, refreshment beverages, coffee, and other grocery products under the Kraft, Oscar Mayer, Heinz, Philadelphia, Lunchables, Velveeta, Ore-Ida, Maxwell House, Kool-Aid, Jell-O, Heinz, ABC, Master, Quero, Kraft, Golden Circle, Wattie's, Pudliszki, and Plasmon brands.

Further Reading

Before you consider Kraft Heinz, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kraft Heinz wasn't on the list.

While Kraft Heinz currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.