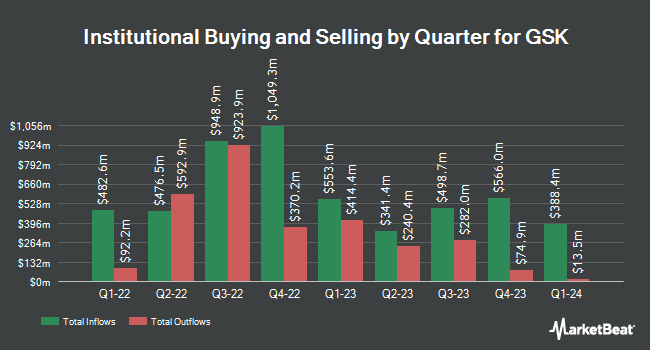

Bell Bank trimmed its position in GSK plc (NYSE:GSK - Free Report) by 14.1% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 150,911 shares of the pharmaceutical company's stock after selling 24,678 shares during the quarter. Bell Bank's holdings in GSK were worth $6,169,000 at the end of the most recent quarter.

Other institutional investors have also made changes to their positions in the company. Primecap Management Co. CA lifted its holdings in shares of GSK by 13.9% during the 2nd quarter. Primecap Management Co. CA now owns 14,511,390 shares of the pharmaceutical company's stock valued at $558,689,000 after buying an additional 1,773,020 shares during the last quarter. Provident Trust Co. lifted its stake in shares of GSK by 1.7% in the 3rd quarter. Provident Trust Co. now owns 3,953,602 shares of the pharmaceutical company's stock valued at $161,623,000 after purchasing an additional 66,765 shares during the last quarter. Equity Investment Corp boosted its holdings in GSK by 1.0% in the second quarter. Equity Investment Corp now owns 3,433,202 shares of the pharmaceutical company's stock worth $132,178,000 after purchasing an additional 34,631 shares in the last quarter. Renaissance Technologies LLC raised its holdings in GSK by 30.9% during the second quarter. Renaissance Technologies LLC now owns 2,347,993 shares of the pharmaceutical company's stock valued at $90,398,000 after buying an additional 554,600 shares in the last quarter. Finally, Dimensional Fund Advisors LP boosted its stake in shares of GSK by 33.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,256,320 shares of the pharmaceutical company's stock worth $86,875,000 after acquiring an additional 569,614 shares in the last quarter. 15.74% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at GSK

In other GSK news, major shareholder Plc Gsk purchased 2,791,930 shares of the stock in a transaction dated Friday, September 27th. The stock was bought at an average price of $8.00 per share, for a total transaction of $22,335,440.00. Following the transaction, the insider now directly owns 16,775,691 shares in the company, valued at $134,205,528. This represents a 19.97 % increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is available at the SEC website. Company insiders own 10.00% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on GSK. Jefferies Financial Group cut GSK from a "buy" rating to a "hold" rating and decreased their target price for the stock from $53.00 to $39.50 in a research report on Tuesday. Barclays upgraded GSK to a "hold" rating in a research note on Tuesday, August 27th. Argus upgraded GSK to a "strong-buy" rating in a report on Wednesday, August 7th. Finally, Guggenheim downgraded shares of GSK from a "buy" rating to a "neutral" rating in a report on Thursday, October 31st. Six research analysts have rated the stock with a hold rating and three have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $43.25.

Check Out Our Latest Research Report on GSK

GSK Price Performance

Shares of GSK stock traded down $0.73 during midday trading on Thursday, hitting $34.38. 7,027,714 shares of the company were exchanged, compared to its average volume of 4,043,772. The firm has a 50 day simple moving average of $39.46 and a 200-day simple moving average of $40.80. GSK plc has a 52 week low of $34.29 and a 52 week high of $45.92. The firm has a market cap of $71.24 billion, a P/E ratio of 22.80, a PEG ratio of 1.36 and a beta of 0.66. The company has a debt-to-equity ratio of 0.98, a current ratio of 0.81 and a quick ratio of 0.53.

GSK Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, January 9th. Investors of record on Friday, November 15th will be issued a dividend of $0.3928 per share. This is an increase from GSK's previous quarterly dividend of $0.38. This represents a $1.57 annualized dividend and a yield of 4.57%. The ex-dividend date is Friday, November 15th. GSK's dividend payout ratio (DPR) is currently 98.70%.

GSK Profile

(

Free Report)

GSK plc, together with its subsidiaries, engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally. It operates through two segments, Commercial Operations and Total R&D.

Further Reading

Before you consider GSK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GSK wasn't on the list.

While GSK currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.