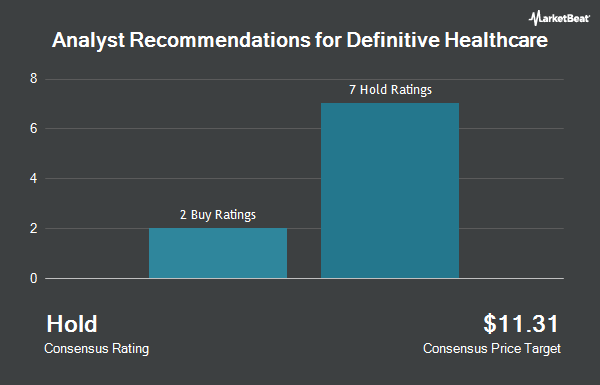

Definitive Healthcare Corp. (NASDAQ:DH - Get Free Report) has earned a consensus recommendation of "Hold" from the eleven brokerages that are presently covering the firm, MarketBeat reports. One investment analyst has rated the stock with a sell recommendation, seven have given a hold recommendation and three have assigned a buy recommendation to the company. The average 12 month price target among brokerages that have updated their coverage on the stock in the last year is $5.81.

Several research analysts have commented on the stock. Deutsche Bank Aktiengesellschaft decreased their price target on shares of Definitive Healthcare from $7.00 to $5.00 and set a "hold" rating on the stock in a research note on Friday, August 9th. Needham & Company LLC restated a "hold" rating on shares of Definitive Healthcare in a research report on Friday. JPMorgan Chase & Co. lowered Definitive Healthcare from a "neutral" rating to an "underweight" rating and lowered their target price for the company from $7.00 to $5.00 in a research note on Wednesday, July 31st. Barclays reduced their price target on Definitive Healthcare from $6.00 to $4.00 and set an "equal weight" rating on the stock in a research report on Wednesday, August 7th. Finally, Robert W. Baird lowered their price objective on Definitive Healthcare from $6.00 to $5.00 and set a "neutral" rating for the company in a research report on Wednesday, August 7th.

Read Our Latest Analysis on Definitive Healthcare

Hedge Funds Weigh In On Definitive Healthcare

Hedge funds and other institutional investors have recently modified their holdings of the stock. Millennium Management LLC purchased a new position in Definitive Healthcare during the second quarter valued at $9,283,000. Massachusetts Financial Services Co. MA lifted its position in Definitive Healthcare by 28.3% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 4,426,420 shares of the company's stock valued at $24,168,000 after acquiring an additional 976,279 shares during the period. 272 Capital LP bought a new stake in Definitive Healthcare during the second quarter worth about $3,480,000. Marshall Wace LLP purchased a new stake in Definitive Healthcare in the second quarter worth about $1,535,000. Finally, Algert Global LLC bought a new position in shares of Definitive Healthcare during the second quarter valued at approximately $1,265,000. Hedge funds and other institutional investors own 98.67% of the company's stock.

Definitive Healthcare Trading Down 1.6 %

Shares of DH traded down $0.07 during midday trading on Friday, reaching $4.24. The stock had a trading volume of 1,200,343 shares, compared to its average volume of 326,752. The company has a debt-to-equity ratio of 0.27, a current ratio of 2.40 and a quick ratio of 2.40. Definitive Healthcare has a 12-month low of $3.19 and a 12-month high of $10.62. The company's 50-day moving average is $4.36 and its 200 day moving average is $5.01.

About Definitive Healthcare

(

Get Free ReportDefinitive Healthcare Corp., together with its subsidiaries, provides software as a service (SaaS) healthcare commercial intelligence platform in the United States and internationally. Its SaaS platform provides information on healthcare providers and their activities to help its customers from product development to go-to-market planning, and sales and marketing execution.

Featured Stories

Before you consider Definitive Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Definitive Healthcare wasn't on the list.

While Definitive Healthcare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.