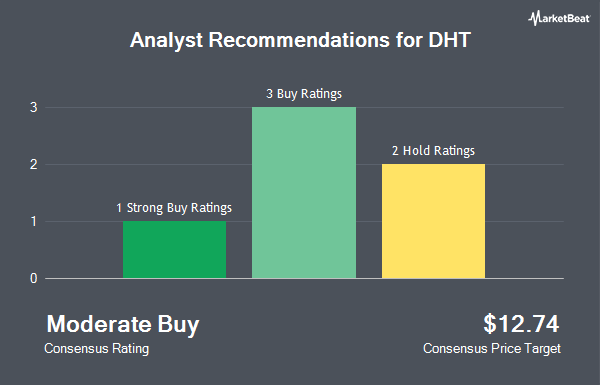

Shares of DHT Holdings, Inc. (NYSE:DHT - Get Free Report) have earned an average rating of "Buy" from the five ratings firms that are currently covering the company, MarketBeat.com reports. One equities research analyst has rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the company. The average twelve-month price objective among brokers that have issued a report on the stock in the last year is $14.50.

DHT has been the topic of a number of research reports. Stifel Nicolaus reduced their price objective on DHT from $13.00 to $11.00 and set a "hold" rating on the stock in a research report on Wednesday, October 23rd. StockNews.com raised shares of DHT from a "sell" rating to a "hold" rating in a research note on Thursday, November 14th. Fearnley Fonds raised shares of DHT to a "strong-buy" rating in a research report on Friday, September 27th. Jefferies Financial Group restated a "buy" rating and issued a $14.00 price objective on shares of DHT in a research note on Wednesday, November 13th. Finally, BTIG Research began coverage on shares of DHT in a report on Tuesday, October 15th. They issued a "buy" rating and a $16.00 price target for the company.

Check Out Our Latest Analysis on DHT

DHT Price Performance

Shares of DHT traded down $0.10 during mid-day trading on Wednesday, reaching $10.54. The company had a trading volume of 1,517,395 shares, compared to its average volume of 1,821,430. The company has a market capitalization of $1.70 billion, a P/E ratio of 10.64 and a beta of -0.36. DHT has a twelve month low of $9.28 and a twelve month high of $12.80. The company's 50-day moving average is $10.93 and its 200-day moving average is $11.25. The company has a debt-to-equity ratio of 0.35, a current ratio of 2.41 and a quick ratio of 1.97.

DHT (NYSE:DHT - Get Free Report) last issued its earnings results on Tuesday, November 12th. The shipping company reported $0.22 EPS for the quarter, beating the consensus estimate of $0.20 by $0.02. The firm had revenue of $92.64 million during the quarter, compared to the consensus estimate of $87.51 million. DHT had a net margin of 27.72% and a return on equity of 15.58%. The business's quarterly revenue was up 4.0% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.19 earnings per share. On average, equities analysts anticipate that DHT will post 1 EPS for the current year.

DHT Cuts Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 29th. Investors of record on Friday, November 22nd will be paid a dividend of $0.22 per share. This represents a $0.88 dividend on an annualized basis and a dividend yield of 8.35%. The ex-dividend date of this dividend is Friday, November 22nd. DHT's payout ratio is currently 108.00%.

Institutional Trading of DHT

Several institutional investors have recently added to or reduced their stakes in DHT. Pekin Hardy Strauss Inc. lifted its holdings in shares of DHT by 1.5% in the third quarter. Pekin Hardy Strauss Inc. now owns 69,000 shares of the shipping company's stock valued at $761,000 after purchasing an additional 1,000 shares in the last quarter. The Manufacturers Life Insurance Company boosted its stake in DHT by 2.5% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 48,435 shares of the shipping company's stock valued at $560,000 after buying an additional 1,172 shares in the last quarter. Stifel Financial Corp grew its position in DHT by 7.7% during the 3rd quarter. Stifel Financial Corp now owns 21,272 shares of the shipping company's stock worth $235,000 after acquiring an additional 1,514 shares during the last quarter. ProShare Advisors LLC raised its holdings in DHT by 7.2% in the first quarter. ProShare Advisors LLC now owns 24,358 shares of the shipping company's stock worth $280,000 after purchasing an additional 1,640 shares during the period. Finally, MQS Management LLC raised its position in shares of DHT by 7.3% during the second quarter. MQS Management LLC now owns 24,423 shares of the shipping company's stock worth $283,000 after purchasing an additional 1,662 shares during the period. 58.53% of the stock is owned by institutional investors and hedge funds.

About DHT

(

Get Free ReportDHT Holdings, Inc, through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, and Norway. The company also offers technical management services. As of March 15, 2024, it had a fleet of 24 very large crude carriers. The company was incorporated in 2005 and is headquartered in Hamilton, Bermuda.

Further Reading

Before you consider DHT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DHT wasn't on the list.

While DHT currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.