Clal Insurance Enterprises Holdings Ltd lessened its stake in shares of NICE Ltd. (NASDAQ:NICE - Free Report) by 4.9% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 1,864,531 shares of the technology company's stock after selling 95,250 shares during the quarter. NICE comprises about 2.9% of Clal Insurance Enterprises Holdings Ltd's investment portfolio, making the stock its 6th biggest holding. Clal Insurance Enterprises Holdings Ltd owned 2.97% of NICE worth $325,272,000 as of its most recent filing with the Securities & Exchange Commission.

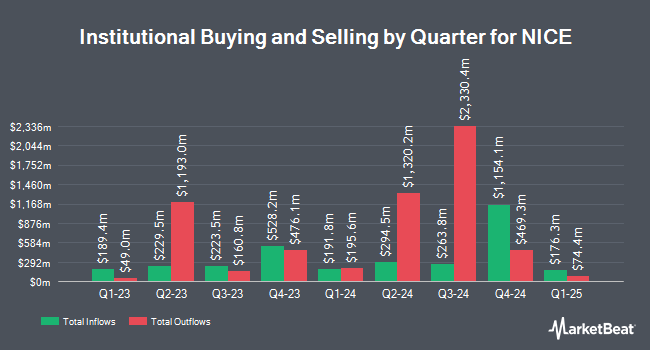

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in NICE. Bruni J V & Co. Co. purchased a new position in shares of NICE during the 3rd quarter worth about $22,849,000. First Hawaiian Bank bought a new position in NICE in the second quarter worth approximately $516,000. Diversified Trust Co raised its holdings in NICE by 237.9% in the second quarter. Diversified Trust Co now owns 6,478 shares of the technology company's stock worth $1,114,000 after purchasing an additional 4,561 shares in the last quarter. Capital World Investors acquired a new stake in shares of NICE in the 1st quarter worth $9,699,000. Finally, Asset Management One Co. Ltd. increased its position in NICE by 13.5% during the 3rd quarter. Asset Management One Co. Ltd. now owns 47,214 shares of the technology company's stock valued at $8,200,000 after buying an additional 5,629 shares in the last quarter. 63.34% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities research analysts have weighed in on NICE shares. Wedbush reaffirmed an "outperform" rating and set a $250.00 price target on shares of NICE in a research report on Friday, August 16th. Oppenheimer cut NICE from an "outperform" rating to a "market perform" rating in a research report on Friday, November 15th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $260.00 price target on shares of NICE in a report on Friday, November 15th. JMP Securities reissued a "market outperform" rating and issued a $300.00 price objective on shares of NICE in a report on Friday, August 16th. Finally, Northland Securities decreased their price objective on shares of NICE from $275.00 to $250.00 and set an "outperform" rating on the stock in a report on Friday, November 15th. Two analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $260.57.

Read Our Latest Report on NICE

NICE Stock Up 2.8 %

NASDAQ:NICE traded up $4.85 on Friday, reaching $176.16. 390,582 shares of the company's stock were exchanged, compared to its average volume of 687,479. NICE Ltd. has a 52-week low of $151.52 and a 52-week high of $270.73. The business has a fifty day moving average of $173.96 and a 200-day moving average of $176.65. The firm has a market capitalization of $11.08 billion, a price-to-earnings ratio of 27.27, a price-to-earnings-growth ratio of 1.38 and a beta of 1.04.

About NICE

(

Free Report)

NICE Ltd., together with its subsidiaries, provides cloud platforms for AI-driven digital business solutions worldwide. It offers CXone, a cloud native open platform; Enlighten, an AI engine for the customer engagement market; and smart self service enable organizations to address consumers' needs; and journey orchestration solutions that empower organizations to connect and route customers to deal with the customer's request, and connects them using real time AI-based routing.

Recommended Stories

Before you consider NICE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NICE wasn't on the list.

While NICE currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.