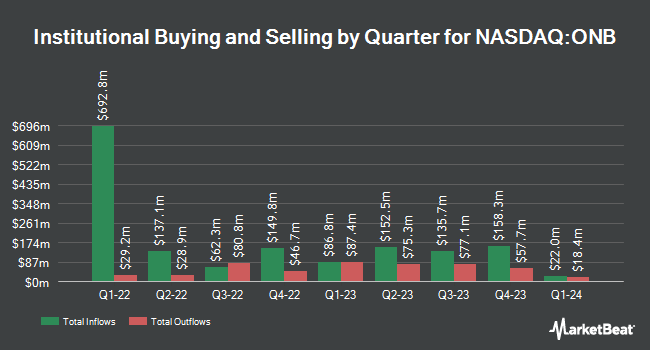

Charles Schwab Investment Management Inc. increased its holdings in Old National Bancorp (NASDAQ:ONB - Free Report) by 2.2% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 3,629,864 shares of the bank's stock after purchasing an additional 78,983 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.14% of Old National Bancorp worth $67,733,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds also recently bought and sold shares of ONB. International Assets Investment Management LLC boosted its stake in Old National Bancorp by 1,766.7% during the third quarter. International Assets Investment Management LLC now owns 1,400 shares of the bank's stock worth $26,000 after acquiring an additional 1,325 shares in the last quarter. GAMMA Investing LLC grew its stake in shares of Old National Bancorp by 194.8% in the 2nd quarter. GAMMA Investing LLC now owns 1,521 shares of the bank's stock worth $26,000 after buying an additional 1,005 shares during the last quarter. HHM Wealth Advisors LLC bought a new position in Old National Bancorp during the 2nd quarter valued at approximately $28,000. LRI Investments LLC purchased a new position in Old National Bancorp during the first quarter valued at $48,000. Finally, Quest Partners LLC bought a new stake in Old National Bancorp in the third quarter worth $91,000. Hedge funds and other institutional investors own 83.66% of the company's stock.

Old National Bancorp Price Performance

ONB traded up $0.02 during trading on Friday, reaching $23.16. 1,713,504 shares of the company traded hands, compared to its average volume of 2,139,558. Old National Bancorp has a 12-month low of $14.63 and a 12-month high of $23.76. The firm has a fifty day simple moving average of $19.87 and a 200 day simple moving average of $18.63. The company has a debt-to-equity ratio of 0.83, a quick ratio of 0.92 and a current ratio of 0.92. The company has a market cap of $7.39 billion, a P/E ratio of 14.02 and a beta of 0.82.

Old National Bancorp (NASDAQ:ONB - Get Free Report) last announced its quarterly earnings results on Tuesday, October 22nd. The bank reported $0.46 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.46. Old National Bancorp had a net margin of 17.93% and a return on equity of 10.10%. The company had revenue of $485.86 million for the quarter, compared to the consensus estimate of $482.20 million. Old National Bancorp's revenue for the quarter was up 6.5% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.51 EPS. On average, equities analysts forecast that Old National Bancorp will post 1.84 EPS for the current year.

Old National Bancorp Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Thursday, December 5th will be paid a $0.14 dividend. The ex-dividend date is Thursday, December 5th. This represents a $0.56 dividend on an annualized basis and a dividend yield of 2.42%. Old National Bancorp's payout ratio is currently 33.94%.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on ONB shares. Keefe, Bruyette & Woods lifted their price target on Old National Bancorp from $23.00 to $28.00 and gave the stock an "outperform" rating in a research report on Tuesday. Piper Sandler reaffirmed an "overweight" rating and issued a $27.00 target price (up from $23.00) on shares of Old National Bancorp in a report on Tuesday. Barclays upped their target price on shares of Old National Bancorp from $24.00 to $26.00 and gave the company an "overweight" rating in a research note on Tuesday. Raymond James raised Old National Bancorp from a "market perform" rating to a "strong-buy" rating and set a $28.00 price objective for the company in a report on Tuesday. Finally, Royal Bank of Canada lifted their target price on Old National Bancorp from $24.00 to $25.00 and gave the company a "sector perform" rating in a research report on Tuesday. Two equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $23.44.

View Our Latest Stock Report on Old National Bancorp

Old National Bancorp Company Profile

(

Free Report)

Old National Bancorp operates as the bank holding company for Old National Bank that provides various financial services to individual and commercial customers in the United States. It accepts deposit accounts, including noninterest-bearing demand, interest-bearing checking, negotiable order of withdrawal, savings and money market, and time deposits; and offers loans, such as home equity lines of credit, residential real estate loans, consumer loans, commercial loans, commercial real estate loans, agricultural loans, letters of credit, and lease financing.

Featured Stories

Before you consider Old National Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old National Bancorp wasn't on the list.

While Old National Bancorp currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.