Charles Schwab Investment Management Inc. raised its position in Olin Co. (NYSE:OLN - Free Report) by 2.9% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,295,699 shares of the specialty chemicals company's stock after acquiring an additional 37,043 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.11% of Olin worth $62,168,000 as of its most recent SEC filing.

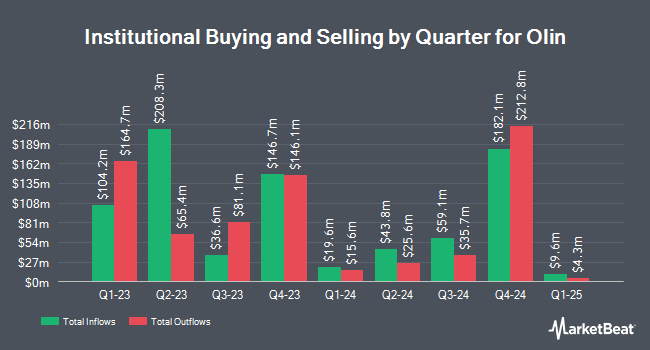

Several other hedge funds and other institutional investors have also made changes to their positions in the stock. Pzena Investment Management LLC boosted its stake in shares of Olin by 24.8% in the 3rd quarter. Pzena Investment Management LLC now owns 3,452,708 shares of the specialty chemicals company's stock valued at $165,661,000 after buying an additional 685,710 shares during the period. Commerce Bank lifted its stake in Olin by 48.0% during the third quarter. Commerce Bank now owns 18,069 shares of the specialty chemicals company's stock worth $867,000 after purchasing an additional 5,863 shares during the last quarter. Segall Bryant & Hamill LLC acquired a new position in Olin during the third quarter worth approximately $916,000. Empowered Funds LLC increased its position in Olin by 126.9% during the third quarter. Empowered Funds LLC now owns 20,498 shares of the specialty chemicals company's stock worth $983,000 after buying an additional 11,466 shares during the period. Finally, Connable Office Inc. increased its position in Olin by 22.9% during the third quarter. Connable Office Inc. now owns 5,680 shares of the specialty chemicals company's stock worth $273,000 after buying an additional 1,057 shares during the period. Hedge funds and other institutional investors own 88.67% of the company's stock.

Ad The TradingPub

Free ebook reveals our #1 chart pattern for 2020, 2021, 2022, 2023 and 2024.

It's time to get smart…

We think many good traders get caught up in the wrong stocks and ultimately burn up their trading accounts, which is why we want to share something special with you…

You see, our top technical trader just published a new e-book sharing his #1 stock pattern for the last 4 years…

It’s the same pattern that’s helped him grow his model portfolio by an average of 85% per year since 2020, and he’s currently giving away digital copies for free.

Inside, he’ll walk you through his #1 pattern, and show you why it forms.

As you’ll see, it’s all thanks to the algorithmic anomaly caused by Wall Street’s trading algorithms…

It's the main reason, this pattern paid out more than 72% of the time.

So, to claim your free digital copy today, simply follow this link and enter your email address.

Olin Stock Performance

Shares of NYSE:OLN opened at $42.59 on Friday. The firm has a market capitalization of $4.97 billion, a PE ratio of 34.35, a P/E/G ratio of 1.73 and a beta of 1.43. The company has a debt-to-equity ratio of 1.32, a current ratio of 1.40 and a quick ratio of 0.82. The business has a 50-day moving average of $44.41 and a two-hundred day moving average of $46.11. Olin Co. has a 12 month low of $39.47 and a 12 month high of $60.60.

Olin Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Thursday, November 14th will be paid a dividend of $0.20 per share. The ex-dividend date is Thursday, November 14th. This represents a $0.80 annualized dividend and a yield of 1.88%. Olin's dividend payout ratio is presently 64.52%.

Insider Activity

In related news, VP R Nichole Sumner sold 10,500 shares of the stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $43.75, for a total value of $459,375.00. Following the completion of the transaction, the vice president now owns 24,056 shares of the company's stock, valued at approximately $1,052,450. This represents a 30.39 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Insiders own 1.60% of the company's stock.

Analyst Ratings Changes

OLN has been the topic of several research analyst reports. Wells Fargo & Company cut their price target on Olin from $48.00 to $44.00 and set an "equal weight" rating on the stock in a research report on Monday, October 28th. BMO Capital Markets dropped their target price on Olin from $50.00 to $47.00 and set a "market perform" rating on the stock in a report on Tuesday, October 29th. Barclays dropped their price objective on Olin from $49.00 to $45.00 and set an "equal weight" rating on the stock in a report on Monday, October 28th. Mizuho assumed coverage on Olin in a report on Thursday, August 8th. They set a "neutral" rating and a $45.00 price objective on the stock. Finally, Royal Bank of Canada dropped their price objective on Olin from $52.00 to $48.00 and set an "outperform" rating on the stock in a report on Tuesday, October 29th. Eight research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat, Olin currently has an average rating of "Hold" and a consensus price target of $51.86.

View Our Latest Report on Olin

About Olin

(

Free Report)

Olin Corporation manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada. It operates through three segments: Chlor Alkali Products and Vinyls; Epoxy; and Winchester. The Chlor Alkali Products and Vinyls segment offers chlorine and caustic soda, ethylene dichloride and vinyl chloride monomers, methyl chloride, methylene chloride, chloroform, carbon tetrachloride, perchloroethylene, hydrochloric acid, hydrogen, bleach products, potassium hydroxide, and chlorinated organics intermediates and solvents.

Featured Articles

Before you consider Olin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Olin wasn't on the list.

While Olin currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.