ARK Investment Management LLC decreased its position in CRISPR Therapeutics AG (NASDAQ:CRSP - Free Report) by 3.6% during the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 7,498,625 shares of the company's stock after selling 279,911 shares during the period. CRISPR Therapeutics comprises approximately 3.2% of ARK Investment Management LLC's portfolio, making the stock its 9th biggest holding. ARK Investment Management LLC owned 8.83% of CRISPR Therapeutics worth $352,285,000 at the end of the most recent quarter.

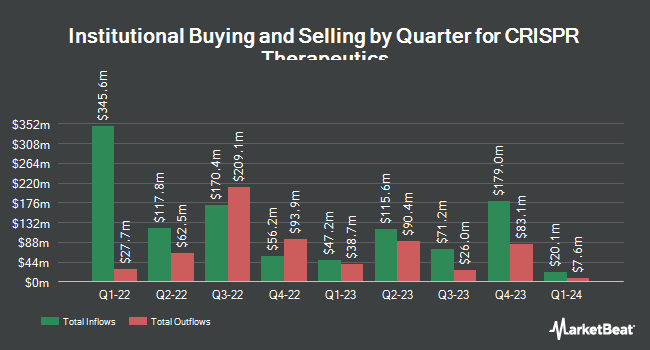

Several other large investors also recently bought and sold shares of the company. SFE Investment Counsel grew its holdings in CRISPR Therapeutics by 3.6% in the second quarter. SFE Investment Counsel now owns 5,846 shares of the company's stock valued at $316,000 after purchasing an additional 203 shares during the last quarter. Northwestern Mutual Wealth Management Co. boosted its stake in shares of CRISPR Therapeutics by 4.8% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 4,606 shares of the company's stock valued at $249,000 after acquiring an additional 211 shares during the last quarter. Orion Capital Management LLC boosted its stake in shares of CRISPR Therapeutics by 44.0% during the first quarter. Orion Capital Management LLC now owns 720 shares of the company's stock valued at $49,000 after acquiring an additional 220 shares during the last quarter. National Bank of Canada FI boosted its stake in shares of CRISPR Therapeutics by 35.0% during the second quarter. National Bank of Canada FI now owns 848 shares of the company's stock valued at $46,000 after acquiring an additional 220 shares during the last quarter. Finally, Larson Financial Group LLC boosted its stake in shares of CRISPR Therapeutics by 95.5% during the second quarter. Larson Financial Group LLC now owns 565 shares of the company's stock valued at $31,000 after acquiring an additional 276 shares during the last quarter. Institutional investors and hedge funds own 69.20% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts recently commented on the company. Truist Financial decreased their price objective on CRISPR Therapeutics from $120.00 to $100.00 and set a "buy" rating on the stock in a research note on Monday, August 12th. Barclays decreased their price objective on CRISPR Therapeutics from $59.00 to $55.00 and set an "equal weight" rating on the stock in a research note on Wednesday. Royal Bank of Canada reissued a "sector perform" rating and issued a $53.00 price target on shares of CRISPR Therapeutics in a research note on Wednesday. Needham & Company LLC reissued a "buy" rating and issued a $84.00 price target on shares of CRISPR Therapeutics in a research note on Wednesday. Finally, Stifel Nicolaus decreased their price target on CRISPR Therapeutics from $60.00 to $59.00 and set a "hold" rating on the stock in a research note on Tuesday, August 6th. Three research analysts have rated the stock with a sell rating, eight have given a hold rating and nine have issued a buy rating to the company's stock. According to data from MarketBeat, CRISPR Therapeutics presently has a consensus rating of "Hold" and an average target price of $74.94.

View Our Latest Stock Analysis on CRSP

CRISPR Therapeutics Stock Performance

Shares of NASDAQ:CRSP traded down $0.26 during mid-day trading on Friday, hitting $51.62. 1,304,947 shares of the company traded hands, compared to its average volume of 1,455,758. The firm has a market cap of $4.39 billion, a P/E ratio of -16.06 and a beta of 1.67. CRISPR Therapeutics AG has a 52-week low of $43.42 and a 52-week high of $91.10. The firm's 50 day simple moving average is $47.38 and its 200 day simple moving average is $52.24.

CRISPR Therapeutics (NASDAQ:CRSP - Get Free Report) last announced its earnings results on Tuesday, November 5th. The company reported ($1.01) EPS for the quarter, beating the consensus estimate of ($1.42) by $0.41. The company had revenue of $0.60 million for the quarter, compared to analysts' expectations of $6.65 million. During the same quarter in the previous year, the business posted ($1.41) earnings per share. Equities research analysts expect that CRISPR Therapeutics AG will post -5.57 EPS for the current fiscal year.

Insider Buying and Selling at CRISPR Therapeutics

In other CRISPR Therapeutics news, General Counsel James R. Kasinger sold 1,089 shares of the firm's stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $46.28, for a total transaction of $50,398.92. Following the completion of the sale, the general counsel now owns 62,597 shares in the company, valued at $2,896,989.16. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In other news, General Counsel James R. Kasinger sold 1,089 shares of CRISPR Therapeutics stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $46.28, for a total value of $50,398.92. Following the completion of the transaction, the general counsel now owns 62,597 shares in the company, valued at approximately $2,896,989.16. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Samarth Kulkarni sold 4,293 shares of CRISPR Therapeutics stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $46.28, for a total value of $198,680.04. Following the completion of the transaction, the chief executive officer now owns 226,540 shares of the company's stock, valued at approximately $10,484,271.20. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. 4.10% of the stock is owned by insiders.

About CRISPR Therapeutics

(

Free Report)

CRISPR Therapeutics is a gene-editing company focused on developing transformative gene-based medicines for serious diseases using its proprietary CRISPR/Cas9 platform. CRISPR/Cas9 is a revolutionary gene-editing technology that allows for precise, directed changes to genomic DNA. CRISPR Therapeutics has established a portfolio of therapeutic programs across a broad range of disease areas including hemoglobinopathies, oncology, regenerative medicine and rare diseases.

See Also

Before you consider CRISPR Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRISPR Therapeutics wasn't on the list.

While CRISPR Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.