Castle Hook Partners LP reduced its holdings in shares of Teck Resources Limited (NYSE:TECK - Free Report) TSE: TECK by 60.7% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 1,068,725 shares of the basic materials company's stock after selling 1,649,434 shares during the period. Teck Resources accounts for approximately 1.0% of Castle Hook Partners LP's investment portfolio, making the stock its 18th biggest holding. Castle Hook Partners LP owned approximately 0.21% of Teck Resources worth $55,830,000 at the end of the most recent quarter.

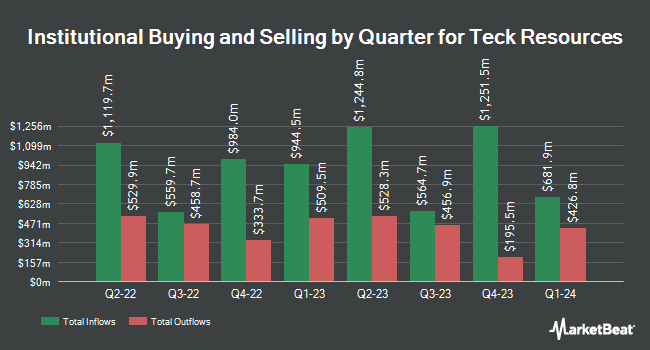

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Daymark Wealth Partners LLC increased its holdings in Teck Resources by 2.8% in the third quarter. Daymark Wealth Partners LLC now owns 8,774 shares of the basic materials company's stock worth $458,000 after purchasing an additional 242 shares in the last quarter. Cigna Investments Inc. New boosted its stake in Teck Resources by 3.8% during the second quarter. Cigna Investments Inc. New now owns 8,762 shares of the basic materials company's stock worth $420,000 after acquiring an additional 317 shares in the last quarter. Candriam S.C.A. grew its holdings in Teck Resources by 4.0% in the second quarter. Candriam S.C.A. now owns 8,897 shares of the basic materials company's stock worth $426,000 after purchasing an additional 343 shares during the period. Evergreen Capital Management LLC increased its stake in Teck Resources by 7.8% in the second quarter. Evergreen Capital Management LLC now owns 5,064 shares of the basic materials company's stock valued at $243,000 after purchasing an additional 365 shares in the last quarter. Finally, Bruce G. Allen Investments LLC raised its holdings in shares of Teck Resources by 77.4% during the third quarter. Bruce G. Allen Investments LLC now owns 878 shares of the basic materials company's stock valued at $46,000 after purchasing an additional 383 shares during the period. 78.06% of the stock is owned by institutional investors and hedge funds.

Teck Resources Stock Performance

TECK stock traded down $0.06 during mid-day trading on Thursday, hitting $46.24. The company had a trading volume of 1,966,723 shares, compared to its average volume of 3,368,484. Teck Resources Limited has a 12 month low of $35.60 and a 12 month high of $55.13. The stock's fifty day moving average price is $48.87 and its two-hundred day moving average price is $48.48. The firm has a market cap of $23.26 billion, a PE ratio of 70.05 and a beta of 1.04. The company has a debt-to-equity ratio of 0.16, a quick ratio of 2.35 and a current ratio of 2.92.

Teck Resources (NYSE:TECK - Get Free Report) TSE: TECK last posted its quarterly earnings data on Thursday, October 24th. The basic materials company reported $0.60 EPS for the quarter, beating the consensus estimate of $0.36 by $0.24. Teck Resources had a return on equity of 6.37% and a net margin of 3.32%. The business had revenue of $2.86 billion for the quarter, compared to the consensus estimate of $2.09 billion. During the same quarter in the prior year, the business earned $0.57 earnings per share. Teck Resources's revenue for the quarter was down 20.6% on a year-over-year basis. On average, analysts forecast that Teck Resources Limited will post 1.83 earnings per share for the current fiscal year.

Teck Resources Cuts Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 13th will be issued a $0.0895 dividend. This represents a $0.36 annualized dividend and a yield of 0.77%. The ex-dividend date of this dividend is Friday, December 13th. Teck Resources's dividend payout ratio (DPR) is currently 56.06%.

Wall Street Analyst Weigh In

A number of analysts recently commented on the company. UBS Group lowered Teck Resources from a "buy" rating to a "neutral" rating in a research report on Monday, November 11th. Deutsche Bank Aktiengesellschaft downgraded Teck Resources from a "buy" rating to a "hold" rating and set a $50.00 price objective for the company. in a report on Friday, October 25th. StockNews.com upgraded Teck Resources from a "sell" rating to a "hold" rating in a report on Thursday, October 24th. Scotiabank boosted their price target on shares of Teck Resources from $78.00 to $79.00 and gave the company a "sector outperform" rating in a research note on Tuesday, October 8th. Finally, JPMorgan Chase & Co. dropped their price objective on shares of Teck Resources from $57.00 to $55.00 and set an "overweight" rating on the stock in a research note on Friday, October 25th. Five research analysts have rated the stock with a hold rating, five have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $65.29.

Read Our Latest Stock Analysis on Teck Resources

Teck Resources Profile

(

Free Report)

Teck Resources Limited engages in exploring for, acquiring, developing, and producing natural resources in Asia, Europe, and North America. The company operates through Steelmaking Coal, Copper, Zinc, and Energy segments. Its principal products include copper, zinc, steelmaking coal, and blended bitumen.

Read More

Before you consider Teck Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teck Resources wasn't on the list.

While Teck Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.