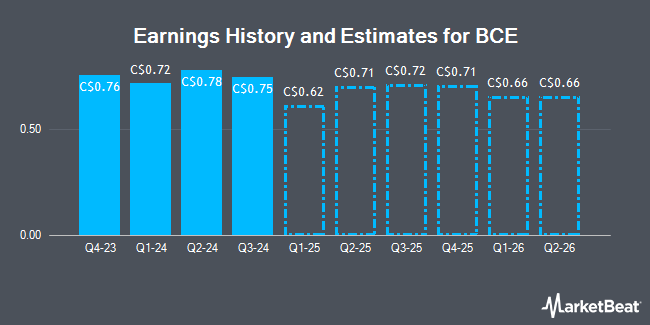

BCE Inc. (TSE:BCE - Free Report) NYSE: BCE - Equities researchers at National Bank Financial lowered their FY2025 earnings per share estimates for shares of BCE in a research report issued on Monday, November 4th. National Bank Financial analyst A. Shine now forecasts that the company will earn $2.90 per share for the year, down from their prior estimate of $3.02. National Bank Financial currently has a "Hold" rating on the stock. The consensus estimate for BCE's current full-year earnings is $3.11 per share.

A number of other equities analysts have also recently commented on the company. Cormark lowered their target price on BCE from C$53.00 to C$52.00 in a report on Friday, August 2nd. Barclays lowered their target price on BCE from C$48.00 to C$46.00 in a report on Wednesday, October 9th. JPMorgan Chase & Co. raised their target price on BCE from C$46.00 to C$47.00 and gave the company a "neutral" rating in a report on Friday, August 2nd. TD Securities lowered their target price on BCE from C$50.00 to C$43.00 in a report on Tuesday. Finally, BMO Capital Markets raised their target price on BCE from C$48.00 to C$51.00 in a report on Thursday, September 19th. Ten analysts have rated the stock with a hold rating and one has given a buy rating to the company. Based on data from MarketBeat.com, BCE presently has an average rating of "Hold" and an average target price of C$47.23.

Check Out Our Latest Research Report on BCE

BCE Trading Up 0.4 %

Shares of TSE BCE traded up C$0.14 during mid-day trading on Wednesday, reaching C$40.06. 6,799,752 shares of the company's stock were exchanged, compared to its average volume of 3,038,167. The company's 50-day moving average is C$46.32 and its 200-day moving average is C$45.95. BCE has a 52-week low of C$39.43 and a 52-week high of C$56.18. The firm has a market capitalization of C$36.55 billion, a price-to-earnings ratio of 18.63, a PEG ratio of 4.67 and a beta of 0.48. The company has a debt-to-equity ratio of 197.43, a quick ratio of 0.43 and a current ratio of 0.65.

BCE Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Tuesday, October 15th were paid a $0.998 dividend. This represents a $3.99 annualized dividend and a dividend yield of 9.97%. The ex-dividend date of this dividend was Monday, September 16th. BCE's payout ratio is presently 185.58%.

BCE Company Profile

(

Get Free Report)

BCE Inc, a communications company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada. The company operates through two segments, Bell Communication and Technology Services, and Bell Media. The Bell Communication and Technology Services segment provides wireless products and services including mobile data and voice plans and devices; wireline products and services comprising data, including internet access, internet protocol television, cloud-based services, and business solutions, as well as voice, and other communication services and products; and satellite TV and connectivity services for residential, small and medium-sized business, government, and large enterprise customers.

Recommended Stories

Before you consider BCE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BCE wasn't on the list.

While BCE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.