Appian (NASDAQ:APPN - Free Report) had its price target lifted by Barclays from $29.00 to $34.00 in a report published on Friday,Benzinga reports. Barclays currently has an underweight rating on the stock.

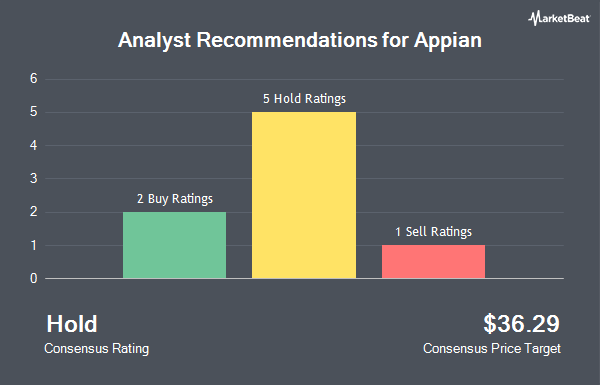

A number of other brokerages have also issued reports on APPN. William Blair lowered shares of Appian from an "outperform" rating to a "market perform" rating in a research note on Thursday, August 1st. DA Davidson reaffirmed a "neutral" rating and set a $33.00 target price on shares of Appian in a research report on Monday, October 14th. KeyCorp lowered Appian from an "overweight" rating to a "sector weight" rating in a report on Friday, August 2nd. Finally, The Goldman Sachs Group reduced their price objective on Appian from $47.00 to $41.00 and set a "buy" rating on the stock in a report on Friday, August 2nd. One analyst has rated the stock with a sell rating, four have assigned a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, Appian presently has a consensus rating of "Hold" and a consensus price target of $40.20.

View Our Latest Stock Analysis on APPN

Appian Price Performance

Shares of APPN traded down $0.78 during midday trading on Friday, hitting $40.78. The stock had a trading volume of 503,192 shares, compared to its average volume of 551,419. The firm has a market cap of $2.95 billion, a PE ratio of -27.37 and a beta of 1.57. Appian has a 1 year low of $26.28 and a 1 year high of $43.33. The stock's 50 day moving average is $33.35 and its 200 day moving average is $32.24.

Appian (NASDAQ:APPN - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported $0.02 earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.22) by $0.24. Appian had a negative return on equity of 532.05% and a negative net margin of 18.80%. The business had revenue of $154.05 million during the quarter, compared to analyst estimates of $150.94 million. As a group, equities research analysts expect that Appian will post -1.08 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, major shareholder Abdiel Capital Advisors, Lp purchased 274,583 shares of the business's stock in a transaction dated Wednesday, August 14th. The shares were acquired at an average cost of $30.05 per share, for a total transaction of $8,251,219.15. Following the acquisition, the insider now owns 9,092,617 shares of the company's stock, valued at $273,233,140.85. The trade was a 0.00 % increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders acquired 819,276 shares of company stock valued at $24,988,101 over the last 90 days. Corporate insiders own 44.00% of the company's stock.

Hedge Funds Weigh In On Appian

Institutional investors and hedge funds have recently bought and sold shares of the company. Crossmark Global Holdings Inc. increased its position in Appian by 3.0% during the 2nd quarter. Crossmark Global Holdings Inc. now owns 9,693 shares of the company's stock valued at $299,000 after buying an additional 280 shares in the last quarter. The Manufacturers Life Insurance Company raised its position in shares of Appian by 3.4% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 21,002 shares of the company's stock valued at $648,000 after purchasing an additional 689 shares during the last quarter. ProShare Advisors LLC raised its position in shares of Appian by 10.0% in the 1st quarter. ProShare Advisors LLC now owns 8,337 shares of the company's stock valued at $333,000 after purchasing an additional 758 shares during the last quarter. Allspring Global Investments Holdings LLC acquired a new stake in Appian in the 3rd quarter worth approximately $29,000. Finally, Point72 Asia Singapore Pte. Ltd. grew its position in Appian by 35.8% during the 2nd quarter. Point72 Asia Singapore Pte. Ltd. now owns 4,126 shares of the company's stock worth $127,000 after purchasing an additional 1,088 shares during the last quarter. 52.70% of the stock is owned by hedge funds and other institutional investors.

About Appian

(

Get Free Report)

Appian Corporation, a software company that provides low-code design platform in the United States, Mexico, Portugal, and internationally. The company's platform offers artificial intelligence, process automation, data fabric, and process mining. It provides The Appian Platform, an integrated automation platform that enables organizations to design, automate, and optimize mission-critical business processes.

Recommended Stories

Before you consider Appian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Appian wasn't on the list.

While Appian currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.