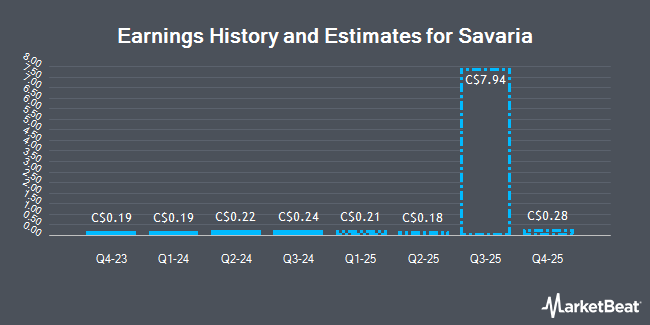

Savaria Co. (TSE:SIS - Free Report) - Research analysts at Desjardins cut their FY2024 EPS estimates for shares of Savaria in a note issued to investors on Thursday, November 7th. Desjardins analyst F. Tremblay now anticipates that the company will earn $0.68 per share for the year, down from their previous forecast of $0.69. Desjardins has a "Buy" rating and a $26.00 price objective on the stock. The consensus estimate for Savaria's current full-year earnings is $1.20 per share. Desjardins also issued estimates for Savaria's FY2025 earnings at $1.07 EPS and FY2026 earnings at $1.44 EPS.

Several other research analysts have also issued reports on the stock. TD Securities increased their price target on shares of Savaria from C$23.00 to C$24.00 and gave the stock a "buy" rating in a research note on Thursday, August 8th. Stifel Nicolaus upped their price target on shares of Savaria from C$24.00 to C$25.00 and gave the company a "buy" rating in a research report on Tuesday, August 20th. National Bankshares raised their price objective on shares of Savaria from C$22.00 to C$27.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Scotiabank set a C$25.00 price target on shares of Savaria and gave the company an "outperform" rating in a report on Thursday, September 26th. Finally, Raymond James lifted their price target on shares of Savaria from C$25.00 to C$27.50 and gave the company an "outperform" rating in a report on Friday, September 13th. Six research analysts have rated the stock with a buy rating, According to MarketBeat.com, Savaria presently has a consensus rating of "Buy" and an average target price of C$25.50.

View Our Latest Report on SIS

Savaria Trading Down 3.9 %

Shares of TSE:SIS traded down C$0.89 on Monday, hitting C$22.00. The company had a trading volume of 218,283 shares, compared to its average volume of 78,254. The firm's 50-day simple moving average is C$21.86 and its two-hundred day simple moving average is C$19.49. Savaria has a 1 year low of C$13.95 and a 1 year high of C$23.92. The company has a quick ratio of 0.91, a current ratio of 1.94 and a debt-to-equity ratio of 56.50. The firm has a market capitalization of C$1.56 billion, a price-to-earnings ratio of 35.22, a P/E/G ratio of 42.72 and a beta of 0.90.

Insider Activity

In related news, Director Jean-Louis Chapdelaine sold 25,000 shares of the company's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of C$20.84, for a total transaction of C$521,000.00. In other news, Senior Officer Sylvain Aubry sold 20,002 shares of the stock in a transaction on Friday, September 13th. The shares were sold at an average price of C$20.75, for a total value of C$415,041.50. Also, Director Jean-Louis Chapdelaine sold 25,000 shares of the stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of C$20.84, for a total transaction of C$521,000.00. Insiders have sold a total of 50,002 shares of company stock worth $1,046,042 over the last quarter. Insiders own 17.45% of the company's stock.

Savaria Dividend Announcement

The business also recently disclosed a monthly dividend, which will be paid on Tuesday, November 12th. Stockholders of record on Thursday, October 31st will be given a dividend of $0.045 per share. This represents a $0.54 annualized dividend and a dividend yield of 2.45%. The ex-dividend date is Thursday, October 31st. Savaria's payout ratio is currently 83.08%.

Savaria Company Profile

(

Get Free Report)

Savaria Corporation provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally. The company operates in two segments, Accessibility and Patient Care. The Accessibility segment designs, manufactures, distributes, and installs a portfolio of accessibility products, including commercial and home elevators, stairlifts, platform lifts, and wheelchair lowered-floor accessible conversions for selected brands of minivans, personal, residential, or commercial applications.

Further Reading

Before you consider Savaria, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Savaria wasn't on the list.

While Savaria currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.