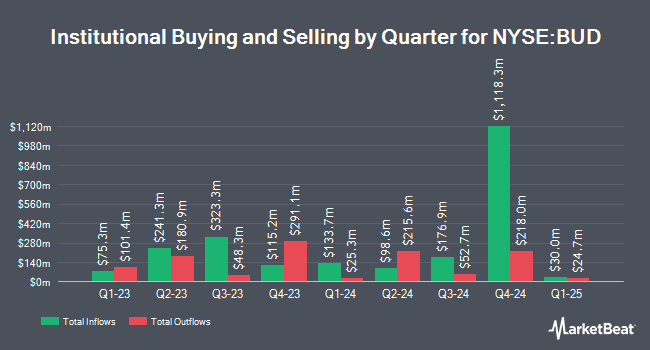

Cerity Partners LLC grew its stake in Anheuser-Busch InBev SA/NV (NYSE:BUD - Free Report) by 61.9% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 61,061 shares of the consumer goods maker's stock after acquiring an additional 23,348 shares during the period. Cerity Partners LLC's holdings in Anheuser-Busch InBev SA/NV were worth $4,048,000 at the end of the most recent reporting period.

Other institutional investors have also modified their holdings of the company. Ashton Thomas Securities LLC purchased a new stake in shares of Anheuser-Busch InBev SA/NV in the third quarter valued at approximately $26,000. GPS Wealth Strategies Group LLC lifted its holdings in shares of Anheuser-Busch InBev SA/NV by 50.7% in the 2nd quarter. GPS Wealth Strategies Group LLC now owns 550 shares of the consumer goods maker's stock worth $32,000 after buying an additional 185 shares during the period. Blue Trust Inc. grew its position in shares of Anheuser-Busch InBev SA/NV by 225.0% during the 2nd quarter. Blue Trust Inc. now owns 546 shares of the consumer goods maker's stock worth $33,000 after buying an additional 378 shares in the last quarter. Addison Advisors LLC increased its stake in shares of Anheuser-Busch InBev SA/NV by 39.7% during the second quarter. Addison Advisors LLC now owns 591 shares of the consumer goods maker's stock valued at $34,000 after buying an additional 168 shares during the period. Finally, Hantz Financial Services Inc. bought a new stake in shares of Anheuser-Busch InBev SA/NV in the second quarter valued at about $35,000. 5.53% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

BUD has been the topic of several recent research reports. Citigroup upgraded shares of Anheuser-Busch InBev SA/NV from a "neutral" rating to a "buy" rating in a report on Tuesday, October 1st. Barclays raised shares of Anheuser-Busch InBev SA/NV to a "strong-buy" rating in a report on Wednesday, October 9th. TD Cowen lowered Anheuser-Busch InBev SA/NV from a "buy" rating to a "hold" rating and upped their target price for the stock from $68.00 to $88.00 in a report on Tuesday, October 8th. Morgan Stanley lifted their price target on Anheuser-Busch InBev SA/NV from $68.50 to $73.00 and gave the company an "overweight" rating in a report on Tuesday, September 10th. Finally, Evercore ISI raised Anheuser-Busch InBev SA/NV to a "strong-buy" rating in a research report on Monday, September 30th. Three investment analysts have rated the stock with a hold rating, four have issued a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $79.00.

Check Out Our Latest Report on Anheuser-Busch InBev SA/NV

Anheuser-Busch InBev SA/NV Price Performance

NYSE BUD opened at $53.80 on Friday. The firm's fifty day simple moving average is $61.12 and its two-hundred day simple moving average is $61.50. The firm has a market capitalization of $96.69 billion, a P/E ratio of 16.60, a P/E/G ratio of 1.73 and a beta of 1.12. The company has a current ratio of 0.69, a quick ratio of 0.51 and a debt-to-equity ratio of 0.85. Anheuser-Busch InBev SA/NV has a 12-month low of $53.16 and a 12-month high of $67.49.

About Anheuser-Busch InBev SA/NV

(

Free Report)

Anheuser-Busch InBev SA/NV produces, distributes, exports, markets, and sells beer and beverages. It offers a portfolio of approximately 500 beer brands, which primarily include Budweiser, Corona, and Stella Artois; Beck's, Hoegaarden, Leffe, and Michelob Ultra; and Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol brands.

Featured Articles

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.