Connor Clark & Lunn Investment Management Ltd. boosted its stake in Affirm Holdings, Inc. (NASDAQ:AFRM - Free Report) by 19.0% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 251,713 shares of the company's stock after purchasing an additional 40,254 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.08% of Affirm worth $10,275,000 at the end of the most recent reporting period.

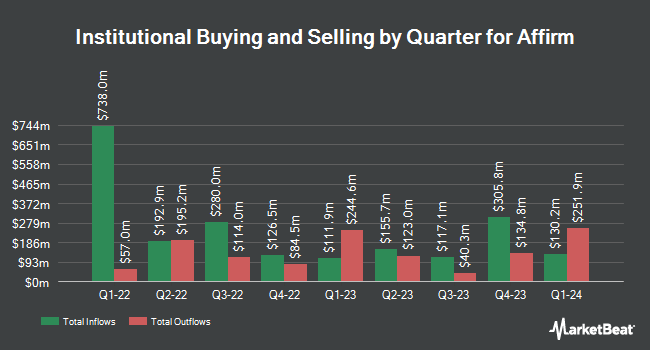

Several other large investors have also bought and sold shares of AFRM. ORG Wealth Partners LLC bought a new stake in shares of Affirm during the 3rd quarter valued at about $29,000. Ridgewood Investments LLC bought a new position in shares of Affirm during the 2nd quarter worth approximately $27,000. Venturi Wealth Management LLC grew its position in shares of Affirm by 200.5% during the 3rd quarter. Venturi Wealth Management LLC now owns 1,097 shares of the company's stock worth $45,000 after buying an additional 732 shares during the period. Allspring Global Investments Holdings LLC increased its stake in shares of Affirm by 82.4% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 1,195 shares of the company's stock valued at $36,000 after acquiring an additional 540 shares in the last quarter. Finally, ORG Partners LLC lifted its position in shares of Affirm by 80.0% during the 2nd quarter. ORG Partners LLC now owns 1,240 shares of the company's stock valued at $37,000 after acquiring an additional 551 shares during the period. 69.29% of the stock is owned by institutional investors.

Affirm Price Performance

Shares of AFRM traded up $0.81 during mid-day trading on Friday, reaching $66.55. 12,391,493 shares of the stock traded hands, compared to its average volume of 9,102,666. The company has a market cap of $20.90 billion, a price-to-earnings ratio of -46.30 and a beta of 3.47. Affirm Holdings, Inc. has a 1 year low of $22.25 and a 1 year high of $70.03. The firm has a fifty day moving average price of $46.44 and a 200 day moving average price of $36.50. The company has a current ratio of 12.60, a quick ratio of 12.60 and a debt-to-equity ratio of 2.50.

Affirm (NASDAQ:AFRM - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported ($0.31) earnings per share for the quarter, topping analysts' consensus estimates of ($0.36) by $0.05. The business had revenue of $698.48 million for the quarter, compared to analyst estimates of $661.39 million. Affirm had a negative return on equity of 12.57% and a negative net margin of 17.67%. During the same period in the prior year, the company earned ($0.57) EPS. As a group, equities research analysts predict that Affirm Holdings, Inc. will post -0.53 earnings per share for the current year.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the stock. Wedbush upgraded shares of Affirm from an "underperform" rating to a "neutral" rating and upped their price objective for the company from $25.00 to $45.00 in a report on Monday, October 14th. Barclays raised their price objective on Affirm from $54.00 to $64.00 and gave the company an "overweight" rating in a research note on Monday. Wells Fargo & Company increased their target price on Affirm from $52.00 to $55.00 and gave the stock an "overweight" rating in a report on Friday, November 8th. JPMorgan Chase & Co. upped their price objective on shares of Affirm from $47.00 to $56.00 and gave the stock an "overweight" rating in a report on Friday, November 8th. Finally, Mizuho lifted their price objective on shares of Affirm from $65.00 to $69.00 and gave the company an "outperform" rating in a report on Tuesday. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating and nine have issued a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $48.74.

Get Our Latest Stock Analysis on AFRM

Insider Activity

In other Affirm news, Director Christa S. Quarles sold 14,400 shares of the stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $40.02, for a total transaction of $576,288.00. Following the transaction, the director now directly owns 141,903 shares in the company, valued at $5,678,958.06. This trade represents a 9.21 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Katherine Adkins sold 200,000 shares of Affirm stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $55.05, for a total transaction of $11,010,000.00. Following the transaction, the insider now directly owns 93,545 shares in the company, valued at $5,149,652.25. This trade represents a 68.13 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 503,738 shares of company stock worth $27,315,878. 12.41% of the stock is currently owned by corporate insiders.

Affirm Profile

(

Free Report)

Affirm Holdings, Inc operates a platform for digital and mobile-first commerce in the United States, Canada, and internationally. The company's platform includes point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Its commerce platform, agreements with originating banks, and capital markets partners enables consumers to pay for a purchase over time with terms ranging up to 60 months.

Featured Articles

Before you consider Affirm, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Affirm wasn't on the list.

While Affirm currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.