Seizert Capital Partners LLC lifted its position in Commercial Metals (NYSE:CMC - Free Report) by 32.5% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 75,873 shares of the basic materials company's stock after acquiring an additional 18,600 shares during the quarter. Seizert Capital Partners LLC owned approximately 0.07% of Commercial Metals worth $4,170,000 as of its most recent filing with the SEC.

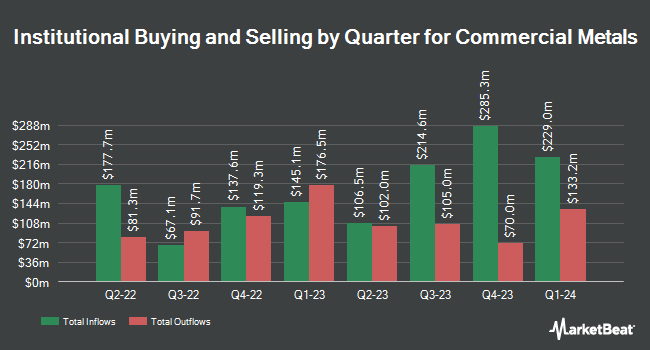

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. nVerses Capital LLC purchased a new stake in shares of Commercial Metals in the third quarter worth approximately $66,000. Archer Investment Corp purchased a new stake in Commercial Metals in the 2nd quarter worth approximately $77,000. GAMMA Investing LLC boosted its stake in shares of Commercial Metals by 21.9% during the 2nd quarter. GAMMA Investing LLC now owns 1,572 shares of the basic materials company's stock valued at $86,000 after buying an additional 282 shares during the period. Thurston Springer Miller Herd & Titak Inc. purchased a new position in shares of Commercial Metals during the 2nd quarter valued at $129,000. Finally, KBC Group NV increased its stake in shares of Commercial Metals by 15.9% in the third quarter. KBC Group NV now owns 3,099 shares of the basic materials company's stock worth $170,000 after acquiring an additional 425 shares during the last quarter. Institutional investors and hedge funds own 86.90% of the company's stock.

Commercial Metals Stock Performance

NYSE:CMC traded down $0.08 during midday trading on Friday, reaching $59.35. The stock had a trading volume of 771,755 shares, compared to its average volume of 973,856. The stock has a market capitalization of $6.76 billion, a P/E ratio of 14.34, a PEG ratio of 2.55 and a beta of 1.14. Commercial Metals has a 1-year low of $43.52 and a 1-year high of $63.40. The company has a debt-to-equity ratio of 0.27, a current ratio of 3.94 and a quick ratio of 2.78. The firm's fifty day simple moving average is $54.47 and its 200-day simple moving average is $54.57.

Commercial Metals (NYSE:CMC - Get Free Report) last issued its quarterly earnings results on Thursday, October 17th. The basic materials company reported $0.90 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.91 by ($0.01). Commercial Metals had a net margin of 6.13% and a return on equity of 12.20%. The business had revenue of $2 billion during the quarter, compared to analyst estimates of $2.07 billion. On average, equities research analysts forecast that Commercial Metals will post 4.35 EPS for the current fiscal year.

Commercial Metals Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, November 14th. Stockholders of record on Thursday, October 31st were given a $0.18 dividend. The ex-dividend date of this dividend was Thursday, October 31st. This represents a $0.72 annualized dividend and a dividend yield of 1.21%. Commercial Metals's dividend payout ratio is 17.39%.

Wall Street Analyst Weigh In

A number of research analysts have commented on the company. BMO Capital Markets set a $62.00 target price on Commercial Metals and gave the company a "market perform" rating in a research note on Friday, October 18th. Jefferies Financial Group initiated coverage on Commercial Metals in a research note on Tuesday, September 3rd. They issued a "buy" rating and a $65.00 price target for the company. Finally, Wolfe Research cut shares of Commercial Metals from an "outperform" rating to a "peer perform" rating in a research note on Wednesday, October 9th. Three equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $65.25.

Get Our Latest Research Report on Commercial Metals

Commercial Metals Company Profile

(

Free Report)

Commercial Metals Company manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally. It operates through two segments, North America and Europe. The company processes and sells ferrous and nonferrous scrap metals to steel mills and foundries, aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, secondary lead smelters, specialty steel mills, high temperature alloy manufacturers, and other consumers.

Featured Articles

Before you consider Commercial Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Commercial Metals wasn't on the list.

While Commercial Metals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.