Clarkston Capital Partners LLC purchased a new stake in shares of Fortive Co. (NYSE:FTV - Free Report) in the third quarter, according to the company in its most recent filing with the SEC. The firm purchased 328,520 shares of the technology company's stock, valued at approximately $25,930,000. Clarkston Capital Partners LLC owned about 0.09% of Fortive at the end of the most recent quarter.

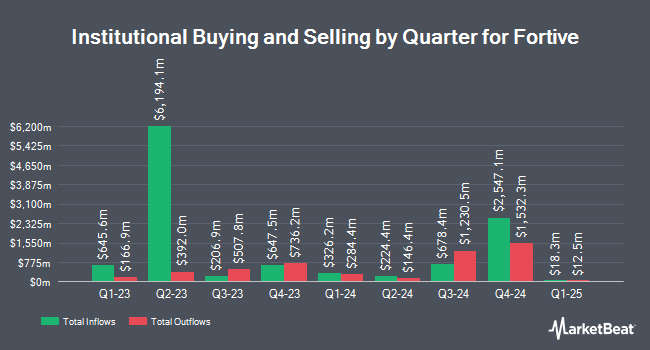

Several other hedge funds and other institutional investors also recently modified their holdings of FTV. Swiss National Bank increased its stake in Fortive by 0.4% in the third quarter. Swiss National Bank now owns 1,044,900 shares of the technology company's stock valued at $82,474,000 after acquiring an additional 4,600 shares during the last quarter. Atlanta Consulting Group Advisors LLC bought a new position in Fortive during the third quarter valued at approximately $223,000. Natixis Advisors LLC lifted its holdings in shares of Fortive by 1.7% in the 3rd quarter. Natixis Advisors LLC now owns 43,593 shares of the technology company's stock worth $3,441,000 after acquiring an additional 737 shares during the last quarter. Mizuho Securities USA LLC boosted its stake in shares of Fortive by 14,635.7% in the 3rd quarter. Mizuho Securities USA LLC now owns 4,000,000 shares of the technology company's stock valued at $315,720,000 after purchasing an additional 3,972,855 shares in the last quarter. Finally, Seelaus Asset Management LLC bought a new position in shares of Fortive during the 3rd quarter valued at $303,000. Hedge funds and other institutional investors own 94.94% of the company's stock.

Fortive Stock Down 0.3 %

FTV stock traded down $0.21 during midday trading on Monday, hitting $74.61. The stock had a trading volume of 2,277,607 shares, compared to its average volume of 1,977,423. The business has a 50-day moving average of $75.53 and a two-hundred day moving average of $74.16. The company has a debt-to-equity ratio of 0.33, a current ratio of 1.25 and a quick ratio of 0.99. The firm has a market cap of $25.89 billion, a price-to-earnings ratio of 29.81, a price-to-earnings-growth ratio of 2.05 and a beta of 1.13. Fortive Co. has a 52-week low of $66.15 and a 52-week high of $87.10.

Fortive (NYSE:FTV - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The technology company reported $0.97 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.93 by $0.04. The company had revenue of $1.53 billion during the quarter, compared to analyst estimates of $1.55 billion. Fortive had a net margin of 14.35% and a return on equity of 12.56%. Fortive's quarterly revenue was up 2.7% compared to the same quarter last year. During the same period last year, the business earned $0.85 EPS. As a group, equities research analysts forecast that Fortive Co. will post 3.85 earnings per share for the current fiscal year.

Fortive Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, November 29th will be paid a $0.08 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.43%. Fortive's dividend payout ratio is currently 12.75%.

Insider Activity

In other news, SVP Jonathan L. Schwarz sold 14,223 shares of the company's stock in a transaction on Friday, September 13th. The stock was sold at an average price of $73.80, for a total transaction of $1,049,657.40. Following the transaction, the senior vice president now directly owns 68,161 shares of the company's stock, valued at $5,030,281.80. This represents a 17.26 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, SVP Peter C. Underwood sold 5,000 shares of Fortive stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $76.58, for a total value of $382,900.00. Following the completion of the sale, the senior vice president now owns 48,346 shares of the company's stock, valued at $3,702,336.68. The trade was a 9.37 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 197,895 shares of company stock worth $14,261,051 over the last three months. 1.01% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of brokerages have recently issued reports on FTV. StockNews.com raised Fortive from a "hold" rating to a "buy" rating in a research note on Friday, September 13th. Royal Bank of Canada decreased their price target on Fortive from $85.00 to $77.00 and set a "sector perform" rating on the stock in a research note on Thursday, October 31st. Wells Fargo & Company dropped their price objective on Fortive from $82.00 to $77.00 and set an "equal weight" rating for the company in a research note on Thursday, October 31st. Barclays decreased their target price on shares of Fortive from $98.00 to $95.00 and set an "overweight" rating on the stock in a research note on Thursday, October 31st. Finally, Mizuho raised shares of Fortive from a "neutral" rating to an "outperform" rating and increased their price target for the company from $80.00 to $90.00 in a research report on Friday, September 6th. Six analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $87.82.

View Our Latest Research Report on Fortive

About Fortive

(

Free Report)

Fortive Corporation designs, develops, manufactures, and services professional and engineered products, software, and services in the United States, China, and internationally. It operates in three segments: Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions. The Intelligent Operating Solutions segment provides advanced instrumentation, software, and services, including electrical test and measurement, facility and asset lifecycle software applications, and connected worker safety and compliance solutions for manufacturing, process industries, healthcare, utilities and power, communications and electronics, and other industries.

Featured Stories

Before you consider Fortive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortive wasn't on the list.

While Fortive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report