Meeder Asset Management Inc. lowered its stake in shares of Cirrus Logic, Inc. (NASDAQ:CRUS - Free Report) by 40.7% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 9,996 shares of the semiconductor company's stock after selling 6,863 shares during the period. Meeder Asset Management Inc.'s holdings in Cirrus Logic were worth $1,242,000 at the end of the most recent reporting period.

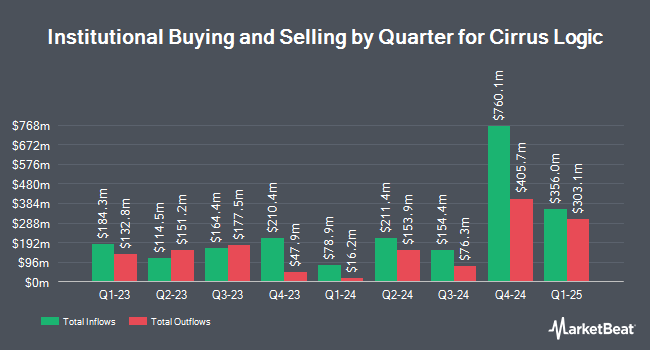

A number of other institutional investors have also recently added to or reduced their stakes in CRUS. Huntington National Bank lifted its position in Cirrus Logic by 10,500.0% during the 3rd quarter. Huntington National Bank now owns 212 shares of the semiconductor company's stock worth $26,000 after acquiring an additional 210 shares in the last quarter. Nisa Investment Advisors LLC boosted its stake in Cirrus Logic by 98.4% in the third quarter. Nisa Investment Advisors LLC now owns 242 shares of the semiconductor company's stock valued at $30,000 after acquiring an additional 120 shares during the period. V Square Quantitative Management LLC bought a new position in Cirrus Logic during the 3rd quarter worth $31,000. Versant Capital Management Inc increased its holdings in shares of Cirrus Logic by 1,911.1% in the 2nd quarter. Versant Capital Management Inc now owns 362 shares of the semiconductor company's stock worth $46,000 after acquiring an additional 344 shares during the period. Finally, GAMMA Investing LLC lifted its position in Cirrus Logic by 79.5% in the 2nd quarter. GAMMA Investing LLC now owns 474 shares of the semiconductor company's stock valued at $61,000 after purchasing an additional 210 shares during the last quarter. Hedge funds and other institutional investors own 87.96% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts recently commented on the company. KeyCorp raised their target price on Cirrus Logic from $155.00 to $165.00 and gave the company an "overweight" rating in a research report on Wednesday, August 7th. Susquehanna lifted their price target on shares of Cirrus Logic from $135.00 to $140.00 and gave the stock a "positive" rating in a research report on Monday. StockNews.com lowered Cirrus Logic from a "buy" rating to a "hold" rating in a research note on Wednesday, November 6th. Loop Capital initiated coverage on Cirrus Logic in a report on Tuesday, November 12th. They set a "buy" rating and a $130.00 price objective on the stock. Finally, Barclays reduced their target price on Cirrus Logic from $120.00 to $105.00 and set an "equal weight" rating for the company in a report on Tuesday, November 5th. Three equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $132.50.

Get Our Latest Research Report on CRUS

Cirrus Logic Stock Performance

Shares of Cirrus Logic stock traded down $0.36 during midday trading on Wednesday, reaching $100.22. 696,208 shares of the company's stock traded hands, compared to its average volume of 518,147. Cirrus Logic, Inc. has a 52 week low of $74.80 and a 52 week high of $147.46. The company's 50 day simple moving average is $116.86 and its 200 day simple moving average is $123.18. The company has a market cap of $5.33 billion, a price-to-earnings ratio of 16.99 and a beta of 0.96.

Cirrus Logic (NASDAQ:CRUS - Get Free Report) last released its quarterly earnings results on Monday, November 4th. The semiconductor company reported $2.25 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.02 by $0.23. Cirrus Logic had a return on equity of 18.15% and a net margin of 17.19%. The company had revenue of $541.90 million during the quarter, compared to the consensus estimate of $520.53 million. During the same quarter in the prior year, the company posted $1.43 EPS. The firm's revenue was up 12.6% on a year-over-year basis. As a group, equities research analysts predict that Cirrus Logic, Inc. will post 5.21 earnings per share for the current year.

About Cirrus Logic

(

Free Report)

Cirrus Logic, Inc, a fabless semiconductor company, develops low-power high-precision mixed-signal processing solutions in China, the United States, and internationally. The company offers audio products, including amplifiers; codecs components that integrate analog-to-digital converters (ADCs) and digital-to-analog converters (DACs) into a single integrated circuit (IC); smart codecs, a codec with integrated digital signal processing; standalone digital signal processors; and SoundClear technology, which consists of a portfolio of tools, software, and algorithms that helps to enhance user experience with features, such as louder, high-fidelity sound, audio playback, voice capture, and hearing augmentation for use in smartphones, tablets, laptops, AR/VR headsets, home theater systems, automotive entertainment systems, and professional audio systems.

See Also

Before you consider Cirrus Logic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cirrus Logic wasn't on the list.

While Cirrus Logic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.