Connor Clark & Lunn Investment Management Ltd. decreased its holdings in BHP Group Limited (NYSE:BHP - Free Report) by 75.7% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 8,814 shares of the mining company's stock after selling 27,457 shares during the quarter. Connor Clark & Lunn Investment Management Ltd.'s holdings in BHP Group were worth $547,000 at the end of the most recent quarter.

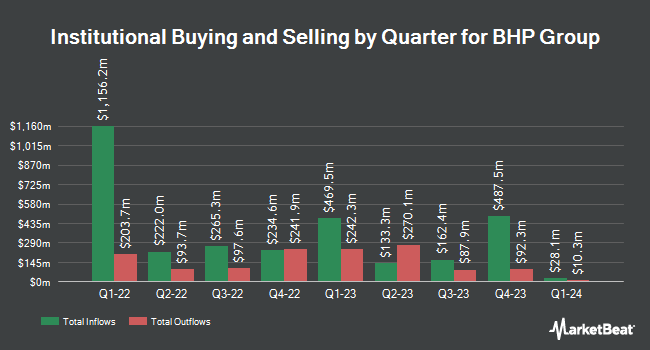

A number of other institutional investors and hedge funds also recently modified their holdings of the stock. XY Capital Ltd grew its position in BHP Group by 503.6% during the third quarter. XY Capital Ltd now owns 921,666 shares of the mining company's stock valued at $57,245,000 after acquiring an additional 768,972 shares during the period. Ausbil Investment Management Ltd acquired a new stake in BHP Group during the 3rd quarter worth approximately $2,360,000. Chartwell Investment Partners LLC purchased a new position in BHP Group in the third quarter valued at approximately $9,830,000. SG Americas Securities LLC lifted its position in BHP Group by 477.0% during the second quarter. SG Americas Securities LLC now owns 209,883 shares of the mining company's stock valued at $11,982,000 after buying an additional 173,510 shares in the last quarter. Finally, AQR Capital Management LLC grew its stake in BHP Group by 269.6% during the second quarter. AQR Capital Management LLC now owns 28,358 shares of the mining company's stock worth $1,619,000 after buying an additional 20,685 shares during the period. Institutional investors and hedge funds own 3.79% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on BHP shares. Jefferies Financial Group lowered shares of BHP Group from a "buy" rating to a "hold" rating and reduced their target price for the company from $72.00 to $68.00 in a report on Friday, October 4th. Argus upgraded BHP Group to a "strong-buy" rating in a research note on Thursday, September 19th. Sanford C. Bernstein upgraded BHP Group from a "market perform" rating to an "outperform" rating in a research note on Monday, September 16th. Finally, StockNews.com upgraded BHP Group from a "buy" rating to a "strong-buy" rating in a report on Tuesday. Three investment analysts have rated the stock with a hold rating, two have given a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, BHP Group presently has an average rating of "Moderate Buy" and a consensus target price of $68.00.

Read Our Latest Analysis on BHP

BHP Group Stock Up 1.6 %

Shares of BHP Group stock traded up $0.85 during trading hours on Friday, hitting $52.65. 1,362,519 shares of the company's stock traded hands, compared to its average volume of 2,455,369. BHP Group Limited has a twelve month low of $50.90 and a twelve month high of $69.11. The stock has a 50 day simple moving average of $56.28 and a 200-day simple moving average of $56.21. The company has a quick ratio of 1.29, a current ratio of 1.70 and a debt-to-equity ratio of 0.38. The company has a market cap of $133.51 billion, a PE ratio of 11.30 and a beta of 0.98.

BHP Group Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

See Also

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.