Impax Asset Management Group plc increased its position in BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report) by 50.0% during the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 134,955 shares of the company's stock after purchasing an additional 45,000 shares during the quarter. Impax Asset Management Group plc owned approximately 0.10% of BJ's Wholesale Club worth $11,131,000 as of its most recent SEC filing.

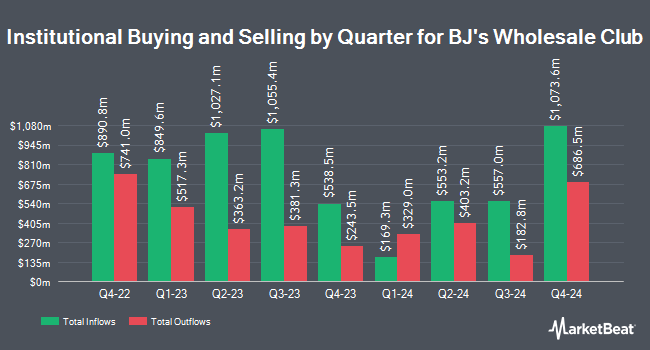

Several other hedge funds have also bought and sold shares of BJ. US Bancorp DE lifted its holdings in BJ's Wholesale Club by 2.2% during the 1st quarter. US Bancorp DE now owns 33,686 shares of the company's stock valued at $2,548,000 after purchasing an additional 715 shares during the last quarter. State Board of Administration of Florida Retirement System boosted its holdings in shares of BJ's Wholesale Club by 4.0% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 104,110 shares of the company's stock worth $7,920,000 after buying an additional 4,004 shares during the period. Seven Eight Capital LP bought a new stake in shares of BJ's Wholesale Club during the 1st quarter worth about $3,983,000. Bessemer Group Inc. grew its stake in BJ's Wholesale Club by 1.8% in the 1st quarter. Bessemer Group Inc. now owns 3,118,913 shares of the company's stock valued at $235,946,000 after buying an additional 56,442 shares during the last quarter. Finally, CANADA LIFE ASSURANCE Co raised its holdings in BJ's Wholesale Club by 1.9% in the 1st quarter. CANADA LIFE ASSURANCE Co now owns 98,280 shares of the company's stock valued at $7,435,000 after acquiring an additional 1,794 shares during the period. 98.60% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In other BJ's Wholesale Club news, SVP Joseph Mcgrail sold 1,000 shares of the business's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $83.57, for a total value of $83,570.00. Following the sale, the senior vice president now directly owns 13,566 shares in the company, valued at $1,133,710.62. The trade was a 6.87 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CEO Robert W. Eddy sold 11,000 shares of the stock in a transaction on Friday, November 1st. The stock was sold at an average price of $85.47, for a total value of $940,170.00. Following the transaction, the chief executive officer now owns 423,792 shares of the company's stock, valued at $36,221,502.24. The trade was a 2.53 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 34,000 shares of company stock worth $2,818,390. 2.00% of the stock is owned by insiders.

BJ's Wholesale Club Trading Up 0.3 %

Shares of BJ's Wholesale Club stock traded up $0.30 on Friday, hitting $87.27. The stock had a trading volume of 1,112,990 shares, compared to its average volume of 1,465,049. The stock has a 50 day moving average of $84.80 and a 200 day moving average of $84.84. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.15 and a current ratio of 0.76. BJ's Wholesale Club Holdings, Inc. has a twelve month low of $63.08 and a twelve month high of $92.37. The firm has a market capitalization of $11.57 billion, a P/E ratio of 22.03, a PEG ratio of 3.23 and a beta of 0.24.

BJ's Wholesale Club (NYSE:BJ - Get Free Report) last released its quarterly earnings results on Thursday, August 22nd. The company reported $1.09 EPS for the quarter, beating analysts' consensus estimates of $1.00 by $0.09. BJ's Wholesale Club had a return on equity of 36.12% and a net margin of 2.62%. The firm had revenue of $5.21 billion for the quarter, compared to analyst estimates of $5.15 billion. During the same quarter in the previous year, the company posted $0.97 EPS. The business's revenue was up 4.9% on a year-over-year basis. Sell-side analysts expect that BJ's Wholesale Club Holdings, Inc. will post 3.82 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

BJ has been the topic of several research reports. Wells Fargo & Company upped their target price on BJ's Wholesale Club from $92.00 to $100.00 and gave the company an "overweight" rating in a research report on Tuesday. Bank of America lowered their price objective on BJ's Wholesale Club from $95.00 to $90.00 and set a "buy" rating on the stock in a research report on Friday, August 23rd. Melius Research began coverage on shares of BJ's Wholesale Club in a research report on Monday, September 23rd. They issued a "buy" rating and a $90.00 target price for the company. JPMorgan Chase & Co. raised shares of BJ's Wholesale Club from an "underweight" rating to a "neutral" rating and raised their price target for the stock from $76.00 to $78.00 in a research report on Monday, August 26th. Finally, Jefferies Financial Group lifted their price objective on shares of BJ's Wholesale Club from $95.00 to $105.00 and gave the stock a "buy" rating in a research note on Friday. Six research analysts have rated the stock with a hold rating and ten have given a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $88.94.

Get Our Latest Report on BJ

BJ's Wholesale Club Company Profile

(

Free Report)

BJ's Wholesale Club Holdings, Inc, together with its subsidiaries, operates warehouse clubs on the eastern half of the United States. It provides groceries, general merchandise, gasoline and other ancillary services, coupon books, and promotions. The company sells its products through the websites BJs.com, BerkleyJensen.com, and Wellsleyfarms.com, as well as the mobile app.

Recommended Stories

Before you consider BJ's Wholesale Club, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Wholesale Club wasn't on the list.

While BJ's Wholesale Club currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.