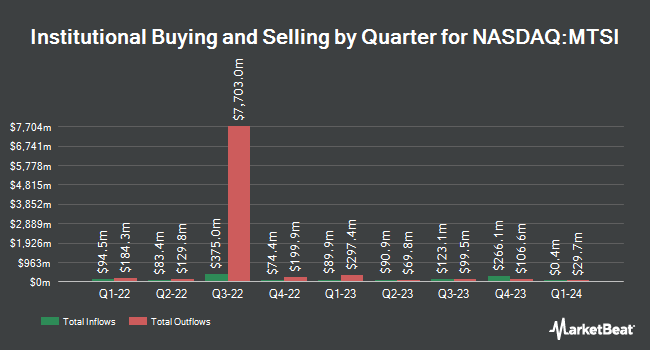

Charles Schwab Investment Management Inc. increased its holdings in shares of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Free Report) by 52.2% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 530,623 shares of the semiconductor company's stock after buying an additional 182,058 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.74% of MACOM Technology Solutions worth $59,037,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds also recently added to or reduced their stakes in the company. Opal Wealth Advisors LLC purchased a new stake in MACOM Technology Solutions during the 2nd quarter valued at about $39,000. GAMMA Investing LLC increased its holdings in MACOM Technology Solutions by 153.0% in the 2nd quarter. GAMMA Investing LLC now owns 468 shares of the semiconductor company's stock worth $52,000 after buying an additional 283 shares during the period. Allspring Global Investments Holdings LLC purchased a new position in MACOM Technology Solutions during the 3rd quarter worth approximately $66,000. FSC Wealth Advisors LLC acquired a new stake in MACOM Technology Solutions during the 2nd quarter valued at approximately $78,000. Finally, Farther Finance Advisors LLC boosted its holdings in shares of MACOM Technology Solutions by 303.5% in the 3rd quarter. Farther Finance Advisors LLC now owns 920 shares of the semiconductor company's stock valued at $102,000 after acquiring an additional 692 shares during the last quarter. 76.14% of the stock is owned by institutional investors and hedge funds.

MACOM Technology Solutions Price Performance

Shares of MACOM Technology Solutions stock traded up $1.15 during trading hours on Friday, reaching $132.82. 197,761 shares of the company's stock were exchanged, compared to its average volume of 572,122. MACOM Technology Solutions Holdings, Inc. has a 1 year low of $79.25 and a 1 year high of $140.27. The company has a market capitalization of $9.62 billion, a P/E ratio of 128.95, a price-to-earnings-growth ratio of 2.31 and a beta of 1.69. The business has a fifty day moving average of $119.42 and a two-hundred day moving average of $109.57. The company has a quick ratio of 6.55, a current ratio of 8.35 and a debt-to-equity ratio of 0.43.

Wall Street Analyst Weigh In

MTSI has been the topic of a number of analyst reports. JPMorgan Chase & Co. raised their price objective on shares of MACOM Technology Solutions from $105.00 to $110.00 and gave the stock a "neutral" rating in a research note on Friday, August 2nd. Needham & Company LLC boosted their target price on shares of MACOM Technology Solutions from $110.00 to $120.00 and gave the company a "buy" rating in a research note on Friday, August 2nd. Piper Sandler boosted their target price on shares of MACOM Technology Solutions from $100.00 to $115.00 and gave the company a "neutral" rating in a research note on Friday, October 25th. Benchmark boosted their target price on shares of MACOM Technology Solutions from $120.00 to $160.00 and gave the company a "buy" rating in a research note on Friday, November 8th. Finally, Barclays boosted their target price on shares of MACOM Technology Solutions from $120.00 to $160.00 and gave the company an "overweight" rating in a research note on Friday, November 8th. Three investment analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $125.91.

View Our Latest Analysis on MTSI

Insider Transactions at MACOM Technology Solutions

In other news, Director Susan Ocampo sold 12,438 shares of the business's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $136.73, for a total transaction of $1,700,647.74. Following the transaction, the director now owns 6,500,755 shares of the company's stock, valued at approximately $888,848,231.15. The trade was a 0.19 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CEO Stephen G. Daly sold 4,742 shares of the business's stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $118.32, for a total transaction of $561,073.44. Following the transaction, the chief executive officer now directly owns 65,577 shares in the company, valued at approximately $7,759,070.64. The trade was a 6.74 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 234,886 shares of company stock valued at $29,454,289 over the last 90 days. 22.75% of the stock is currently owned by corporate insiders.

MACOM Technology Solutions Company Profile

(

Free Report)

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

Featured Stories

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.