Cerity Partners LLC boosted its stake in shares of FirstEnergy Corp. (NYSE:FE - Free Report) by 7.3% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 275,682 shares of the utilities provider's stock after purchasing an additional 18,847 shares during the quarter. Cerity Partners LLC's holdings in FirstEnergy were worth $12,227,000 at the end of the most recent quarter.

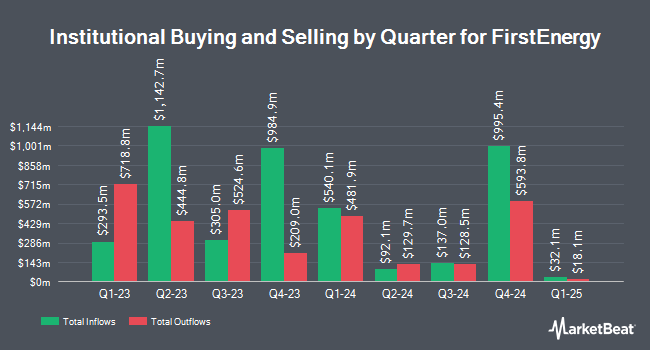

Other hedge funds and other institutional investors also recently bought and sold shares of the company. ST Germain D J Co. Inc. increased its position in shares of FirstEnergy by 1,138.9% during the second quarter. ST Germain D J Co. Inc. now owns 669 shares of the utilities provider's stock valued at $26,000 after purchasing an additional 615 shares during the period. Livelsberger Financial Advisory bought a new stake in FirstEnergy in the 3rd quarter valued at $26,000. Strategic Investment Solutions Inc. IL acquired a new position in shares of FirstEnergy in the 2nd quarter valued at $32,000. West Oak Capital LLC acquired a new position in shares of FirstEnergy in the 2nd quarter valued at $38,000. Finally, Ashton Thomas Private Wealth LLC bought a new position in shares of FirstEnergy during the 2nd quarter worth about $38,000. 89.41% of the stock is currently owned by institutional investors and hedge funds.

FirstEnergy Trading Up 0.8 %

FE stock traded up $0.35 during midday trading on Wednesday, reaching $42.63. The stock had a trading volume of 2,217,293 shares, compared to its average volume of 2,934,371. The firm has a market cap of $24.57 billion, a price-to-earnings ratio of 27.50, a PEG ratio of 2.27 and a beta of 0.51. FirstEnergy Corp. has a twelve month low of $35.41 and a twelve month high of $44.97. The company has a quick ratio of 0.46, a current ratio of 0.56 and a debt-to-equity ratio of 1.58. The business has a fifty day simple moving average of $42.78 and a two-hundred day simple moving average of $41.49.

Ad The TradingPub

Free ebook reveals our #1 chart pattern for 2020, 2021, 2022, 2023 and 2024.

It's time to get smart…

We think many good traders get caught up in the wrong stocks and ultimately burn up their trading accounts, which is why we want to share something special with you…

You see, our top technical trader just published a new e-book sharing his #1 stock pattern for the last 4 years…

It’s the same pattern that’s helped him grow his model portfolio by an average of 85% per year since 2020, and he’s currently giving away digital copies for free.

Inside, he’ll walk you through his #1 pattern, and show you why it forms.

As you’ll see, it’s all thanks to the algorithmic anomaly caused by Wall Street’s trading algorithms…

It's the main reason, this pattern paid out more than 72% of the time.

So, to claim your free digital copy today, simply follow this link and enter your email address.

FirstEnergy (NYSE:FE - Get Free Report) last issued its earnings results on Tuesday, October 29th. The utilities provider reported $0.85 EPS for the quarter, missing the consensus estimate of $0.90 by ($0.05). The business had revenue of $3.73 billion for the quarter, compared to the consensus estimate of $3.96 billion. FirstEnergy had a net margin of 6.64% and a return on equity of 11.38%. The business's revenue was up 6.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.88 EPS. As a group, research analysts expect that FirstEnergy Corp. will post 2.68 EPS for the current fiscal year.

FirstEnergy Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Sunday, December 1st. Shareholders of record on Thursday, November 7th will be paid a $0.425 dividend. This represents a $1.70 annualized dividend and a yield of 3.99%. The ex-dividend date is Thursday, November 7th. FirstEnergy's payout ratio is presently 109.68%.

Analyst Ratings Changes

Several equities analysts recently commented on FE shares. Morgan Stanley cut their target price on FirstEnergy from $52.00 to $50.00 and set an "overweight" rating for the company in a research report on Friday, November 22nd. Bank of America lifted their price objective on FirstEnergy from $42.00 to $43.00 and gave the company an "underperform" rating in a report on Thursday, August 29th. Wells Fargo & Company upped their target price on shares of FirstEnergy from $42.00 to $45.00 and gave the stock an "equal weight" rating in a report on Thursday, August 1st. Argus raised shares of FirstEnergy from a "hold" rating to a "buy" rating and set a $50.00 price target for the company in a report on Friday, September 20th. Finally, KeyCorp boosted their price target on shares of FirstEnergy from $47.00 to $48.00 and gave the company an "overweight" rating in a research report on Tuesday, October 22nd. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $45.91.

Read Our Latest Research Report on FirstEnergy

FirstEnergy Profile

(

Free Report)

FirstEnergy Corp., through its subsidiaries, generates, transmits, and distributes electricity in the United States. It operates through Regulated Distribution and Regulated Transmission segments. The company owns and operates coal-fired, nuclear, hydroelectric, wind, and solar power generating facilities.

See Also

Before you consider FirstEnergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstEnergy wasn't on the list.

While FirstEnergy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.