BNP PARIBAS ASSET MANAGEMENT Holding S.A. decreased its position in shares of Thomson Reuters Co. (NYSE:TRI - Free Report) TSE: TRI by 12.7% in the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 148,924 shares of the business services provider's stock after selling 21,681 shares during the quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A.'s holdings in Thomson Reuters were worth $25,406,000 at the end of the most recent quarter.

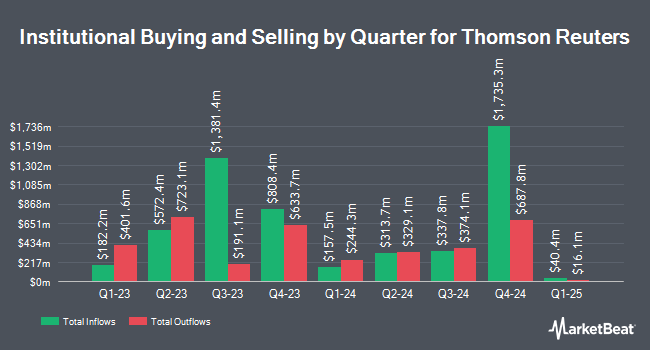

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Advisors Asset Management Inc. boosted its stake in Thomson Reuters by 73.5% in the 3rd quarter. Advisors Asset Management Inc. now owns 4,265 shares of the business services provider's stock worth $728,000 after purchasing an additional 1,807 shares during the period. Connor Clark & Lunn Investment Management Ltd. boosted its stake in Thomson Reuters by 11.0% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 2,577,905 shares of the business services provider's stock worth $439,665,000 after purchasing an additional 255,387 shares during the period. Hilton Capital Management LLC boosted its stake in Thomson Reuters by 1.8% in the 3rd quarter. Hilton Capital Management LLC now owns 83,169 shares of the business services provider's stock worth $14,189,000 after purchasing an additional 1,460 shares during the period. West Family Investments Inc. boosted its stake in Thomson Reuters by 3.1% in the 3rd quarter. West Family Investments Inc. now owns 4,216 shares of the business services provider's stock worth $719,000 after purchasing an additional 126 shares during the period. Finally, Banque Cantonale Vaudoise boosted its stake in Thomson Reuters by 5,169.8% in the 3rd quarter. Banque Cantonale Vaudoise now owns 5,586 shares of the business services provider's stock worth $954,000 after purchasing an additional 5,480 shares during the period. Institutional investors own 17.31% of the company's stock.

Thomson Reuters Trading Down 0.4 %

Thomson Reuters stock traded down $0.64 during trading hours on Friday, reaching $161.20. The company had a trading volume of 299,640 shares, compared to its average volume of 312,670. The firm has a market cap of $72.53 billion, a price-to-earnings ratio of 31.73, a P/E/G ratio of 5.47 and a beta of 0.73. Thomson Reuters Co. has a 12-month low of $138.09 and a 12-month high of $176.03. The company has a 50-day moving average price of $167.38 and a 200 day moving average price of $167.25. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.94 and a quick ratio of 0.94.

Thomson Reuters (NYSE:TRI - Get Free Report) TSE: TRI last issued its quarterly earnings data on Tuesday, November 5th. The business services provider reported $0.80 earnings per share for the quarter, topping analysts' consensus estimates of $0.77 by $0.03. Thomson Reuters had a return on equity of 14.85% and a net margin of 32.12%. The firm had revenue of $1.72 billion for the quarter, compared to analyst estimates of $1.71 billion. During the same period last year, the company earned $0.82 EPS. The business's quarterly revenue was up 8.2% compared to the same quarter last year. Equities analysts forecast that Thomson Reuters Co. will post 3.69 earnings per share for the current year.

Thomson Reuters Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Thursday, November 21st will be issued a $0.54 dividend. This represents a $2.16 annualized dividend and a yield of 1.34%. This is an increase from Thomson Reuters's previous quarterly dividend of $0.15. The ex-dividend date is Thursday, November 21st. Thomson Reuters's payout ratio is 42.52%.

Wall Street Analysts Forecast Growth

Several research analysts have commented on TRI shares. Royal Bank of Canada raised their target price on Thomson Reuters from $171.00 to $173.00 and gave the stock a "sector perform" rating in a research note on Wednesday, November 6th. National Bank Financial raised Thomson Reuters from a "sector perform" rating to an "outperform" rating in a report on Monday, September 9th. JPMorgan Chase & Co. raised their price target on Thomson Reuters from $163.00 to $164.00 and gave the company a "neutral" rating in a report on Friday, August 2nd. StockNews.com cut Thomson Reuters from a "hold" rating to a "sell" rating in a report on Friday. Finally, Scotiabank raised their price target on Thomson Reuters from $182.00 to $187.00 and gave the company a "sector outperform" rating in a report on Wednesday, November 6th. One investment analyst has rated the stock with a sell rating, six have given a hold rating and four have assigned a buy rating to the stock. According to MarketBeat, Thomson Reuters presently has an average rating of "Hold" and an average target price of $176.33.

Check Out Our Latest Analysis on Thomson Reuters

Thomson Reuters Profile

(

Free Report)

Thomson Reuters Corporation engages in the provision of business information services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It operates in five segments: Legal Professionals, Corporates, Tax & Accounting Professionals, Reuters News, and Global Print. The Legal Professionals segment offers research and workflow products focusing on legal research and integrated legal workflow solutions that combine content, tools, and analytics to law firms and governments.

Recommended Stories

Before you consider Thomson Reuters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thomson Reuters wasn't on the list.

While Thomson Reuters currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.