DA Davidson downgraded shares of Clearwater Analytics (NYSE:CWAN - Free Report) from a buy rating to a neutral rating in a research note released on Friday, Marketbeat.com reports. DA Davidson currently has $35.00 price target on the stock, up from their prior price target of $31.00.

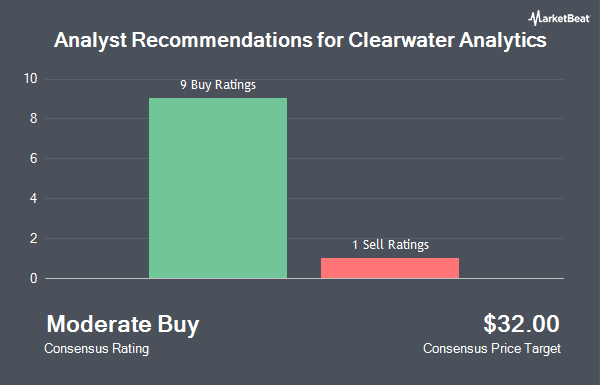

A number of other equities research analysts have also commented on the company. The Goldman Sachs Group upped their target price on Clearwater Analytics from $20.00 to $22.00 and gave the company a "sell" rating in a research report on Thursday. Citigroup initiated coverage on Clearwater Analytics in a report on Monday, August 19th. They issued a "buy" rating and a $28.00 price target for the company. Wells Fargo & Company raised their price objective on shares of Clearwater Analytics from $23.00 to $33.00 and gave the stock an "overweight" rating in a research note on Thursday. Morgan Stanley boosted their target price on shares of Clearwater Analytics from $20.00 to $30.00 and gave the company an "equal weight" rating in a research note on Thursday, October 17th. Finally, Royal Bank of Canada lifted their price objective on shares of Clearwater Analytics from $28.00 to $32.00 and gave the company an "outperform" rating in a report on Thursday. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, Clearwater Analytics currently has an average rating of "Hold" and a consensus price target of $30.67.

Read Our Latest Stock Analysis on CWAN

Clearwater Analytics Stock Performance

CWAN stock traded down $0.97 during trading on Friday, reaching $31.82. The company had a trading volume of 1,746,921 shares, compared to its average volume of 1,472,489. The company has a debt-to-equity ratio of 0.11, a quick ratio of 4.78 and a current ratio of 4.78. Clearwater Analytics has a twelve month low of $15.62 and a twelve month high of $35.71. The company has a market cap of $7.84 billion, a price-to-earnings ratio of -1,638.50, a price-to-earnings-growth ratio of 9.53 and a beta of 0.61. The firm has a 50-day simple moving average of $25.64 and a 200-day simple moving average of $21.85.

Clearwater Analytics (NYSE:CWAN - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported $0.05 earnings per share for the quarter, beating analysts' consensus estimates of $0.03 by $0.02. The firm had revenue of $115.83 million for the quarter, compared to analyst estimates of $113.37 million. Clearwater Analytics had a negative net margin of 1.14% and a positive return on equity of 3.55%. As a group, sell-side analysts expect that Clearwater Analytics will post 0.14 earnings per share for the current year.

Insider Activity

In other Clearwater Analytics news, insider Subi Sethi sold 21,497 shares of the stock in a transaction dated Wednesday, August 21st. The shares were sold at an average price of $24.30, for a total transaction of $522,377.10. Following the completion of the transaction, the insider now owns 81,812 shares of the company's stock, valued at $1,988,031.60. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In other Clearwater Analytics news, CFO James S. Cox sold 13,700 shares of the business's stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $23.64, for a total transaction of $323,868.00. Following the sale, the chief financial officer now directly owns 232,503 shares in the company, valued at $5,496,370.92. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Subi Sethi sold 21,497 shares of the firm's stock in a transaction that occurred on Wednesday, August 21st. The shares were sold at an average price of $24.30, for a total transaction of $522,377.10. Following the completion of the transaction, the insider now directly owns 81,812 shares of the company's stock, valued at approximately $1,988,031.60. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 1,864,693 shares of company stock valued at $45,128,342. 3.46% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Clearwater Analytics

A number of hedge funds have recently added to or reduced their stakes in CWAN. William Blair Investment Management LLC boosted its stake in shares of Clearwater Analytics by 42.5% in the 1st quarter. William Blair Investment Management LLC now owns 10,364,266 shares of the company's stock valued at $183,344,000 after buying an additional 3,090,352 shares during the period. Hood River Capital Management LLC purchased a new position in Clearwater Analytics in the second quarter worth approximately $43,280,000. Vanguard Group Inc. grew its holdings in Clearwater Analytics by 17.2% during the 1st quarter. Vanguard Group Inc. now owns 15,131,505 shares of the company's stock worth $267,676,000 after acquiring an additional 2,219,459 shares in the last quarter. Bamco Inc. NY raised its holdings in shares of Clearwater Analytics by 30.8% in the 1st quarter. Bamco Inc. NY now owns 5,359,172 shares of the company's stock valued at $94,804,000 after purchasing an additional 1,262,150 shares in the last quarter. Finally, Stephens Investment Management Group LLC acquired a new stake in shares of Clearwater Analytics in the 3rd quarter valued at $11,071,000. 50.10% of the stock is currently owned by institutional investors and hedge funds.

About Clearwater Analytics

(

Get Free Report)

Clearwater Analytics Holdings, Inc develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Featured Stories

Before you consider Clearwater Analytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Analytics wasn't on the list.

While Clearwater Analytics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report