Connor Clark & Lunn Investment Management Ltd. raised its position in Wipro Limited (NYSE:WIT - Free Report) by 116.8% during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 1,610,319 shares of the information technology services provider's stock after acquiring an additional 867,516 shares during the period. Connor Clark & Lunn Investment Management Ltd.'s holdings in Wipro were worth $10,435,000 as of its most recent filing with the SEC.

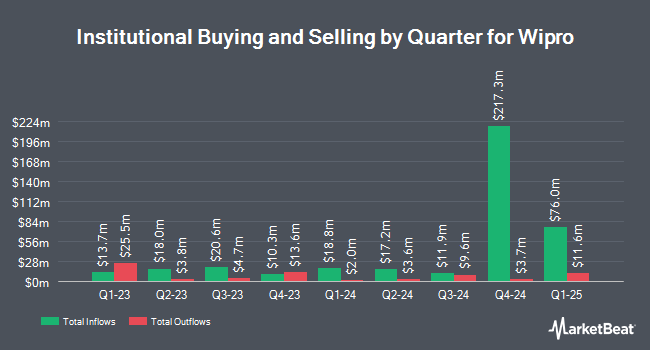

A number of other large investors have also recently bought and sold shares of the company. GAMMA Investing LLC raised its holdings in Wipro by 37.8% during the third quarter. GAMMA Investing LLC now owns 8,841 shares of the information technology services provider's stock worth $57,000 after acquiring an additional 2,426 shares in the last quarter. Mayflower Financial Advisors LLC acquired a new position in shares of Wipro during the 2nd quarter worth approximately $64,000. Abacus Wealth Partners LLC acquired a new stake in shares of Wipro in the 3rd quarter valued at approximately $71,000. Werba Rubin Papier Wealth Management bought a new position in shares of Wipro in the third quarter valued at $71,000. Finally, Catalytic Wealth RIA LLC acquired a new position in Wipro during the third quarter worth $81,000. Institutional investors and hedge funds own 2.36% of the company's stock.

Analyst Ratings Changes

Several research firms have recently weighed in on WIT. StockNews.com lowered shares of Wipro from a "buy" rating to a "hold" rating in a research note on Monday. Investec lowered Wipro from a "hold" rating to a "sell" rating in a research note on Thursday, October 3rd. Three equities research analysts have rated the stock with a sell rating, one has given a hold rating, one has assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $5.60.

Get Our Latest Stock Report on Wipro

Wipro Price Performance

NYSE WIT traded up $0.19 during trading on Friday, hitting $6.98. 5,233,007 shares of the company's stock were exchanged, compared to its average volume of 2,505,686. The company has a market cap of $36.47 billion, a PE ratio of 25.15, a P/E/G ratio of 4.60 and a beta of 0.89. The company has a current ratio of 2.69, a quick ratio of 2.69 and a debt-to-equity ratio of 0.08. Wipro Limited has a fifty-two week low of $4.67 and a fifty-two week high of $7.04. The stock's 50 day moving average price is $6.58 and its two-hundred day moving average price is $6.15.

Wipro (NYSE:WIT - Get Free Report) last released its quarterly earnings data on Thursday, October 17th. The information technology services provider reported $0.07 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.07. Wipro had a net margin of 13.23% and a return on equity of 14.98%. The business had revenue of $2.66 billion during the quarter, compared to analysts' expectations of $2.66 billion. Research analysts expect that Wipro Limited will post 0.27 EPS for the current year.

About Wipro

(

Free Report)

Wipro Limited operates as an information technology (IT), consulting, and business process services company worldwide. It operates through IT Services and IT Products segments. The IT Services segment offers IT and IT-enabled services, including digital strategy advisory, customer-centric design, technology and IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, cloud and infrastructure, business process, cloud, mobility and analytics, research and development, and hardware and software design services to enterprises.

Featured Articles

Before you consider Wipro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wipro wasn't on the list.

While Wipro currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.