Bright Horizons Family Solutions (NYSE:BFAM - Get Free Report) was upgraded by equities researchers at Robert W. Baird from a "neutral" rating to an "outperform" rating in a research note issued on Friday, MarketBeat.com reports. The firm currently has a $140.00 price objective on the stock. Robert W. Baird's price objective suggests a potential upside of 24.09% from the company's current price.

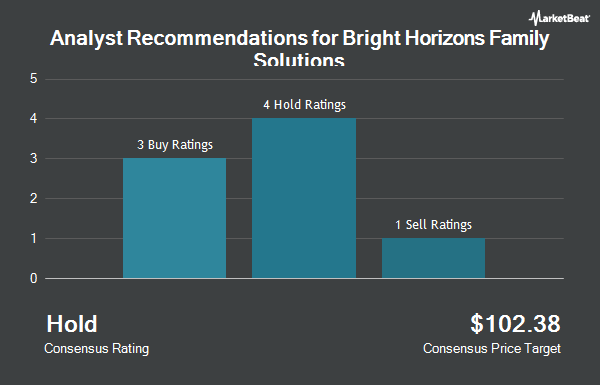

A number of other equities analysts also recently issued reports on BFAM. JPMorgan Chase & Co. increased their price objective on shares of Bright Horizons Family Solutions from $137.00 to $149.00 and gave the company an "overweight" rating in a research note on Tuesday, November 5th. The Goldman Sachs Group increased their target price on shares of Bright Horizons Family Solutions from $142.00 to $162.00 and gave the company a "buy" rating in a research report on Tuesday, November 5th. Barclays increased their target price on shares of Bright Horizons Family Solutions from $125.00 to $160.00 and gave the company an "overweight" rating in a research report on Friday, August 30th. Deutsche Bank Aktiengesellschaft increased their target price on shares of Bright Horizons Family Solutions from $114.00 to $140.00 and gave the company a "hold" rating in a research report on Friday, August 2nd. Finally, UBS Group increased their target price on shares of Bright Horizons Family Solutions from $145.00 to $148.00 and gave the company a "neutral" rating in a research report on Tuesday, November 5th. One equities research analyst has rated the stock with a sell rating, three have assigned a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $141.50.

Check Out Our Latest Report on Bright Horizons Family Solutions

Bright Horizons Family Solutions Trading Up 1.6 %

BFAM stock traded up $1.77 during mid-day trading on Friday, reaching $112.82. The company had a trading volume of 361,391 shares, compared to its average volume of 386,565. The company has a debt-to-equity ratio of 0.66, a current ratio of 0.61 and a quick ratio of 0.61. The company has a market capitalization of $6.56 billion, a PE ratio of 56.27 and a beta of 1.49. The firm has a 50 day moving average of $129.07 and a 200 day moving average of $122.46. Bright Horizons Family Solutions has a 12 month low of $86.79 and a 12 month high of $141.90.

Bright Horizons Family Solutions (NYSE:BFAM - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The company reported $1.11 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.06 by $0.05. Bright Horizons Family Solutions had a net margin of 4.44% and a return on equity of 13.23%. The firm had revenue of $719.00 million for the quarter, compared to the consensus estimate of $713.16 million. During the same period last year, the firm earned $0.78 earnings per share. The company's quarterly revenue was up 11.3% on a year-over-year basis. On average, equities analysts predict that Bright Horizons Family Solutions will post 3 earnings per share for the current fiscal year.

Insider Transactions at Bright Horizons Family Solutions

In related news, COO Mary Lou Burke sold 800 shares of the company's stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of $136.94, for a total transaction of $109,552.00. Following the sale, the chief operating officer now directly owns 31,025 shares of the company's stock, valued at $4,248,563.50. This represents a 2.51 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 1.22% of the company's stock.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the stock. OLD National Bancorp IN lifted its stake in shares of Bright Horizons Family Solutions by 2.7% in the 3rd quarter. OLD National Bancorp IN now owns 3,159 shares of the company's stock worth $443,000 after acquiring an additional 82 shares during the period. EverSource Wealth Advisors LLC boosted its position in shares of Bright Horizons Family Solutions by 6.0% in the second quarter. EverSource Wealth Advisors LLC now owns 2,097 shares of the company's stock worth $252,000 after acquiring an additional 119 shares during the last quarter. Avior Wealth Management LLC boosted its position in shares of Bright Horizons Family Solutions by 2.9% in the third quarter. Avior Wealth Management LLC now owns 4,674 shares of the company's stock worth $655,000 after acquiring an additional 133 shares during the last quarter. Daiwa Securities Group Inc. boosted its position in shares of Bright Horizons Family Solutions by 37.2% in the third quarter. Daiwa Securities Group Inc. now owns 535 shares of the company's stock worth $75,000 after acquiring an additional 145 shares during the last quarter. Finally, MJP Associates Inc. ADV boosted its position in shares of Bright Horizons Family Solutions by 7.0% in the second quarter. MJP Associates Inc. ADV now owns 2,390 shares of the company's stock worth $263,000 after acquiring an additional 157 shares during the last quarter.

Bright Horizons Family Solutions Company Profile

(

Get Free Report)

Bright Horizons Family Solutions Inc provides early education and childcare, back-up care, educational advisory, and other workplace solutions services for employers and families in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India. The company operates in three segments: Full Service Center-Based Child Care, Back-Up Care, and Educational Advisory and Other Services.

Further Reading

Before you consider Bright Horizons Family Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bright Horizons Family Solutions wasn't on the list.

While Bright Horizons Family Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.