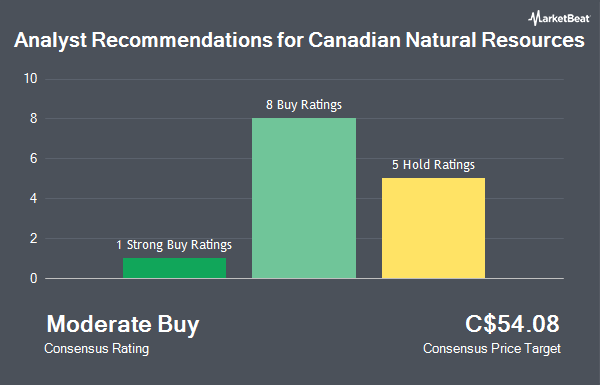

Shares of Canadian Natural Resources Limited (TSE:CNQ - Get Free Report) NYSE: CNQ have been assigned an average rating of "Hold" from the fifteen brokerages that are currently covering the firm, Marketbeat Ratings reports. Eight equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. The average twelve-month target price among brokerages that have covered the stock in the last year is C$74.31.

Several research firms have recently commented on CNQ. CIBC lifted their price target on shares of Canadian Natural Resources from C$57.50 to C$59.00 in a research report on Wednesday, October 9th. Raymond James upped their price target on Canadian Natural Resources from C$50.00 to C$51.00 and gave the company a "market perform" rating in a research note on Friday, November 1st. Desjardins raised Canadian Natural Resources from a "hold" rating to a "buy" rating and raised their price objective for the stock from C$56.00 to C$59.00 in a research report on Tuesday, October 8th. Gerdes Energy Research increased their target price on shares of Canadian Natural Resources from C$53.00 to C$55.00 in a research note on Friday, November 1st. Finally, BMO Capital Markets boosted their price target on shares of Canadian Natural Resources from C$57.50 to C$60.00 and gave the company an "outperform" rating in a research note on Tuesday, October 8th.

Check Out Our Latest Stock Analysis on Canadian Natural Resources

Insider Activity

In other Canadian Natural Resources news, Director Stephen W. Laut sold 6,400 shares of Canadian Natural Resources stock in a transaction that occurred on Tuesday, November 19th. The stock was sold at an average price of C$47.04, for a total transaction of C$301,056.00. Also, Senior Officer Devin Craig Lowe sold 3,750 shares of the business's stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of C$49.04, for a total value of C$183,900.00. In the last quarter, insiders sold 16,422 shares of company stock worth $785,328. Corporate insiders own 4.26% of the company's stock.

Canadian Natural Resources Trading Up 0.8 %

Shares of CNQ traded up C$0.41 during mid-day trading on Friday, reaching C$48.71. The stock had a trading volume of 4,860,784 shares, compared to its average volume of 11,454,809. The company has a debt-to-equity ratio of 29.64, a current ratio of 0.88 and a quick ratio of 0.54. The business's fifty day moving average is C$47.35 and its 200 day moving average is C$58.91. Canadian Natural Resources has a 52-week low of C$40.02 and a 52-week high of C$56.49. The firm has a market cap of C$103.75 billion, a price-to-earnings ratio of 13.76, a P/E/G ratio of 0.53 and a beta of 1.89.

Canadian Natural Resources Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 3rd. Stockholders of record on Friday, December 13th will be given a dividend of $0.525 per share. The ex-dividend date is Friday, December 13th. This represents a $2.10 annualized dividend and a dividend yield of 4.31%. Canadian Natural Resources's dividend payout ratio is presently 60.97%.

About Canadian Natural Resources

(

Get Free ReportCanadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and synthetic crude oil (SCO).

Featured Stories

Before you consider Canadian Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Natural Resources wasn't on the list.

While Canadian Natural Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.