Robinhood Markets (NASDAQ:HOOD - Get Free Report) had its price target lifted by analysts at Deutsche Bank Aktiengesellschaft from $27.00 to $32.00 in a report released on Monday,Benzinga reports. The brokerage currently has a "buy" rating on the stock. Deutsche Bank Aktiengesellschaft's target price suggests a potential downside of 2.44% from the stock's previous close.

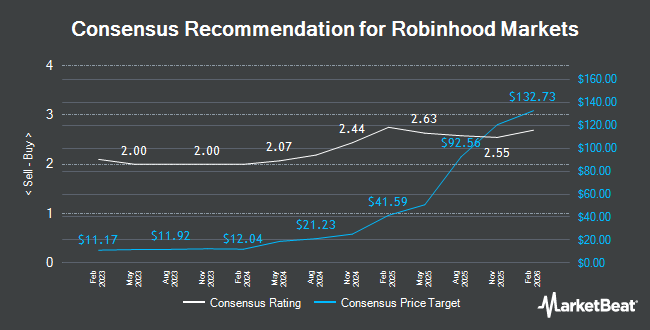

Several other research firms have also recently weighed in on HOOD. Piper Sandler raised their target price on shares of Robinhood Markets from $27.00 to $30.00 and gave the company an "overweight" rating in a research note on Monday, October 21st. Morgan Stanley lifted their price objective on shares of Robinhood Markets from $22.00 to $24.00 and gave the company an "equal weight" rating in a research report on Monday. Needham & Company LLC reiterated a "hold" rating on shares of Robinhood Markets in a research note on Thursday, October 31st. Barclays boosted their price target on Robinhood Markets from $23.00 to $26.00 and gave the stock an "equal weight" rating in a research report on Thursday, October 31st. Finally, KeyCorp raised their price objective on Robinhood Markets from $25.00 to $30.00 and gave the company an "overweight" rating in a research report on Monday, October 21st. One investment analyst has rated the stock with a sell rating, seven have given a hold rating and eight have given a buy rating to the stock. According to MarketBeat.com, Robinhood Markets has an average rating of "Hold" and an average price target of $25.63.

Get Our Latest Stock Report on HOOD

Robinhood Markets Stock Performance

NASDAQ:HOOD traded up $2.26 during trading hours on Monday, hitting $32.80. The stock had a trading volume of 43,844,248 shares, compared to its average volume of 15,915,146. Robinhood Markets has a one year low of $7.91 and a one year high of $34.32. The company has a market cap of $28.99 billion, a price-to-earnings ratio of 55.59, a P/E/G ratio of 0.73 and a beta of 1.84. The business's 50 day moving average is $24.42 and its 200-day moving average is $21.94.

Robinhood Markets (NASDAQ:HOOD - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported $0.17 earnings per share for the quarter, missing the consensus estimate of $0.18 by ($0.01). The company had revenue of $637.00 million during the quarter, compared to analyst estimates of $660.53 million. Robinhood Markets had a net margin of 21.80% and a return on equity of 7.52%. The firm's quarterly revenue was up 36.4% compared to the same quarter last year. During the same quarter last year, the company earned ($0.09) EPS. On average, sell-side analysts anticipate that Robinhood Markets will post 0.71 EPS for the current fiscal year.

Insider Activity at Robinhood Markets

In related news, Director Meyer Malka sold 3,225,806 shares of the business's stock in a transaction on Tuesday, October 8th. The stock was sold at an average price of $25.07, for a total transaction of $80,870,956.42. Following the sale, the director now directly owns 29,357,336 shares in the company, valued at approximately $735,988,413.52. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In related news, CEO Vladimir Tenev sold 250,000 shares of the stock in a transaction dated Wednesday, September 4th. The stock was sold at an average price of $19.26, for a total transaction of $4,815,000.00. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Meyer Malka sold 3,225,806 shares of the stock in a transaction dated Tuesday, October 8th. The shares were sold at an average price of $25.07, for a total value of $80,870,956.42. Following the sale, the director now owns 29,357,336 shares of the company's stock, valued at $735,988,413.52. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 4,854,493 shares of company stock worth $118,173,265. 19.95% of the stock is owned by company insiders.

Institutional Investors Weigh In On Robinhood Markets

Several institutional investors and hedge funds have recently bought and sold shares of the business. Intech Investment Management LLC lifted its stake in shares of Robinhood Markets by 871.9% in the 3rd quarter. Intech Investment Management LLC now owns 192,960 shares of the company's stock valued at $4,519,000 after purchasing an additional 173,107 shares during the period. EULAV Asset Management lifted its stake in shares of Robinhood Markets by 22.2% in the 3rd quarter. EULAV Asset Management now owns 550,000 shares of the company's stock valued at $12,881,000 after purchasing an additional 100,000 shares during the period. Commerce Bank lifted its stake in shares of Robinhood Markets by 3.3% in the 3rd quarter. Commerce Bank now owns 13,245 shares of the company's stock valued at $310,000 after purchasing an additional 423 shares during the period. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in shares of Robinhood Markets in the 3rd quarter valued at approximately $365,000. Finally, Banque Cantonale Vaudoise lifted its stake in shares of Robinhood Markets by 77.0% in the 3rd quarter. Banque Cantonale Vaudoise now owns 132,523 shares of the company's stock valued at $3,104,000 after purchasing an additional 57,663 shares during the period. Hedge funds and other institutional investors own 93.27% of the company's stock.

About Robinhood Markets

(

Get Free Report)

Robinhood Markets, Inc operates financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds (ETFs), American depository receipts, options, gold, and cryptocurrencies. The company offers fractional trading, recurring investments, fully-paid securities lending, access to investing on margin, cash sweep, instant withdrawals, retirement program, around-the-clock trading, and initial public offerings participation services.

Read More

Before you consider Robinhood Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Robinhood Markets wasn't on the list.

While Robinhood Markets currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.