Equities research analysts at Royal Bank of Canada assumed coverage on shares of Cytokinetics (NASDAQ:CYTK - Get Free Report) in a research report issued on Friday, Marketbeat.com reports. The firm set an "outperform" rating and a $80.00 price target on the biopharmaceutical company's stock. Royal Bank of Canada's price target would indicate a potential upside of 37.79% from the company's current price.

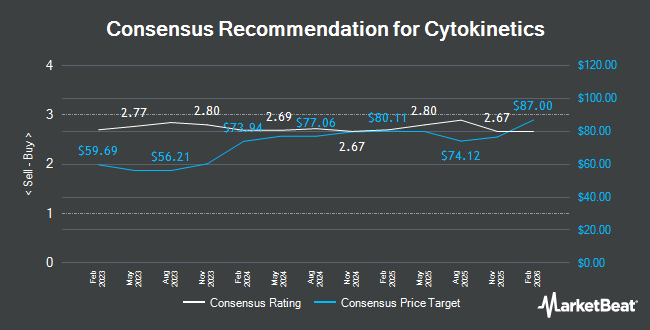

Several other research firms also recently weighed in on CYTK. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Cytokinetics in a report on Friday, October 18th. HC Wainwright reissued a "buy" rating and set a $120.00 target price on shares of Cytokinetics in a report on Thursday. The Goldman Sachs Group downgraded Cytokinetics from a "buy" rating to a "neutral" rating and cut their target price for the stock from $85.00 to $60.00 in a research report on Tuesday, August 13th. Needham & Company LLC reiterated a "buy" rating and set a $72.00 price target on shares of Cytokinetics in a research report on Thursday, October 17th. Finally, JPMorgan Chase & Co. upped their price objective on Cytokinetics from $65.00 to $71.00 and gave the company an "overweight" rating in a report on Thursday, September 5th. One research analyst has rated the stock with a sell rating, four have given a hold rating and twelve have issued a buy rating to the stock. Based on data from MarketBeat.com, Cytokinetics has a consensus rating of "Moderate Buy" and a consensus price target of $83.67.

View Our Latest Stock Analysis on Cytokinetics

Cytokinetics Stock Performance

Shares of NASDAQ:CYTK traded up $2.22 on Friday, reaching $58.06. 865,317 shares of the company's stock were exchanged, compared to its average volume of 2,073,192. The business's 50-day moving average is $54.08 and its two-hundred day moving average is $55.70. The company has a quick ratio of 10.39, a current ratio of 10.39 and a debt-to-equity ratio of 5.93. Cytokinetics has a fifty-two week low of $30.68 and a fifty-two week high of $110.25. The firm has a market capitalization of $6.83 billion, a price-to-earnings ratio of -10.40 and a beta of 0.78.

Cytokinetics (NASDAQ:CYTK - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The biopharmaceutical company reported ($1.36) earnings per share for the quarter, missing analysts' consensus estimates of ($1.27) by ($0.09). The company had revenue of $0.46 million for the quarter, compared to analyst estimates of $1.21 million. During the same quarter in the previous year, the business posted ($1.35) earnings per share. The firm's revenue for the quarter was up 22.5% on a year-over-year basis. As a group, equities research analysts forecast that Cytokinetics will post -5.15 EPS for the current year.

Insider Buying and Selling at Cytokinetics

In related news, CEO Robert I. Blum sold 5,000 shares of the firm's stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $57.03, for a total transaction of $285,150.00. Following the completion of the sale, the chief executive officer now directly owns 397,456 shares in the company, valued at approximately $22,666,915.68. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. In other news, CEO Robert I. Blum sold 11,500 shares of the firm's stock in a transaction on Monday, August 12th. The shares were sold at an average price of $55.17, for a total transaction of $634,455.00. Following the transaction, the chief executive officer now owns 399,412 shares in the company, valued at approximately $22,035,560.04. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Robert I. Blum sold 5,000 shares of the firm's stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $57.03, for a total value of $285,150.00. Following the completion of the transaction, the chief executive officer now directly owns 397,456 shares in the company, valued at $22,666,915.68. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 70,236 shares of company stock valued at $3,800,944 in the last 90 days. 3.40% of the stock is currently owned by corporate insiders.

Institutional Trading of Cytokinetics

Institutional investors and hedge funds have recently modified their holdings of the company. Louisiana State Employees Retirement System increased its stake in shares of Cytokinetics by 0.6% in the third quarter. Louisiana State Employees Retirement System now owns 32,600 shares of the biopharmaceutical company's stock worth $1,721,000 after purchasing an additional 200 shares during the period. UMB Bank n.a. increased its position in Cytokinetics by 65.6% in the 3rd quarter. UMB Bank n.a. now owns 601 shares of the biopharmaceutical company's stock worth $32,000 after buying an additional 238 shares during the period. First Bank & Trust lifted its holdings in shares of Cytokinetics by 4.7% during the second quarter. First Bank & Trust now owns 6,757 shares of the biopharmaceutical company's stock worth $366,000 after buying an additional 303 shares during the last quarter. Nisa Investment Advisors LLC boosted its position in shares of Cytokinetics by 2.9% in the third quarter. Nisa Investment Advisors LLC now owns 15,062 shares of the biopharmaceutical company's stock valued at $795,000 after acquiring an additional 430 shares during the period. Finally, J.Safra Asset Management Corp boosted its position in shares of Cytokinetics by 642.3% in the second quarter. J.Safra Asset Management Corp now owns 527 shares of the biopharmaceutical company's stock valued at $29,000 after acquiring an additional 456 shares during the period.

Cytokinetics Company Profile

(

Get Free Report)

Cytokinetics, Incorporated, a late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases. The company develops small molecule drug candidates primarily engineered to impact muscle function and contractility.

Featured Stories

Before you consider Cytokinetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cytokinetics wasn't on the list.

While Cytokinetics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.