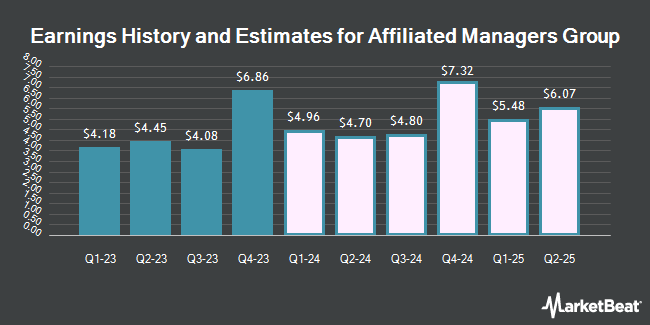

Affiliated Managers Group, Inc. (NYSE:AMG - Free Report) - Equities researchers at Barrington Research lowered their Q4 2024 earnings estimates for shares of Affiliated Managers Group in a report issued on Tuesday, November 5th. Barrington Research analyst A. Paris now anticipates that the asset manager will post earnings of $6.05 per share for the quarter, down from their previous forecast of $6.76. Barrington Research has a "Outperform" rating and a $200.00 price objective on the stock. The consensus estimate for Affiliated Managers Group's current full-year earnings is $22.02 per share. Barrington Research also issued estimates for Affiliated Managers Group's FY2025 earnings at $23.25 EPS.

Affiliated Managers Group (NYSE:AMG - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The asset manager reported $4.82 earnings per share for the quarter, missing the consensus estimate of $4.84 by ($0.02). The firm had revenue of $525.20 million for the quarter, compared to analysts' expectations of $521.87 million. Affiliated Managers Group had a net margin of 27.02% and a return on equity of 16.76%. The business's quarterly revenue was up 1.7% compared to the same quarter last year. During the same quarter in the prior year, the business earned $4.08 EPS.

A number of other equities analysts have also recently commented on AMG. Bank of America lifted their price objective on shares of Affiliated Managers Group from $200.00 to $201.00 and gave the stock a "neutral" rating in a research note on Tuesday, July 30th. StockNews.com cut Affiliated Managers Group from a "buy" rating to a "hold" rating in a research note on Tuesday, July 30th. TD Cowen downgraded Affiliated Managers Group from a "buy" rating to a "hold" rating and decreased their price objective for the company from $226.00 to $177.00 in a research report on Tuesday. Finally, Deutsche Bank Aktiengesellschaft dropped their target price on Affiliated Managers Group from $219.00 to $204.00 and set a "buy" rating for the company in a report on Tuesday. Three equities research analysts have rated the stock with a hold rating and two have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $195.50.

Read Our Latest Stock Report on Affiliated Managers Group

Affiliated Managers Group Trading Down 1.6 %

AMG traded down $3.03 during trading hours on Thursday, hitting $183.17. The company's stock had a trading volume of 134,468 shares, compared to its average volume of 183,105. The stock has a market cap of $5.46 billion, a price-to-earnings ratio of 11.95, a P/E/G ratio of 0.57 and a beta of 1.18. The business's 50-day moving average price is $180.73 and its 200-day moving average price is $168.93. Affiliated Managers Group has a 12 month low of $129.57 and a 12 month high of $199.52.

Hedge Funds Weigh In On Affiliated Managers Group

Several institutional investors have recently made changes to their positions in the company. Ashton Thomas Securities LLC bought a new position in Affiliated Managers Group during the 3rd quarter worth about $30,000. Altshuler Shaham Ltd bought a new position in Affiliated Managers Group in the second quarter worth approximately $28,000. UMB Bank n.a. lifted its holdings in Affiliated Managers Group by 481.3% during the third quarter. UMB Bank n.a. now owns 186 shares of the asset manager's stock worth $33,000 after buying an additional 154 shares during the period. Daiwa Securities Group Inc. purchased a new stake in Affiliated Managers Group during the second quarter worth $47,000. Finally, Huntington National Bank increased its holdings in shares of Affiliated Managers Group by 7,575.0% in the 3rd quarter. Huntington National Bank now owns 307 shares of the asset manager's stock valued at $55,000 after acquiring an additional 303 shares during the period. Hedge funds and other institutional investors own 95.30% of the company's stock.

Insider Transactions at Affiliated Managers Group

In other Affiliated Managers Group news, CEO Jay C. Horgen sold 9,000 shares of the company's stock in a transaction on Monday, August 19th. The stock was sold at an average price of $171.98, for a total value of $1,547,820.00. Following the transaction, the chief executive officer now owns 377,276 shares of the company's stock, valued at $64,883,926.48. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. In other Affiliated Managers Group news, CEO Jay C. Horgen sold 9,000 shares of the company's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $171.98, for a total value of $1,547,820.00. Following the transaction, the chief executive officer now directly owns 377,276 shares in the company, valued at $64,883,926.48. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, COO Thomas M. Wojcik sold 4,786 shares of Affiliated Managers Group stock in a transaction that occurred on Friday, August 16th. The shares were sold at an average price of $172.71, for a total transaction of $826,590.06. Following the sale, the chief operating officer now directly owns 84,392 shares of the company's stock, valued at $14,575,342.32. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 22,408 shares of company stock worth $3,865,068. 1.90% of the stock is currently owned by company insiders.

Affiliated Managers Group Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, November 29th. Stockholders of record on Thursday, November 14th will be paid a dividend of $0.01 per share. The ex-dividend date is Thursday, November 14th. This represents a $0.04 dividend on an annualized basis and a dividend yield of 0.02%. Affiliated Managers Group's dividend payout ratio is 0.26%.

About Affiliated Managers Group

(

Get Free Report)

Affiliated Managers Group, Inc, through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States. It provides advisory or sub-advisory services to mutual funds.

Featured Articles

Before you consider Affiliated Managers Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Affiliated Managers Group wasn't on the list.

While Affiliated Managers Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.