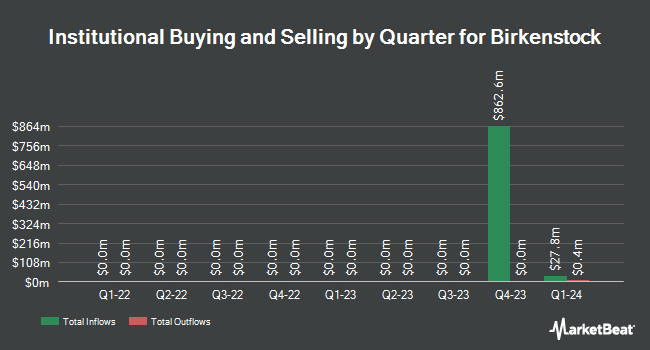

LMR Partners LLP decreased its stake in shares of Birkenstock Holding plc (NYSE:BIRK - Free Report) by 83.0% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 135,000 shares of the company's stock after selling 660,239 shares during the period. LMR Partners LLP owned 0.07% of Birkenstock worth $6,654,000 at the end of the most recent quarter.

A number of other large investors also recently modified their holdings of BIRK. Victory Capital Management Inc. raised its position in shares of Birkenstock by 12.7% during the third quarter. Victory Capital Management Inc. now owns 388,360 shares of the company's stock worth $19,142,000 after acquiring an additional 43,657 shares during the last quarter. Aigen Investment Management LP raised its holdings in Birkenstock by 35.9% during the 3rd quarter. Aigen Investment Management LP now owns 11,301 shares of the company's stock worth $557,000 after purchasing an additional 2,986 shares during the last quarter. GSA Capital Partners LLP raised its holdings in Birkenstock by 109.0% during the 3rd quarter. GSA Capital Partners LLP now owns 27,051 shares of the company's stock worth $1,333,000 after purchasing an additional 14,108 shares during the last quarter. Venturi Wealth Management LLC lifted its position in Birkenstock by 58.8% during the 3rd quarter. Venturi Wealth Management LLC now owns 6,670 shares of the company's stock valued at $329,000 after purchasing an additional 2,470 shares during the period. Finally, Malaga Cove Capital LLC boosted its stake in shares of Birkenstock by 168.9% in the 3rd quarter. Malaga Cove Capital LLC now owns 11,701 shares of the company's stock valued at $577,000 after purchasing an additional 7,350 shares during the last quarter. 19.93% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of research firms recently weighed in on BIRK. Evercore ISI reissued an "outperform" rating and set a $77.00 price target (up from $63.00) on shares of Birkenstock in a research note on Monday, August 26th. BMO Capital Markets reissued an "outperform" rating and issued a $60.00 price target on shares of Birkenstock in a research note on Friday, August 30th. Bank of America upgraded Birkenstock from a "neutral" rating to a "buy" rating and raised their price target for the stock from $62.00 to $65.00 in a research report on Thursday, July 25th. BTIG Research set a $60.00 target price on Birkenstock and gave the company a "buy" rating in a research note on Friday, October 18th. Finally, Telsey Advisory Group restated an "outperform" rating and set a $70.00 target price on shares of Birkenstock in a report on Tuesday, September 24th. Two research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $66.40.

Get Our Latest Report on BIRK

Birkenstock Stock Up 0.3 %

Shares of Birkenstock stock traded up $0.15 on Tuesday, hitting $46.61. The company had a trading volume of 781,587 shares, compared to its average volume of 1,015,653. The stock has a 50-day moving average of $48.03 and a 200-day moving average of $52.44. The company has a debt-to-equity ratio of 0.55, a current ratio of 2.91 and a quick ratio of 1.49. Birkenstock Holding plc has a twelve month low of $41.00 and a twelve month high of $64.78. The firm has a market capitalization of $8.75 billion and a P/E ratio of 76.16.

Birkenstock (NYSE:BIRK - Get Free Report) last released its earnings results on Thursday, August 29th. The company reported $0.49 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.56 by ($0.07). The firm had revenue of $564.76 million for the quarter, compared to the consensus estimate of $628.70 million. Birkenstock had a return on equity of 5.79% and a net margin of 6.26%. Research analysts predict that Birkenstock Holding plc will post 1.37 earnings per share for the current year.

Birkenstock Company Profile

(

Free Report)

Birkenstock Holding plc manufactures and sells footwear products. It also offers sandals, shoes, closed-toe silhouettes, skincare products, and accessories. The company sells its products through e-commerce sites and a network of owned retail stores, as well as business-to-business channels. It operates in the United States, Brazil, Canada, Mexico, Europe, APMA, and internationally.

Read More

Before you consider Birkenstock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Birkenstock wasn't on the list.

While Birkenstock currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.