Bentley Systems (NASDAQ:BSY - Get Free Report)'s stock had its "buy" rating reissued by equities research analysts at Rosenblatt Securities in a research report issued on Friday,Benzinga reports. They presently have a $62.00 price target on the stock. Rosenblatt Securities' price objective would suggest a potential upside of 27.62% from the company's previous close.

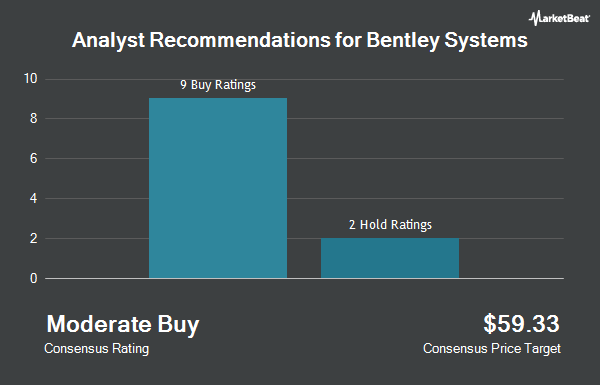

Several other analysts have also recently weighed in on the stock. Piper Sandler lifted their price target on shares of Bentley Systems from $63.00 to $65.00 and gave the company an "overweight" rating in a report on Friday. The Goldman Sachs Group lowered their price target on Bentley Systems from $57.00 to $50.00 and set a "neutral" rating for the company in a research report on Wednesday, August 7th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and issued a $61.00 price target on shares of Bentley Systems in a research report on Wednesday, August 7th. One equities research analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $59.86.

View Our Latest Analysis on BSY

Bentley Systems Price Performance

Shares of BSY stock traded down $2.51 during trading hours on Friday, hitting $48.58. 1,122,693 shares of the company's stock were exchanged, compared to its average volume of 1,212,321. The company has a market capitalization of $14.12 billion, a PE ratio of 42.61, a PEG ratio of 4.10 and a beta of 1.04. Bentley Systems has a 12-month low of $43.82 and a 12-month high of $57.19. The business's 50 day simple moving average is $49.54 and its 200-day simple moving average is $50.44. The company has a current ratio of 0.49, a quick ratio of 0.49 and a debt-to-equity ratio of 1.36.

Bentley Systems (NASDAQ:BSY - Get Free Report) last issued its earnings results on Tuesday, August 6th. The company reported $0.31 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.23 by $0.08. Bentley Systems had a net margin of 29.17% and a return on equity of 31.71%. The firm had revenue of $330.34 million for the quarter, compared to analysts' expectations of $325.20 million. During the same quarter last year, the business earned $0.20 earnings per share. The business's revenue was up 11.3% on a year-over-year basis. On average, equities research analysts anticipate that Bentley Systems will post 0.9 earnings per share for the current year.

Insider Buying and Selling at Bentley Systems

In related news, Director Raymond B. Bentley sold 91,045 shares of the business's stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $49.43, for a total transaction of $4,500,354.35. Following the completion of the transaction, the director now directly owns 16,598,656 shares in the company, valued at approximately $820,471,566.08. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. In other Bentley Systems news, Director Barry J. Bentley sold 34,987 shares of the company's stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $48.37, for a total value of $1,692,321.19. Following the completion of the transaction, the director now directly owns 12,213,248 shares in the company, valued at $590,754,805.76. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, Director Raymond B. Bentley sold 91,045 shares of the company's stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $49.43, for a total value of $4,500,354.35. Following the sale, the director now directly owns 16,598,656 shares in the company, valued at $820,471,566.08. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 326,032 shares of company stock worth $16,168,176 in the last three months. 21.12% of the stock is currently owned by company insiders.

Institutional Trading of Bentley Systems

Several hedge funds have recently modified their holdings of the company. Allspring Global Investments Holdings LLC grew its position in Bentley Systems by 4,618.2% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 519 shares of the company's stock valued at $26,000 after acquiring an additional 508 shares during the last quarter. GAMMA Investing LLC boosted its position in Bentley Systems by 90.1% during the second quarter. GAMMA Investing LLC now owns 576 shares of the company's stock valued at $28,000 after purchasing an additional 273 shares in the last quarter. Blue Trust Inc. boosted its position in Bentley Systems by 68,500.0% during the second quarter. Blue Trust Inc. now owns 686 shares of the company's stock valued at $36,000 after purchasing an additional 685 shares in the last quarter. Central Pacific Bank Trust Division boosted its position in Bentley Systems by 57.1% during the third quarter. Central Pacific Bank Trust Division now owns 759 shares of the company's stock valued at $39,000 after purchasing an additional 276 shares in the last quarter. Finally, Tortoise Investment Management LLC raised its stake in Bentley Systems by 75.4% in the second quarter. Tortoise Investment Management LLC now owns 833 shares of the company's stock valued at $41,000 after buying an additional 358 shares during the last quarter. 44.16% of the stock is owned by hedge funds and other institutional investors.

Bentley Systems Company Profile

(

Get Free Report)

Bentley Systems, Incorporated, together with its subsidiaries, provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. The company offers open modeling engineering applications, such as MicroStation, OpenBridge, OpenBuildings, OpenCities, OpenComms, OpenFlows, OpenPlant, OpenRail, OpenRoads, OpenSite, OpenTower, OpenTunnel, OpenUtilities, and OpenWindowPower; and open simulation engineering applications, including ADINA, AutoPIPE, CUBE, DYNAMEQ, EMME, LEGION, Power Line Systems, RAM, SACS, SPIDA, and STAAD; and geoprofessional applications for modeling and simulation of near and deep subsurface conditions, including AGS, Central, GeoStudio, Imago, Leapfrog, MX Deposit, Oasis montaj, OpenGround, and PLAXIS.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bentley Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bentley Systems wasn't on the list.

While Bentley Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report