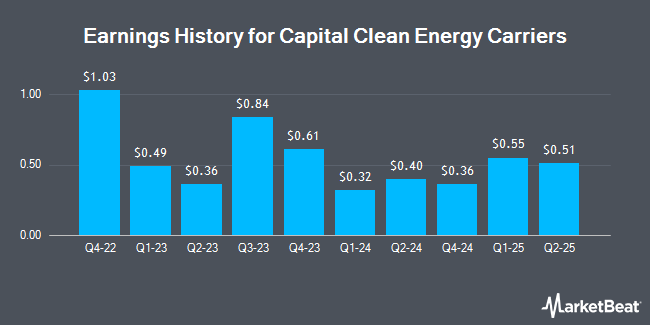

Capital Clean Energy Carriers (NASDAQ:CCEC - Get Free Report) is scheduled to be announcing its earnings results before the market opens on Friday, November 8th. Analysts expect the company to announce earnings of $0.48 per share for the quarter.

Capital Clean Energy Carriers (NASDAQ:CCEC - Get Free Report) last posted its quarterly earnings data on Friday, August 2nd. The company reported $0.40 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.17 by $0.23. The business had revenue of $95.51 million for the quarter, compared to analysts' expectations of $90.22 million. Capital Clean Energy Carriers had a return on equity of 6.83% and a net margin of 24.89%. On average, analysts expect Capital Clean Energy Carriers to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Capital Clean Energy Carriers Stock Up 2.0 %

Shares of NASDAQ:CCEC traded up $0.38 during midday trading on Tuesday, reaching $18.99. The company's stock had a trading volume of 11,821 shares, compared to its average volume of 61,560. The company's 50 day moving average is $18.38. Capital Clean Energy Carriers has a 1 year low of $12.70 and a 1 year high of $20.26. The firm has a market cap of $1.05 billion, a price-to-earnings ratio of 7.30 and a beta of 0.86. The company has a debt-to-equity ratio of 1.99, a quick ratio of 0.50 and a current ratio of 0.53.

Capital Clean Energy Carriers Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 15th. Stockholders of record on Monday, November 11th will be paid a dividend of $0.15 per share. The ex-dividend date of this dividend is Monday, November 11th. This represents a $0.60 annualized dividend and a dividend yield of 3.16%. Capital Clean Energy Carriers's dividend payout ratio is presently 23.53%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have issued reports on CCEC shares. Evercore ISI started coverage on Capital Clean Energy Carriers in a research report on Thursday, September 5th. They set an "outperform" rating and a $22.00 price target for the company. Fearnley Fonds upgraded Capital Clean Energy Carriers to a "strong-buy" rating in a report on Thursday, October 10th.

View Our Latest Analysis on CCEC

About Capital Clean Energy Carriers

(

Get Free Report)

Capital Clean Energy Carriers Corp., a shipping company, provides marine transportation services in Greece. The company's vessels provide a range of cargoes, including liquefied natural gas, containerized goods, and cargo under short-term voyage charters, and medium to long-term time charters. It owns vessels, including Neo-Panamax container vessels, Panamax container vessels, cape-size bulk carrier, and LNG carriers.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Capital Clean Energy Carriers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capital Clean Energy Carriers wasn't on the list.

While Capital Clean Energy Carriers currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.